Part 2

Now that you’ve

decided where to position your design center and target it to meet the

needs of specific customers types, it’s time to decide what to put in it.

The first part of this two-part series, featured in the July/August edition

(www.furninfo.com/authors/jennifer-magee/86), explained why creating a prominent and well-configured Design Center

attracts customers, especially those who value design or feel they need help

to make better purchasing decisions. Also covered were:

- Placement strategies.

-

Placement strategies. Ways to create design center areas that complement

the sales process.

- How to think about issues of exclusivity and accessibility.

-

Good, better and best approaches to balance the needs of different

customer types.Examples of how retailers such as Pottery Barn, Living

Spaces, Interiors Home, La-Z-Boy, Furnitureland South, and others have

approached design center projects.

-

Examples of how retailers such as Pottery Barn, Living Spaces, Interiors

Home, La-Z-Boy, Furnitureland South, and others have approached design

center projects.

This installment expands the discussion, taking a closer look at the

amenities and technologies retailers should consider including in design

areas to better engage home furnishings shoppers.

Amenities & Special Features

Consider outfitting Design Centers with amenities and special features that

make customers feel comfortable and empowered.

Snacks: Having a coffee bar or water station with snacks

increases the time customers work with in-store designers.

Screens: Install large-scale digital screens for

presentations. In private room settings, these can be easily mounted on an

adjacent wall surface. In an open Design Center setting, interactive digital

screens can be integrated into meeting tables.

Staging Areas: Some retailers designate a portion of their

Design Center as a staging area. This space can be used to make physical

presentations of furniture or decor displayed on a stage or series of

platforms. It may also include:

- A hanging bar from which to drape rugs or curtains.

- Pull-down screens that can provide a colored backdrop or image.

-

Specialty track lighting that can be adjusted to create a particular mood.

- Cork or MDF boards for pinning up samples and images.

A staging space may also be used by interior designers to showcase

accessorized furniture groupings to help customers fully visualize the

design of their home.

MATHIS DESIGN STUDIO: Mathis Design Studio (top left)

provides large, comfortable tables with integrated dual-sided digital

screens where customers can sit with a designer.

ETHAN ALLEN: Ethan Allen (top right) allows customers

to use touch screens to browse a full product portfolio while also

accessing fabric and wood samples.

FURNITURE MALL OF MISSOURI: For its new Kansas City

store, Furniture Mall of Missouri added multiple Design Centers,

including one for high-end customers (bottom) that includes a central

staging area.

Lighting

Lighting is an essential part of the Design Center experience. Providing

natural light through a skylight or adjacent windows can help customers see

the actual colors and textures of fabric swatches. Installing artificial

skylights and windows that mimic natural light is often a more

cost-effective and flexible alternative to natural light. Some retailers

have also installed “light bars” to showcase different types of lighting

(incandescent, LED, fluorescent) at different color temperatures, so

customers can evaluate fabric samples under the type of illumination they

have in their homes.

It is best to use true-color light bulbs when possible so that colors and

fabrics are seen true-to-life. It is also important that fabric and finish

samples are lit properly from an angle above. Track light should be set four

to six feet off the face of samples and angled 30 to 60 degrees to fully

wash light down the face of vertical displays.

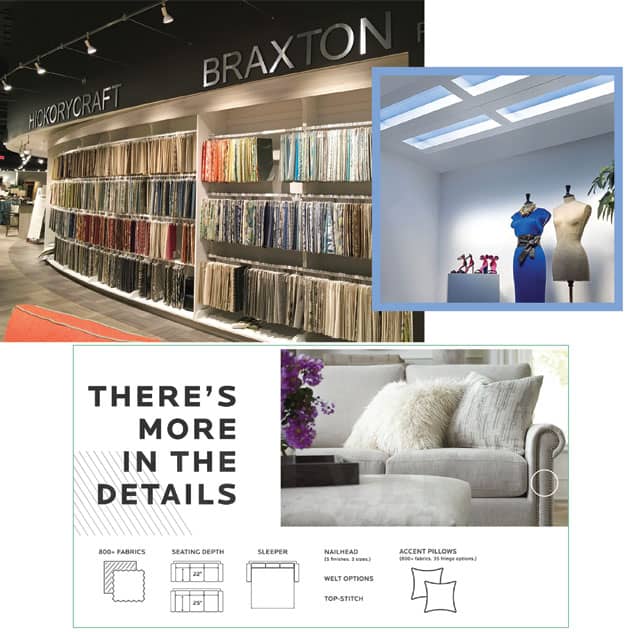

NATURAL LIGHT: Better engineering and light

simulation has made artificial skylights and windows a viable

alternative to natural light. CoeLux Artificial Skylights from

Lightology shown top right.

JOHNNY JANOSIK: Johnny Janosik’s centrally-located,

oval-shaped Design Center features each brand’s name above fabric

samples, making the selections (above left) easy to browse.

BASSETT: In addition to offering physical

customization displays in-store, Bassett does an excellent job of

walking customers through custom options (bottom) online.

Displays

Most Design Centers feature an upholstery/ fabric customization story. It is

important to present fabric swatches in a prominent and easy-to-browse way.

The most common approach is to suspend fabric swatches on hangers hung on

rods in open cabinets or off walls. Ideally, rods should be adjustable so

both shorter and longer swatches can be easily displayed. It also helps to

waterfall fabrics from the upper back to the lower front of the display to

accommodate more samples and catch light from the track above. The most

efficient way to sell customized fabrics is to group them by brand.

Leather samples are best displayed as large-scale cowhides hung on walls

from hooks. Sofa or chair customization options such as arm and leg styles,

trim and cushions should not be overlooked. Present all of the variations in

a clear and precise way. The best approach is to display physical samples

for each option. For example, Bassett Furniture offers an in-store display

that includes custom options for legs, trim, arms and cushions. Sample sofas

are elevated on platforms. They hang their custom fabrics in cabinets. The

same kind of customization options are also featured online. These kinds of

displays help tell stories that are relevant to each brand.

Everything for the Home

Many furniture retailers have added customizable options for dining tables,

chairs, counter stools, bedrooms and Amish furniture. Customers can select

wood types, door styles and hardware.

We are also seeing an increase in retailers offering Design Center add-ons

such as:

-

Custom draperies, window coverings and blinds, like those from Hunter

Douglas.

- Flooring options such as luxury vinyl tile, hardwood, and tile.

- Custom kitchens, bathrooms, and closets.

-

Customized sleep options that pair mattresses with adjustable bases to

meet clients’ specific needs.

Retailers will lose sales if they don’t make an effort at multiple

touchpoints to let customers know that they provide these add-on options.

“Some retailers have installed ‘light bars’ that showcase different types of

lighting so customers can see fabric samples under the type of lighting they

have in their home.”

As Design Center concepts continue to expand, furniture retailers have found

that strategically moving certain merchandise categories to adjacent areas

is a good idea. Rugs, for example, work extremely well next to these areas,

leading to easy add-on sales. Accent chairs and tables tend to perform

better near Design Centers, as do accessories, artwork and other

marketplace-type items. Consider putting up wall displays of lamps, pillows

and accents directly adjacent to or within Design Centers to inspire

shoppers and help them create complete design looks.

3D PLANNING SOFTWARE: Allowing customers to use 3D

Room Planning software has become a popular part of the Design Center

experience (pictured to right).

SCHEELS HOME & HARDWARE: Scheels Home & Hardware

offers a Design Studio that features everything from Hunter Douglas

window treatments to Sherman-Williams paint finishes. They even have a

botanical area for plants & florals (top left).

Current Trends

Style Centers and Stylists: During COVID, it was common for

retailers to have difficulty fulfilling custom orders in a reasonable amount

of time. This forced some to drop customized products from line-ups in favor

of items that could be stocked and sold off the floor.

To continue to cater to customers looking for custom options, stores

improvised. Many displayed large numbers of accent pillows on a pillow wall

to make any sofa “custom.” Some provided “custom” hardware options for

dining and bedroom groups. Others emphasized accessorizing with accent

lamps, decor and rugs to give shoppers the feeling of customization.

Instead of referring to designers as interior designers or interior

decorators, the descriptions “stylists” and “style experts” emerged. Design

Centers became “Style Centers.” Retailers moved away from the promise of

“customization” and towards “interior decoration” and “styling services.”

“Customers don’t want to walk back and forth between a sofa they like and

fabric sample options displayed in a centrally located Design Center farther

away. The solution is to create customization outposts.”

Customization Outposts: Customers often resist walking back

and forth between a sofa they like and fabric sample options displayed at a

centrally located Design Center farther away. One solution is to create

customization outposts that bring fabric options closer to furniture

displays.

Interiors Home, for example, is opening a new 35,000-square-foot store in

York, Pennsylvania, which features three separate “Style Centers,” one for

each price point (Good, Better & Best). These areas are augmented by a large

Design Center located towards the rear of the store where customers can sit

down with designers and work through ideas. Included are additional options

like window treatments, rugs, and casegood hardware.

Modular and Movable Displays: Retailers are also moving

towards modular and portable fabric displays. These offer limited selections

of custom fabric options displayed on carts that can easily be wheeled

around. Limiting fabric selection to best-sellers in mostly neutral colors

and textures at mid-level price points has the advantage of not overwhelming

customers. If a customer does not find a suitable fabric on the cart, they

can be led to the larger Design Center that features all the fabric

selections (including repeats of those on the carts). This arrangement keeps

sales associates from having to shuffle customers back and forth and,

therefore, losing sales.

Technology: In addition to physical displays, technology

should be fully integrated into Design Center experiences. Include room

planning software that allows designers and customers to plan out spaces and

quickly render them in 3D. Programs like Ikea’s Home Planner, La-Z-Boy’s 3D

Room Planner, Ashley’s Room Planner, and other browser-based visualization

tools give designers the ability to work more quickly and effectively. Close

rates dramatically increase when customers can visualize how their

re-designed room will look.

“Modular and movable fabric display units offer a more limited selection of

custom fabric options on smaller carts that can be easily wheeled around.”

Other emerging technologies like Occipital’s Canvas allows shoppers to scan

rooms in their homes using a mobile app. Once shared, in-store designers can

manipulate scans in 3D to show clients various design options. Other

technologies enable customers to make 3D scans of furniture pieces as they

walk around a store. These scans can be projected onto an image of their

room to see how it might look. Retailers like Wayfair and Ikea use this

technology to boost sales conversions. Visualization tools help sell

expanded packages of furniture and decor creating higher average sales.

Conclusion

No matter how you offer customization options, it is important to know who

your customer is and their expectations. Only then can you offer them the

type of customization experience that will best meet their needs and appeal

to their individual tastes. Once you get this right, you will be happily

rewarded with increased business and sales.