Decisions that impact cash flow, warehouse operations sales performance and image must be properly planned.

Merchandising decisions impact cash flow, warehouse operations, sales performance, and image; yet many buyers in our industry operate basically from the seat of their pants. Buying decisions are often unplanned reactions to special deals, the newest hottest item, or something that a buyer has fallen in love with. Merchandising processes should rely on detailed information, should be well planned and therefore, by necessity, be labor intensive.

The number one reason that companies go out of business is poor cash flow. There are several things that well run organizations do to appropriately maintain cash flow. At the top of the list is a strong and consistent focus on merchandising processes since well-run organizations recognize that their number one physical asset is their inventory. Having a good computer system aids in the processes of understanding merchandise performance, and this allows you to be able to drill-down to each merchandise category, each vendor and ultimately to each item. Smaller operations with limited SKU’s may be able to handle the processes manually. However, not maximizing the use of a good computer system will preclude growth.

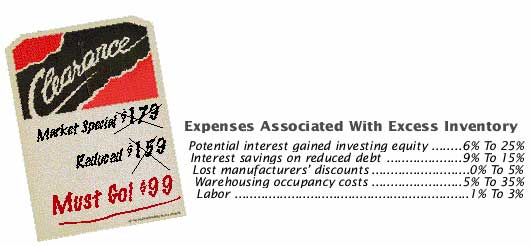

Merchandise is an asset. It is, unfortunately, a depreciating asset. Sitting on shelves in a warehouse it is best viewed as piles of money sitting under a mattress or buried in the backyard. You may be comforted to know that you own the asset, but every day its value diminishes. Excess inventory should be viewed not as case goods and accessories, but rather as piles of cash loosing value daily. Expenses associated with excess inventory are approximated below. These costs total about $20 to $30/$100 on average. That means that a $100 item in inventory today will become a $130 item one year from now.

Oops! You Did It Again Scenario: While at market, you find a great widget. You fall in love with it and you know that it will sell. Unfortunately, it does not sell. You do nothing about it.

SLOW TURNING INVENTORY EXAMPLE

• Cost of the widget is $100.

• You set the retail price at $179.

• One year later, it has cost you $30 to carry the item. The new cost is $130.

• You lower the retail price just a little to $169. It still does not sell.

• One year later, your cost has gone up another 30%. The new cost is $169.

• Your widget has received some damage so you mark it down to $99.

• Not only has your cash been tied up, but you are now selling the widget for $70 below your purchase cost plus the cost to carry it in your inventory for 2 years.

If you are over-inventoried, your cash flow is negatively impacted. The lower the turnover, the more your equity (cash) is tied up. Factoring in things like the terms you receive from manufacturers and customer down payments -- on average, 8 turns yields zero equity. In essence (on average) if you get 8 turns you sell the goods and collect the cash before you pay for the merchandise. Having a company turnover of two, means that you have 75% to 80% equity tied up in your inventory. A company with a $400,000 inventory, turning over its inventory once every 6 months (an inventory turnover of 2), on average would have $300,000 of equity tied up in inventory. A company with the same inventory, but turning their inventory every 3 months (an inventory turnover of 4), would have about $200,000 of equity tied up in their inventory on average.

The more inventory turns you get -- the better your equity position -- the better your cash flow.

8 Turns = 1.5 Months On-Hand = 0 Equity

6 Turns = 2.0 Months On-Hand = 26% Equity

4 Turns = 3.0 Months On-Hand = 51% Equity

2 Turns = 6.0 Months On-Hand = 75% Equity

How can you start to improve your equity position? First benchmark your own performance. Set goals for improvement and closely monitor your progress. Take steps to eliminate dead merchandise. You can tell that the amount of dead merchandise on your floor is extensive if:

•You find that you are overcrowding your isles and your overall display presentation.

•You possess large quantities of cancelled special orders or discontinued floor samples in your warehouse.

•You have large quantities of damaged goods.

•You have large quantities of new goods that you have not been able to place on your floor.

In the instances above, the problem may be dramatic enough to warrant a major inventory reduction event.

THE OLD The 80/20 RULE

A better understanding of the following merchandising concepts can help you to challenge the old 80/20 rule. This rule is based on the observation that 20% of inventory yields 80% of sales. This so-called rule is primarily a result of inadequate merchandising. Although it is not possible to achieve, the goal should be to make the rule for your floors 100/100, in order to maximize your stores’ square footage.

Develop a nail down policy. If you make a great choice and you sell it off of the floor, how many could you have sold during the 4 to 12 weeks that it takes you to floor the item again. If you release your line-up items how will you be able to measure how effective they could be? Having a great computerized inventory system without such policies renders the system’s information fairly meaningless.

A good inventory control system combined with strong merchandising processes is essential. It will give you data that can be used to dramatically improve your ability to refine and improve your product mix. A good system will provide feedback by category and by vendor, and allow you to drill down to item productivity. This is a proven way to improve profits and cash flow. It also helps to drive sales improvement and encourages GMROI increases now possible with the availability of detailed data on categories and vendors.

UNDERSTAND GMROI

GMROI (gross margin return on investment or as some people call it: gross margin return on inventory investment) is a measurement designed to demonstrate how much you will get back for every dollar invested in inventory. GMROI combines the impact of both gross margin dollars and inventory turnover.

Average inventory is most often used in determining GMROI. During the course of a year, inventory can vary dramatically from month to month. Using an average number, therefore, gives you a better indicator of inventory performance. This number is arrived by adding your beginning inventory to 12 consecutive month-end inventories and dividing by 13.

To determine GMROI, divide your annual gross profit by your average inventory. You do this by company, by category, by vendor and by item.

&Mac247; During the course of a year your average inventory on widgets was $1,000.

&Mac247; You had retail sales of $4,000 at a 50% gross margin so your gross margin dollars were $2,000.

&Mac247; Your GMROI equals $2.00.

Use GMROI as a guide to compare widgets to other items. This will allow you to determine the fate of your merchandise. Lower GMROI items get less of the open-to-buy dollars (how much of your available inventory dollars will be allocated to a vendor, category and ultimately individual items) and will serve as a guide in determining the eventual fate of widgets and other items in your line-up.

MERCHANDISE PLANS

•Determine the correct number of slots for each category. Develop a floor plan that will maximize product presentation. Be aware that less may be more. Keep your floor open to help your customers visualize how your products will fit in their homes.

•Identify your most important styles and price points within each category. Do this by reviewing historical performance, conducting customer surveys, and by encouraging salesperson feedback.

•Ensure that your floor is dominated by and merchandised around the styles and price points that you determine are most important.

•Experiment outside those price points and closely observe those experiments for trends. Ideally you would be able to trend upward but if market conditions or changing demographics demonstrate otherwise then react appropriately elimination strategy.

When you purchased the widget you were very excited. You knew that it would be a great seller for you or you would not have purchased it. 30 days have gone by and no widgets have sold.

•First challenge your display.

•Is it in the right place?

•Is it appropriately accessorized?

•Is it properly lit?

•Is there something wrong with the widget on display?

Next challenge your sales team. They may not understand why you bought it. You may not have properly communicated your excitement concerning potential sales of this widget.

If over the next period of time (30 days or whatever you determine appropriate) sales do not pick up, then it is time for a marginal markdown. If you lower gross margin on an item but it starts to turn, then your GMROI will potentially increase, making the item worthy of staying in the line up.

If this has no impact, then make your next markdown more meaningful. At a price everything becomes a value to someone. Remember the above example of the widget that was carried for two years and effectively sold for $70 less then cost. You are much better off taking your hits one at a time than developing serious inventory issues and having to run major inventory reduction events.

Some computer systems have markdown strategies built-in. Use these strategies as guidelines. If your system does not have such a strategy, then develop your own strategy manually.

Merchandising is labor intensive. Run proformas or “what if” scenarios to determine the cost effectiveness of investing in the necessary labor, etc., that will position you to be good merchandisers. Ask yourselves:

•How much could your sales increase?

•How much could your gross margins increase?

•How much would your cash flow position improve?

•How much more profitable could you be by developing strong merchandising processes?

You may ask: “How can we find the time to do all this detail work?”

A better question to ask may be: “What is the cost to benefit ratio of investing the necessary time and labor expense?”

Or you may ask: “What is it costing me in sales and profits by not maximizing my inventory investment?”

The most successful furniture retailers are great merchandisers and they are acutely aware that retailing is detailing. Improving merchandising performance is exciting because it allows you to improve your profits and cash flow, while simultaneously helping your customers to create better home environments. With all the stress that you face in the day-to-day operation of your business, at times you may forget just how great the business is that you have chosen. Find the passion to become great merchandisers.

Joe Milevsky is the president and founder of JRM Sales & Management, Inc. JRM is a consulting company that has been extremely successful in improving the profitability of furniture retailers of all sizes. JRM helps furniture retailers in all areas of their businesses including improving merchandising performance. Questions can be directed to Joe Milevski care of FURNITURE WORLD at milevsky@furninfo.com.