Interview with Laura Khoury

The language of

furniture styles has become nuanced and complicated. This presents a

challenge for furniture retailers.

From 1960 through the early ‘90s Furniture World published many thousands of

“History of Furniture Styles” sales training guides for furniture retailers.

These 16-page inserts categorized furniture designs into traditional,

transitional and contemporary categories, then further, into styles

including Chippendale, Sheraton, Empire, French Provincial and others. This

made sense at a time when purchasing matching sets was the norm, and when so

many people owned Early American or Queen Anne-styled dining sets.

Since then, the language of furniture styles has become nuanced and

complicated. Some customers shop to find products that reflect their own

personal style. Others have eclectic tastes or can’t tell the difference

between style categories that often incorporate subtle design influences.

This presents a challenge for furniture retailers who need to collect

information on shoppers’ style preferences, either online or in-store.

Fortunately, when shown a product image, furniture shoppers know whether or

not they like it. This reality presented an opportunity for Laura Khoury who

founded Shoptelligence, a product selection tool that helps shoppers

identify furniture items and make suggestions based on relevant click data.

Furniture World spoke with Khoury to get her views about how retailers can

help their customers put together rooms that meet their needs.

“Most furniture shoppers start their purchase journey online,” Khoury

explained, “and every item a shopper clicks on leaves evidence of what their

style preferences are.”

Seven Foundational Styles

In 2015 Khoury decided to leave her big corporate job to found

Shoptelligence. It was a project she’d been thinking about for several

years.

“Earlier in my career,” she recalled, “I focused heavily on B2C strategies,

using the internet to generate leads, drive shoppers into stores, retain

them and grow customer lifetime value. From there I became an attorney. It

was a short detour into practicing corporate and technology law before going

to work for KPMG, heading up their advanced solutions practice.

“The idea for Shoptelligence grew out of a terrible experience I had

shopping for apparel. I was pre-judged by a salesperson and it occurred to

me that their opinion of what I should purchase had no relevance to my

personal style preferences or shopping objectives.”

From that spark of inspiration, Khoury and her team started to look at ways

to combine consumer behavioral analytics with style reasoning to produce

home furnishings purchase suggestions. Khoury explained that defining

furniture styles in a useful way was challenging.

“At that time,” she recalled, “furniture styles seemed to be so much more

intangible and unstructured than data. “We brought in a team of designers to

get their thoughts on what differentiates the look and feel of a traditional

style from contemporary or rustic.

“Thankfully, in almost all verticals there are foundational styles. For

furniture, we found seven: contemporary, transitional, traditional,

mid-century, rustic, craftsman, and industrial.

“There are derivatives of these seven styles. Farmhouse chic is a blend of

contemporary and rustic. Many styles are related. Today, retailers might be

selling farmhouse chic. Tomorrow, a derivative style might be sold as

farmhouse glam. It’s just another combination we call a secondary style.

“Decorating with furniture is complicated,” she added. “Furniture can be

mixed and matched in various creative ways. A rustic-styled room may include

contemporary or craftsman-style pieces. Furthermore, retailers may

merchandise an accent chair as a living room item that may also work well in

a bedroom or a home office setting.”

To be useful, any algorithm needs to be able to identify furniture and

accessories that are appropriate suggestions for individual shoppers.

“That,” she said, “required the tracking of relevant product attributes

independent of style. The last piece of the puzzle we had to address was the

most complicated. Our algorithms had to be trained to output correct

combinations based on how products are used, the styles and inventory a

retailer has available, and the attributes of each item.”

A Million Choices

“The goal for any retailer,” Khoury said, “is to make decisions simpler for

consumers by helping them to visualize multiple items altogether. That by

itself helps drive up consumer engagement and yields as much as a six-time

increase in engagement plus 30 or more percent increases in average order

value. Imagine trying to show a million products, one by one, it would never

work. But if you can show them six, 12, 18, 30 products at a time, in an

engaging way, where it’s gamified, it becomes fun.

“The object of the game from the consumer’s standpoint,” Khoury observed,

“is to achieve their objectives. This is difficult for people as they scroll

through websites that present hundreds of SKUs. Let’s say a shopper wants to

purchase a chair, rug, sofa, coffee table, lamp and a piece of wall art to

put above that sofa. If there are 10 selections in each category, they end

up with a million choices (10 to the sixth power). That’s why consumers are

so overwhelmed when shopping online for furniture.

“If a shopper searches for farmhouse style online, there will absolutely be

a bias as to what items they’re clicking on,” she explained. “But when

considering the style or look of an entire room, there is a chance that

something from another style category will work perfectly to complement the

design. And so, it’s in a retailer’s best interest to initially expose that

shopper to more farmhouse styled items, but along the way, suggest

additional pieces that work together in the context of the room that the

shopper wants to create.

“The beauty of looking at consumer preferences by offering choices and

keeping track of where they click is that a consumer profile can be created.

This profile can take into consideration every click a shopper makes, and

all of the product attributes associated with each item a shopper looks at.

The objective is to show them more appropriate choices—and fewer items that

they probably won’t be interested in—to narrow the selection field.” This

process mirrors what creative design associates might do when working with

clients in stores to put together rooms.

Style surveys are highly effective at engaging shoppers who want to collect

personal style information and move shoppers forward into an online or

digital sales funnel. “But,” Khoury said, “retailers run up against

limitations when presenting lifestyle images. These can inspire, but what

happens when items go out of stock? It becomes more like a magazine

experience than an interactive digital experience.

“No matter how a retailer approaches the issue of choice, the goal is to

help move the shopper down that funnel, from ‘I don’t know exactly what I’m

looking for in this room’ to ‘I found one item,’ and then to, ‘I found

everything else I need to finish that room,’ whether it’s one more item or

10 more.”

Getting Them Into the Store

A primary goal for most furniture retailers is to engage shoppers on their

websites to get them to either purchase online or convince them that it’s

worth visiting a brick-and-mortar location. “The idea is to increase average

order value on-site,” said Khoury, “and capture lower funnel leads to get

shoppers engaged with products enough to provide retailers with an email

address for follow up.” Another goal is to convert store traffic into sales.

“Information collected from website interactions where consumers share

information on style preferences via surveys or for those retailers who use

click data, can help sales associates to make more relevant suggestions. The

better that retailers understand their customers’ style preferences and

serve them in the way they want to be served, the greater the likelihood of

success.”

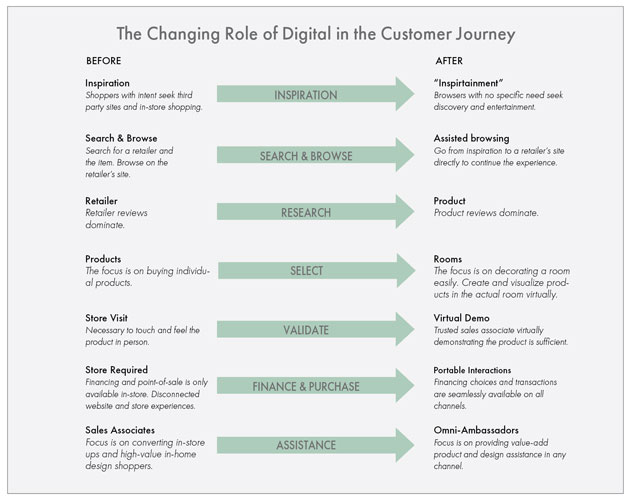

Omnichannel

The advantage of offering interior design services to dramatically increase

close rates and average sales is well documented. Furniture World asked

Khoury if making design suggestions online can work against stores that work

hard to offer these in-store services.

“Even if a retailer with an established clientele has designers on staff,

the concept of omnichannel is still relevant,” she replied. “Home

furnishings are the third largest purchase in a person’s life behind housing

and automobiles. It’s high-ticket and therefore high consideration. Whether

or not a customer is working with a designer, they want to go online and be

able to do research, experiment and interact with products outside of the

in-store experience.

“While many retailers have started to adopt omnichannel practices, others

have fallen behind. Omnichannel creates a seamless experience throughout the

entire consumer journey across all channels. Not only does it allow

retailers to serve their customers in a convenient and effective manner, it

is individualized, leveraging consumer behavior as well as style data and

analytics. This can be used to serve up more recommendations to increase

average order value and engagement. It also allows retailers to fully

understand where each consumer is along their purchase path so tools and

marketing efforts can be applied when they make the most sense.”

Post COVID

“During COVID, there was more demand than there was supply. So instead of

just merchandising what looks best, we were able to add a bit more weight to

show items that were in stock. Now, as the economy is swinging back and

people are talking of a possible recession, the situation has changed.

“The objective is to show them more appropriate choices and fewer

items—

— that they probably won’t be interested in—to narrow the selection field.”

“It is time for retailers to focus on getting the most out of every shopper

in terms of closing sales and raising average tickets. And that’s true for

first-time shoppers or returning customers.

“Retailers that are still looking at their websites as online brochures are

at risk, frankly, because the consumer is expecting more.”

More Suggestions From Khoury

Sales Education: When a consumer visits a store, they may

have already spent hours online looking through different products and

weighing the pros and cons of each. Be aware that shoppers are often more

informed than sales associates regarding information found on their store’s

website. It’s important for retailers to stop treating their websites like

separate businesses, almost completely siloed and sometimes a second

thought.

Not only does omnichannel help sales associates understand where each

shopper is along their journey, continued sales education will ensure that

shoppers are given the right information, in the right place and at the

right time.

Product Data: Many retailers need to put more focus on

updating their product data. It doesn’t have to be perfect, but at a

minimum, every item needs to have a least a couple of lines of well written

copy.

Lead Data: Make sure there is an email capture on every

website page. Collection of email addresses and phone numbers, whether or

not a shopper purchases, is increasingly important. Shoppers won’t randomly

give you their email addresses; there has to be a quid pro quo. For example,

if an undecided customer decides to leave the store without purchasing, the

sales associates might ask, ‘Would you like me to email you a report of the

items we looked at together that you showed interest in today?’ That’s a

value-add exchange that recognizes that the shopper isn’t just shopping in

one channel. They want that portability, which can and should be built into

the sales process.

Other Data: Third-party cookies will become almost

irrelevant going forward. The emphasis has shifted to collecting first-party

data through cookies. It’s the only way retailers can get demographic

insights about shoppers who visit their websites.

Access to high-quality data has become increasingly important for every home

furnishings retailer. Consumer behavior analytics offers better visibility

into shopping trends and preferences. Using it wisely improves customer

experiences, increases sales and boosts customer loyalty.

Questions about this article can be directed to Laura Khoury care of

editor@furninfo.com.