Secrets for preventing internal fraud.

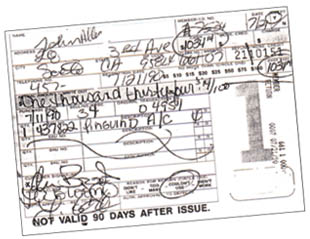

An Employee Filled Out Over 150 Refund/ Merchandise Credit Vouchersmaking up customer names and writing in expensive store items which had supposedly been returned.

In the August/September issue of FURNITURE WORLD we discussed external frauds in the form of bogus credit cards, negotiable Instruments and counterfeit merchandise receipts. In this issue, we continue the discussion with internal fraud prevention. Scams not only come from outside of the business but may also be perpetrated by trusted employees within.

Employee fraud against businesses accounts for $400 billion in annual losses. Bookkeepers and other employees with access to your business records can siphon off your profits and then cover their trail by making sure that your accounting books balance. Many methods for protecting your business from fraud simply require good old common sense. Others involve more complex issues of which you may not be aware. Let’s consider some examples of business-related scams and frauds and how to avoid them.

Beware of Embezzlement Schemes

Embezzlement can be defined as "to take fraudulently in violation of a trust." Some of the simpler forms of embezzlement involve employees stealing company checks and then forging them, making the checks payable to themselves and claiming that the company owed them those funds if their embezzlement attempt is discovered. In a similar type of scam, a woman stole fifteen checks while she was employed by an insurance company. She forged these checks and deposited them to a fictitious account, which she soon liquidated. These checks totaled over $100,000.

In another version of this scam, the bookkeeper takes one of your company checks and makes it payable to a fictitious person or company. The bookkeeper has already had an accomplice set up a fictitious business account in the phony company name that appears as payee on the check in question. Of course, the address shown on the signature card at the bank is either a drop box, or a non-existent location occupying the space between two legitimate addresses. The bookkeeper then gives the check to the accomplice who cashes it at the bank that has the fictitious account. Your bookkeeper could also simply deposit such forged checks at the ATM or night drop, then return a few days later to liquidate that deposit by systematic withdrawals from the ATM machine.

This is a profitable scam for the bookkeeper because there is certainly plausible deniability and low risk. Large sums of money could easily be liquidated within a few weeks—if not sooner, depending on the bank—and you would not be aware of it until the damage was already done. In fact, skilled bookkeepers can cook the books so well that a year could go by before the embezzled money would be noticed. In some cases, losses could even be disguised so cleverly that you would never notice at all. Indeed, when employees discover that they can get away with such scams once, they will repeat them time and again.

There are simple precautions that you can take against such embezzlement schemes. My late father used to be the head accountant for the Academy of Arts and Motion Pictures, as well as Comptroller for Carter Hawley Hale Stores, Inc., and troubleshooter for various other large institutions. He told me that there is an old accounting rule for companies that many seem to ignore today: you should not have the same person handling both disbursements and revenue. That is, the person who logs in your company’s income should not be the person who pays the company bills. In large corporations these divisions are rather natural; however, in medium-size to smaller companies, the same person often handles both revenue and disbursements.

When only one person handles both revenue and disbursements, this same person skimming off money on the disbursement side can cover his or her tracks on the revenue side by making sure that the books always balance. Two different persons, who are not best friends, should be in charge of these different sides of your company’s accounting departments so as to guarantee that you don’t get pinched at either end of the equation. This is an obvious safeguard. Further, all of your business accounts should be reconciled at least every month. The earlier you notice that something is going wrong, the greater chance you will have to remedy the problem and minimize your losses.

Great Remedy!

It is a good idea to have the bank mail original, canceled company checks and monthly statements to a different address than that used by the person(s) authorized to disburse funds. The business owner or manager can have statements and canceled checks mailed to his or her home address or a separate business P.O. Box. All that is needed is few minutes each month to review each check. Look for obvious fraud, such as checks made payable to employees from an account not used for payroll. Look closely to ensure that each check is made payable to a legitimate business account and that it matches both the payee and the amount listed in the account ledger. If it is the routine policy of management to take physical possession of the account ledger monthly and compare the returned checks, it is very unlikely that fraudulent accounting schemes will be perpetrated against you.

Bogus Invoicing Scams

Although many invoicing scams can come from outside your company, there is another invoicing scam that takes the form of an embezzlement by one of your employees. This scam can be accomplished by using past legitimate invoices from your regular vendors. Dates and invoice numbers are simply altered, leaving the main form of the invoice the same including the vendor’s signature. But here is the big trick—your employee writes the name of that regular vendor in the checkbook ledger, but then writes a different payee name on the check itself. Now the trail is covered in your bookkeeping records, however, the check can be negotiated in a pre-determined name to be used by the dishonest bookkeeper. This is why it is important to compare returned checks with your checkbook ledger! And if your bookkeepers know that you do this regularly, then they will not attempt this scam.

Many times, your longtime employees have earned trust and demonstrated their loyalty by working long hours or by never taking vacations. What their actions may really be telling you is that they need to stay around to continue covering their tracks so that nobody else notices their embezzling activities while they are gone. If a bookkeeper consistently stays late and seldom takes his or her vacation time you should be alerted to the possibility that something may be wrong! Embezzlement schemes can go unnoticed for years when these "faithful" accounting personnel never leave. An important fraud prevention tactic is to insure that all accounting staff take their allotted vacation time so that another person can step in and take over their duties while they are gone.

Merchandise Scams

In addition to bookkeeping schemes, there are other types of embezzlement that get more creative and complicated. An employee for a home building supply store filled out over 150 refund/merchandise credit vouchers with fictitious entries. Customer names and addresses were invented and expensive store items that had supposedly been returned were itemized. Since the vouchers indicated that the sale items had been paid for in cash, the employee put these cash amounts in his pocket. Working alone at the returns counter, this industrious embezzler was able to misappropriate around $100,000 with his simple scheme.

To prevent this scam, you should ensure that returned items go back into inventory, which should then balance with your merchandise credit vouchers. If you balance these weekly, you will have a good handle on company cash receipts and inventory and will thereby protect yourself against such embezzlements.

You should also consider teaming up employees at the returns counter since it is less likely that two employees will conspire together in such a scam.

Time Card Schemes

One easy way that employees can take money from your company is simply by raising the time amounts on their time cards if they are kept by hand. This is like a slow leak in a pool: you don’t notice the leak for awhile, and it’s hard to find. If this kind of fraud continues over time, you may start to wonder where your profit’s are going. Detection is difficult because all of your books will balance, giving you an unrealistic appraisal of your company’s performance.

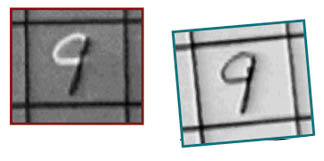

This type of case recently occurred in Washington State. When no one was looking, employees altered the weekly numbers on their time cards It’s very easy to turn a "6" into an "8," for example, or a "1" into a "7" or "9." Another twist to this scheme can be perpetrated by working employees who fill in time values for other employees who are not working on particular days.

Yet another time card scam occurs when a temporary employee increases the hours on a copy of a legitimate time card which bears the approving signature of a supervisor. He or she then submits the altered card to the temp agency as additional periods worked. The distance between the employer’s HR department and the temp agency creates a natural lag in communication, allowing this scam to go on undetected for quite some time. When dealing with a temp agency, consider faxing copies of approved time cards to the agency, to be followed by delivery of the original via routing channels. Any differences between the original and the faxed copies will expose fraud quickly.

It is best to use a mechanical time card machine that automatically stamps dates and times. You shouldn’t trust employees to fill in their time cards by hand, as this offers them too great a temptation to commit fraud against you. The machine and cards should be kept in a busy but controlled location, so that employees can’t make changes when no one is looking. After the time cards are processed, business owners should keep all original copies locked up in a safe place with limited access to employees. Employers should retain originals for two years, as they are the best evidence should any labor disputes arise down the road.

|

Shown is an image of what the "9" looks like to the naked eye, and the same image seen in an infrared picture showing the alteration to the "1". The original entry was really a ONE but then later altered to be a 9 in a time card fraud scheme. |

A former Federal and State Government Forensic Document Examiner, Jim Blanco is owner of Blanco Forensic Documents and Fraud Prevention Services, located in Rocklin California. He is a speaker and trainer in Fraud Prevention matters and author of “Business Fraud; Know It & Prevent It.” Questions can be directed to Jim at FURNITURE WORLD at jblanco@furninfo.com.

The information and photographs in this article are copy right protected and may not be reproduced without the written permission of the author and FURNITURE WORLD.