In GoodBed.com’s Expert Q&A mattress forum, we get a lot of questions from people looking to buy an exact replacement of a bed they already have. Clearly, these people are happy with what they have, and they figure they'll save some time and reduce their risk by simply buying the same thing again. It's the "if it ain't broke, don't fix it" school of mattress shopping.

This observation raises several questions. Do consumers really value mattress innovation to the degree they do with other products? If not, why don’t more consumers value mattress innovation? And finally, what can retailers do with this knowledge?

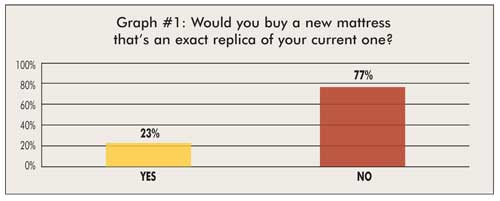

Do consumers really value mattress innovation? We asked over 1,000 mattress shoppers this question: “Would you buy a new mattress that’s an exact replica of your current one? The results are shown in Graph #1.

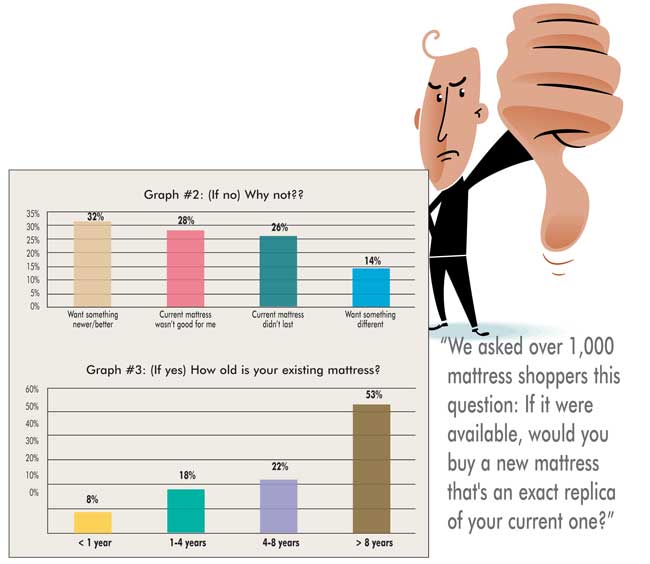

Since most mattresses being replaced are at least 5 years old, the hope was that by asking visitors the additional question, “How old is your existing mattress?”, it would also answer the question of whether consumers value the ‘latest and greatest’ in mattress innovation or the ‘tried and true’ (results are shown in Graph #3).

At first blush, we see that only one in four mattress shoppers would want to buy an exact replica of the mattress they already have. But before we concluded that the remaining majority of consumers are driven by a desire for the ‘latest and greatest’ in mattress technology, we asked them why they wouldn’t want a replica of their current mattress. The responses to the question, “If no, why not?” are summarized in graph #2.

The unfortunate reality uncovered here is that a large group of mattress owners (approximately 50%) weren't very happy with their previous purchase. This group was split pretty evenly between people that simply chose the wrong bed for them and people that chose a bed that didn’t last. As it turns out, the number of people who said that they were expressly seeking the latest mattress innovations is a rather small minority, about one in four mattress shoppers.

So, why don't more consumers value mattress innovation? For the mattress industry, this begs an obvious question: why are there so many consumers that don't value innovation when it comes to mattresses? After all, mattress companies work hard on continuously improving their products, to the point where the mattress they had before probably isn't even made anymore.

Unfortunately, this isn't the kind of question that's easy to ask people in a survey. However, we can get some pretty big clues by looking at why mattresses (at least historically speaking) aren't like some other product categories:

- Mattresses don't tend to have actively used features (unlike TV's, computers, and mountain bikes). There's an obvious reason for this: it's a product we use primarily when we're sleeping.

- Mattress performance tends to be difficult to assess (unlike golf clubs, musical instruments, and power tools). Historically, it's been very hard for most people to gauge and appreciate how a mattress is really 'performing' in terms of the quality of their sleep.

- Mattresses don't tend to make a style statement (unlike couches, clothing, and carpeting). The plain fact here is that mattresses are covered up most of the time.

What can retailers do with this knowledge? This survey data seems to divide mattress consumers into four discrete groups of roughly equal size:

Mattress Buying Group #1:

People that were happy with their previous mattress and want the exact same thing. This group of mattress shoppers may represent the greatest opportunity for mattress retailers. Provided they are confident you are offering the exact mattress they want, they are already pre-sold on it being a quality product, a good value, and a good match for them. In other words, they are halfway to the cash register! This points to a clear opportunity to maintain more continuity in mattress product lines and model names over time, and argues against the current approach of constantly discontinuing models only to replace them with differently named versions of the same (or nearly the same) thing. Short of this, some of these customers can be captured by making it transparent (eg, on your website) by listing names of any older models you carried that are equivalent to your existing models.

Mattress Buying Group #2:

People that previously chose the wrong mattress for them. This is a group that lacks confidence in their ability to choose the right mattress. This lack of confidence will inevitably postpone and prolong their purchase process, and may well lower their willingness to pay up for a premium product. Imagine how helpful it would be for members of this group to directly compare the currently available choices against their existing mattress. Your last bed proved slightly too firm but otherwise good? Try this one, which is the same thing except one notch up in plushness… That’s the kind of information that would give them the confidence to buy, and to buy from you.

Mattress Buying Group #3:

People who previously chose a mattress that didn’t last. This group also lacks confidence, but more so in the mattress industry than in themselves. After having been disappointed by the longevity of their existing mattress they could be prime candidates for an upsell. After all, higher quality materials should last longer and deliver more value over time. However, having been burned before, they will first need to be shown exactly why the new mattress would succeed where their existing mattress failed, which requires a transparent side-by-side comparison of old and new. Short of this, many of these people will choose to invest even less in their next mattress, figuring “fool me once, shame on you, but fool me twice, shame on me”.

Mattress Buying Group #4:

People that are interested in the latest and greatest in mattress technology. Arguably, this group, just 24% of all mattress shoppers, is the only one being properly served by the current model of mattress retailing. They expressed a focused interest in benefiting from the latest innovations that the mattress industry has to offer, so they will be pleased to see that most mattress models on the sales floor are new within the last 12 months.

About Michael Magnuson: Michael Magnuson is the founder and CEO of GoodBed.com, the leading online research destination for mattress shoppers. He has 15 years of experience in the digital media industry, as both an entrepreneur and a private equity investor. Michael graduated from the University of Pennsylvania, and received his MBA from Stanford University. Questions about this article or any topic related to bedding sales and marketing can be directed to him at www.goodbed.com/contact or call 415 738-9500.