The center of power in the furniture industry is shifting. Now is the time to re-evaluate your position in the New Value Chain.

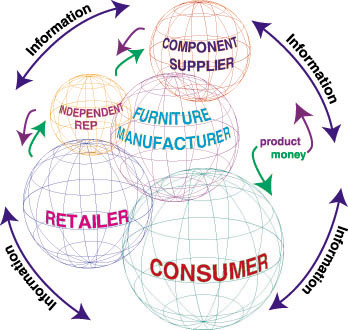

Editor's Note: The first portion of this article published in the October/November issue of FURNITURE WORLD discussed the emergence of a "New Value Chain" in the home furnishings industry. A value chain, is a network of organizations and individuals through which products and services flow in one direction and money flows in the other direction. The changes, brought about largely by information technology is causing a power shift in the industry. The implication of these changes, the article points out, is not that brick & mortar business will cease to be a significant channel of distribution, but that they will be challenged by new business paradigms. In this article, Sekar Sundararajan continues his discussion by presenting strategies that furniture retailers, manufacturers and suppliers can use to identify potential problems as well as business opportunities.

Each organization has to develop a vision and action plan based on the answers to the four key questions restated here from part 1.

- Understand what business you are in.

- Enable the customer.

- Create a responsive & adaptive internal organization.

- Collaborate with other organizations to develop the value chain.

Understand what business you are in:

This is an often overlooked question because every company believes it is too obvious. Yet, few if any can articulate that well. Rolex has made a conscious effort not to be in the business of making watches – but to sell jewelry. Hence, Rolex watches cost a lot more than other watches. Steelcase, an office furniture manufacturer, advertises that it manufactures desks, chairs and credenzas, but that is not what they sell. They sell comfort and productivity enhancement in the office. How many watches would you need if you had to tell time. One. But, Swatch, the Swiss manufacturer, sells its watches as a fashion accessory and hence is able to sell one in every color to the fashion conscious. Bassett Furniture is promoting the idea of selling individualized furniture needs and promoting the "Simply Yours" theme much like Gateway Computer's "Yourware" program. While Stanley Furniture has found that they want to be the "Quick Response" company... Robb and Stucky's in Naples, Florida has determined that their customers would like to see displays that reflect a tasteful home-like setting. Robb & Stucky's, therefore, seeks to provide customers with an in-store experience that allows them to imagine how the furniture will actually look in their homes. Similarly, each retailer and manufacturer has to determine what is the business they "are in." This realization will enable them to decide in which value chains they need to participate.

A useful way any organization can derive this information, is to honestly answer the following question. Who would care if you were not in business? The answer will provide the basis for understanding the value that you provide to your current customer base and also provide clues to what value you can provide to the non-customers you want to attract.

Enable the customer

A value chain starts with the end customer or consumer. One of the critical steps to undertake, is to understand why a customer shops for furniture. It may be as obvious and simplistic as to create a beautiful home environment or a productive home office, but the actions of most retailers show clearly that this is not the perspective that drives their interactions with customers. Rather than focusing on how to enable the customer, most retailers end up "pushing" products on their floor. This behavior tends to create an arm's length transaction with minimal customer loyalty. Interactive relationships with customers allow a company to get beyond the pursuit of cost saving, to growth through the creation of new, more valuable products and services. To create and be part of the future value added chain, the retailer and manufacturer need to understand how to enable the customer and use the product as a platform to develop a long-term relationship. Make every effort to involve your customer to help you help them.

Methods need to be established to understand the needs of the customers and how value can be added to enable them to be successful. There are two approaches you can use to begin understanding customer needs. The first method is a broad brush conventional approach using the tools of market research which are the subject of many text books, and will not be discussed further. The second is the emerging approach of capturing the needs of individual customers and tailoring the products and services to their needs which is discussed in greater detail.

Some specific techniques to build customer involvement are listed below. However, the techniques used to build customer involvement are radically different from the techniques required to conduct broad market research. They require a significant cultural adjustment on the part of the entire value-providing chain. In addition, there may be several technology barriers that need to be overcome (such as security, integration, interoperability of systems, data entry and data access procedures) between partners in a value providing chain. The challenge will also be to translate customer needs and wishes into product and service requirements and then to compare these against the capability of the value providing chain to provide solutions that are win-win to all partners.

Living the life of the customer:

This refers to the notion of intimately understanding each individual customer to such an extent that you can tell "where the shoe pinches". For example, Levi's always made their jeans in standard sizes. These sizes did not fit as most women would have liked, resulting in a large volume of returns. This, in turn, resulted in significant cost to the company. Today, Levi's sells custom-made jeans fit exactly to an individual, thereby both reducing returns and expanding sales. Such individualized products can be built only when the organization has the ability to understand the individual needs of each customer.

Customer Advisory Boards:

In some instances it is feasible to have customers and customer's customers be part of an Advisory Board (focus groups) to bring back ideas and features they would like to see. For example, due to limited funding, the Pennsylvania Department of Transportation (PennDOT) could maintain no more than 25% of the Pennsylvania road system at any given time. Customer Advisory groups were formed in all local regions in Pennsylvania; their job was to help PennDOT prioritize the allocation of available funds to serve the maximum number of customers. These Customer Advisory groups consisted of a diverse group of stakeholders such as truck drivers, taxicab drivers, school bus drivers, local government officials, etc.

Manage the customer's inventory:

For non-retailers, the secret to understanding customer needs is to really understand the needs of your customer's customers. For example, Kraft Foods manages the inventory on the shelves at some grocery stores. This provides Kraft with a great amount of intelligence about point-of-sale information, thereby helping Kraft plan its production and promotion efforts appropriately and in a cost-effective manner. By providing order and sales information in real-time, suppliers can receive accurate and timely information directly from end-users, enabling dynamic response to changing market conditions. This ability generates efficiencies that benefit all partners throughout the value chain. Without open communications between channel partners this VMI (vendor managed inventory) undertaking can become a VHI (vendor has inventory) program, which will not realize economies or efficiencies.

Co-location with customer:

Co-location with your customer provides opportunities to build trust and informal relationships. As part of their informal network, customers are more likely to share information on their future plans ahead of any formal process. This enables an intelligent and observant workforce to find opportunities where their organization can add value.

On-going customer interviews:

As opposed to informal relationships, formal, periodic feedback from customers provides an alternate source of information. This is one way that information gained through informal relationships can be validated and formalized. To avoid injecting personal bias into the survey it is suggested that a third party conduct, analyze and report the findings.

Data mining for business intelligence:

Every day customers leave a tremendous amount of information about their needs. If only it could be intelligently captured and analyzed! For example, using point-of-sale information, Wal-Mart was able to understand the relationships between the various products they sell and place the products on shelves accordingly. Wal-Mart found that people buy bananas when they buy breakfast cereal and Kleenex with Tylenol; now bananas sit on the shelves next to the cereals and the Kleenex tissue is closer to the Tylenol. Such information will not be readily apparent without intelligent analysis of customer data. It may seem obvious after the fact, but it was unknown until Wal-Mart mined the data. Today, companies such as Procter and Gamble are willing to discount prices to Wal-Mart in return for this type of intelligent information. Companies today are run by data, and the data and analysis available far exceed that available a few short years ago. By analyzing, or mining for computer-based information about customers' purchasing habits, companies can augment their methods for knowing what their customers want.

Making It Work:

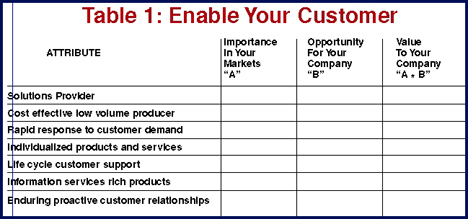

An organization that chooses to embark on the path of reshaping its value chain has to characterize its context, define the attributes that are necessary for success and develop an action plan. The attributes should be prioritized based on the importance in your marketplace, the opportunity for your company and the potential value due to that attribute. A sample of the kind of table that can help you to understand the value of such attributes can be found on page 19. Table values might be based on a low-medium-high priority scale 1-5 (where 1=low, 3=medium and 5=high). More detailed analysis is possible and desirable. Such analysis could focus on customer types and detailed market segmentation. Additional charts and examples of this kind of analysis will be presented in part 3 of this series in the February/March issue of FURNITURE WORLD.

Next Issue: This series will continue with a discussion of how to create an adaptive internal organization, how to collaborate with other organizations and how to make all these issues work together.

Sekar Sundararajan is President, Libra Consulting Corporation, a leading business intelligence and decision sciences firm based in Bethlehem, PA. Libra Consulting specializes in supporting industry and government in crafting and implementing agile and mass customization strategies for the rapidly changing global marketplace. They provide consulting, training and decision support software services for their clients. International clients include Fortune 500 companies as well as small and medium sized businesses, across a variety of industries - furniture, food, appliance, automotive, and government. A short list of clients includes Stanley Furniture, Whirlpool, Ford, Kraft Foods and the Commonwealth of Pennsylvania. As, Executive Partner, of the Iacocca Institute at Lehigh University, Sekar has been at the forefront of the Agile Manufacturing revolution taking place in the U.S.. He was an invited industry representative to the Iacocca Institute at Lehigh University, to create the vision for 21st century manufacturing. His expertise is in the areas of agile strategies, reshaping value chains, lead time reduction strategies, supply chain optimization, theory of constraints, and plant design. Direct questions or comments to editor@furninfo.com.