Wayfair's Way Day Brought Traffic, But Did It Bring Sales?

Furniture World News Desk on

5/24/2018

On April 25, Wayfair offered a day of “amazing deals” on all that’s home, right when more people are moving or on the lookout for fresh home decorating excitement. “Spring is the season when our customers are especially focused on sprucing up and furnishing outdoor spaces in anticipation of warm weather and summer entertaining,” said Steve Oblak, Wayfair’s chief merchandising officer, in announcing the 24-hour Way Day promotion.

In Way Day, Wayfair positioned its day as the new “retail holiday,” joining Amazon’s Prime Day, to give customers a chance at enjoying deep Black-Friday discounts. And like Amazon’s Prime Day, Wayfair offered flash sales for a limited time throughout the day, like a 4-piece sofa set with cushions for $282 and a Charbroil gas grill for $302.

The strategy was borrowed from Amazon’s playbook, which was first launched in July 2015. But unlike Amazon Prime Day, which is only open to its Prime members, Wayfair’s Way Day celebration was open to all.

And also unlike Amazon, which wasted no time announcing the results of its first Prime Day on July 16, the day after, Wayfair has remained mum about its results, other than a brief mention in the company’s 1Q2018 report. “Most recently, we were excited to see the success of Way Day,” the company stated, as it reported a sales increase of 47.7% year-over-year and a 33.2% increase in active customers in the first quarter ending March 31, about a month before Way Day.

This may tell us all we need to know about the first Way Day promotion. It wasn’t the big deal that the company hoped for, otherwise it would be out beating its chest like Amazon did after its first Prime Day.

Way Day brought more traffic

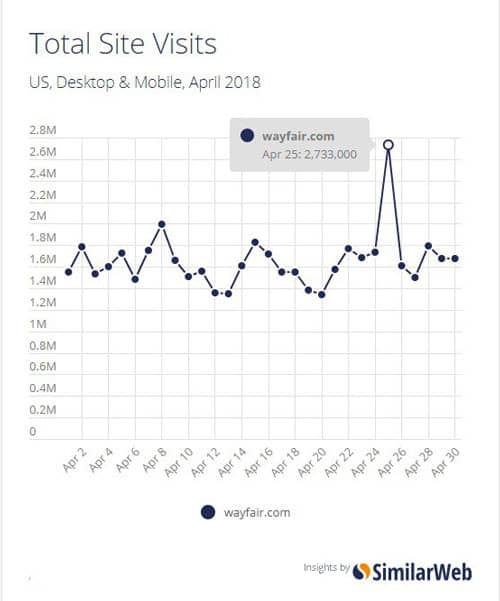

However, we can get an outside-in look at the results of Way Day from big data compiled by SimilarWeb, a digital data analytics company. Its data shows that on Way Day, Wayfair’s online traffic peaked at 2.7 million visits, which was 75% more than its 1.6 million daily average. But even when Wayfair increased traffic on its most popular day, it still received just 5% of Amazon’s traffic on April 26, compared to 3% on any other day. SimilarWeb reports that Amazon averaged 59.3 million daily visits in the past year (May 2017-April 2018), compared with Wayfair’s daily 1.6 million average.

Wayfair visitors also spent more time and clicked on more pages that day than is typical. On Way Day people spent an average of 9 minutes on the site and clicked on 10.2 pages each visit. This was an increase of over 3 minutes and 4 pages per visit though the rest of the month, SimilarWeb also reports.

The results show much greater levels of consumer engagement on Way Day compared to any other day for Wayfair, but 9 minutes to make a decision about buying a new sofa or bedroom set seems unrealistic. Since Wayfair’s average order size was only $236 during the first quarter of 2018, it suggests the company is selling a whole lot more decorative accents than major furniture pieces. So 9 minutes may be more than adequate time to click off an area rug, lamp, set of pillows or an end table. But a sofa? I don’t think so.

On the plus side, Wayfair got on a lot more people’s radar screens thanks to the Way Day promotion. Direct traffic from organic search rose from 284,000 visits on Tuesday before Way Day to 570,000 on Wednesday April 25.

“Seeing traffic from direct visits double is incredibly valuable, as this source is the best indication of brand strength,” says Ethan Chernofsky, director of corporate marketing at SimilarWeb. “Seeing the primary growth channel coming from one so closely associated with brand awareness is a huge sign that Way Day benefits will continue to be felt for a long time to come.”

Be careful what you wish for

From the outside then, Way Day looks to have been a digital success, “helping the site increase traffic immensely,” Chernofsky contends. However, as much as Wayfair has been growing revenues, $5.2 billion in the 12 months through March 31, 2018, it has been losing money even faster. In 1Q2018 its net loss rose 90.6%, to $107.7 million from $56.5 million in 1Q2017, nearly twice the rate of its sales increase of 47.7%, from $961 million to $1.4 billion.

That is the kicker: more customers and more sales means even more loss for the company. A recent analysis from professors Daniel McCarthy, Emory University, and Peter Fadar, University of Pennsylvania, found that Wayfair loses $10 on every new customer acquired. Wayfair pays $69 to get a new customer, but each one only yields a lifetime contribution to profits of $59.

This study was conducted to argue for new customer data metrics to value public companies, using Wayfair and Overstock as case studies, not because of any inherent interest in these companies, but simply that each provided public data needed for their analysis, specifically revenues coming from new customers and existing customers who are being retained. That both companies compete in similar home verticals also proved useful, since furniture is a category with long purchase cycles. The professors, however, argue that their analysis model applies even for low frequency purchases, since a customer is a customer regardless of how often he or she buys.

Regarding Wayfair, Fadar said,

They’re spending like crazy to acquire very, very inefficiently. If you just look at the surface level, you see this kind of hockey stick, exponential growth. But it’s all acquisition. They’re just getting a bunch of people to come in. Those same people aren’t coming back nearly as often as you might expect them to be. In fact, their repeat purchase rates are a lot lower than they were for Amazon, even close to 20 years ago. And this is from their own data.”

Overstock, by contrast, does much better than Wayfair in their analysis, spending only $38 to acquire a new customer and generating $47 in profits afterwards. They concluded that customer retention needs to be where Wayfair should be investing its efforts, which is where Overstock, and Amazon for that matter through its Prime subscriptions, is focusing.

“While one could argue that some of Wayfair’s advertising expenses are earmarked for customer retention, the proportion is likely to be small, and because Overstock is a relatively more mature business, its corresponding proportion [in customer retention] is likely larger than Wayfair’s,” Fader said.

At the end of the day, Way Day may have been a success in bringing lookers and buyers to the site. But Wayfair needs to figure out how to get the customers it acquires for a premium to buy more often and spend more when they do. Until it figures that out, there is no way forward for Wayfair. As a result, Way Day looks to have only added to the company’s loss, rather than its profitable growth.

More about Pam Danziger: Pamela N. Danziger is an internationally recognized expert specializing in consumer insights for marketers targeting the affluent consumer segment. She is president of Unity Marketing, a boutique marketing consulting firm she founded in 1992 where she leads with research to provide brands with actionable insights into the minds of their most profitable customers.

She is also a founding partner in Retail Rescue, a firm that provides retailers with advice, mentoring and support in Marketing, Management, Merchandising, Operations, Service and Selling.

A prolific writers, she is the author of eight books including Shops that POP! 7 Steps to Extraordinary Retail Success, written about and for independent retailers. She is a contributor to The Robin Report and Forbes.com. Pam is frequently called on to share new insights with audiences and business leaders all over the world. Contact her at pam@unitymarketingonline.com.