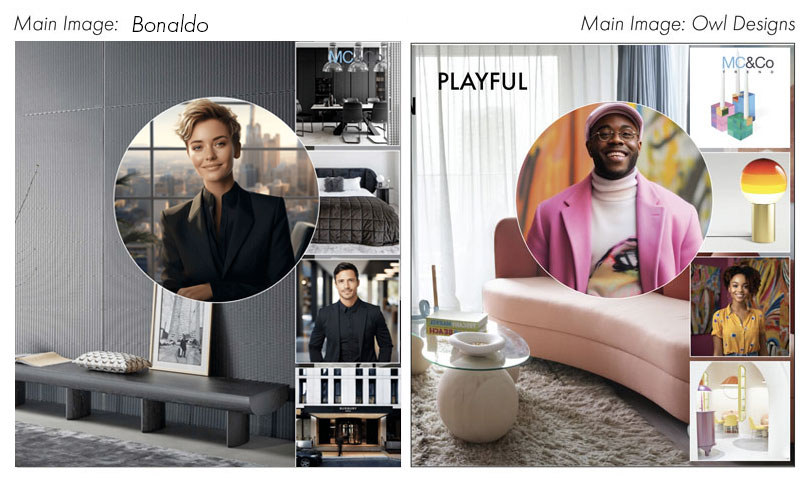

INTERVIEW WITH MICHAEL CLEGHORN, MC&Co TREND

Here is a close look at the six shopper aspirations that MC&Co Trend says

will define how consumers will make furniture purchase decisions in 2024.

For this Design and Designer series installment, Furniture World interviewed

Michael Cleghorn, Founder & CEO of MC&Co Trend, a company that, according to

the company website (mccotrend.com), presents “powerful, unbiased trend

forecasting reports to change the way you predict, develop and design,

without guesswork or bias.”

Cleghorn noted that what differentiates MC&Co Trend is that he and his

co-founder, Linda Simpson, CEO of Imagination Network, their US and North

American partner, both came to the company from commercial backgrounds.

“Linda,” he said, “had diverse experience as a buyer and product development

manager with companies such as Bloomingdale’s, Associated Merchandising,

Silvestri and Enesco. I was a buyer, merchandiser, and brand manager for

large Australian retailers. We met while working on a project with the

Department of Trade in the Philippines tasked with repositioning the

Philippines as a credible source for homewares and furniture. It was then

that we realized there was an opportunity to create a forecasting process

that was commercially focused and actionable.

“Some trend reports we saw in the marketplace at the time had such a broad

focus that it seemed like everything was trending. We wanted to bring our

reporting into focus for manufacturing and retail brands. This idea drove us

to develop a scalable process we call our Trend Intelligence System.

“Our forecasts look at about 40,000 images from the world’s most important

retail and wholesale brands, interior designers, hotels, and magazines. We

use this information to create 26 different positions on style every six

months. We also track 26 moods and put them through a series of useful

filters.”

Cleghorn said their forecasting process starts with a focus on six

‘aspirations’ that align with the ‘moods’ in the marketplace —grounded,

ordered, escape, nostalgic, playful and opulent. “Although they are always

present in the home furnishings market,” he observed, “these aspirations

evolve due to geopolitical, demographic, social, economic and other

conditions.

“The second thing we look at is how home furnishings consumers view their

lives through the five attributes of mood, color, pattern, material and

texture, and shape. There are four different ways that people approach their

lives through these five attributes: optimism, ambition, discipline, and

accomplishment. “Thirdly, our analysis addresses the evolution of the styles

we follow regarding their commercial timing and positioning. For example,

what’s happening with coastal, mid-century or traditional elements.”

Although MC&Co Trend’s analysis looks at trend forecasting from a macro

perspective, its primary focus is creating information that can be highly

customized for manufacturing brands and retailers. To take advantage of the

full range of information available, brands and retail organizations must,

as a first step, have awareness of the evolving aspirations of their target

customers. That’s something many furniture retailers haven’t fully grappled

with.

Pragmatic vs. Decorated Homes

“I think it’s essential, Cleghorn said, “that retailers and brands start

looking more closely at their customers’ aspirations. Much of the market is

moving away from offering products that are highly focused on serving

pragmatic sorts of customers, for example, by showing the best-priced

three-piece recliner set in leather and building a room package around it.

“Their forecasting process starts with a focus on six ‘aspirations’ that

align with the ‘moods’ in the marketplace—grounded, ordered, escape,

nostalgic, playful and opulent.”

“The consumer focus on expressing personality through furnishing homes is a

growing trend, driven in part by ‘reveal shows’ that change rooms from

cluttered messes to fabulous environments. Studio McGee’s mission to ‘Make

Life Beautiful’ and similar shows have built awareness that there is

spiritual or emotional significance to home environments that can make

people feel better.

“Many retailers have been looking at each other and trying to price

competitively rather than taking a broader view of their customer’s

lifestyles. Retailers like Williams Sonoma have grown by taking on lifestyle

positions. Big box companies like Lowe’s and Target, have developed a real

focus on trends that surpasses what many traditional furniture retailers

have done.”

Six Aspirations Defined

-

Ground Aspiration: “The ground aspiration is the

emotional connection to creating calming, relaxing havens that make

customers feel earthy, spiritual and healthy. It has grown in influence

over the last ten years, along with yoga, mindfulness, farmer’s markets

and slow living. The ground aspiration is internally focused on ‘me, my

health and self.’ From a macro perspective, the ground aspiration is

stable and has influenced the following five aspirations.”

-

Escape Aspiration: “The escape aspiration is about

being extroverted, engaging with people, having good times, entertaining

and, sometimes, bringing vacations into home environments. We see the

nostalgic aspiration, a sentimental idea, growing and diversifying in

the current geopolitical environment.“

-

Nostalgic Aspiration: “Our customers have experienced a

pandemic, a cost-of-living crisis, inflation, uncertain geopolitical

situations and wars popping up everywhere. They feel nostalgic for what

seems like safer times. The nostalgic aspiration is growing and

diversifying from a macro perspective.”

-

Opulent Aspiration: “Opulent is an aspiration connected

to being seen as wealthy and living a luxurious, sophisticated, worldly

existence. It is also increasing in influence. From a fashion

perspective, labels have moved from the outside to the inside of

garments because overt displays of wealth during tough times can be seen

as vulgar. Soccer moms have transitioned from driving a Mercedes Sport

to a Mercedes SUV. They still buy luxury but frame their purchases from

a different set of needs, such as the safety of their kids. Instead of

saying they are going to a glamorous resort, they may describe it as a

six-senses yoga retreat.

“People want to achieve old-money looks as opposed to new-money looks.

Louis Vuitton, Chanel and other well-known apparel companies tend to be

seen as crass, new-money brands. Instead, consumers are reconsidering

Brooks Brothers and classic Ralph Lauren aesthetics.”

-

Ordered Aspiration: “The ordered aspiration is all

about seeking comfort in order. This aspiration is currently stable and

influential.”

-

Playful Aspiration: “Playful, characterized by whimsy

and color, is all about being spirited, cheerful and rebellious. We’re

talking Jonathan Adler-type styles, boosted by an exit from COVID with a

need for optimism.”

“Pottery Barn focuses on traditional American nostalgia. West Elm focuses on

mid-century nostalgia. Crate & Barrel has an ordered and grounded

aspiration, and Jonathan Adler has a highly playful aspiration.”

Gobblers and Nibblers

“I don’t mean this in a derogatory way,” Cleghorn noted, “but retail market

share is being siphoned off from many old-style furniture companies. The

market is changing. Look at what fast retail fashion brand Zara

(https://www.zara.com) did in clothing and home furnishings, then consider

why department stores have lost so much market share over the past 20

years.”

Cleghorn elaborated on why furniture retailers should be alert for what he

calls gobblers and nibblers. “Many emerging digital home furnishings brands

that focus on a single aspiration,” he observed, “have gobbled up market

share from more traditional brick-and-mortar furniture store brands that

appeal to a wide audience.”

He is uncertain whether many of Furniture World’s readers have focused

enough on identifying these single aspiration competitors or created

effective strategies to compete against them. “For example,” he said,

“Pottery Barn focuses on traditional American nostalgia. West Elm focuses on

mid-century nostalgia. Crate & Barrel has an ordered and grounded

aspiration, and Jonathan Adler has a highly playful aspiration. For high-end

stores, maybe RH is gobbling up market share, and for a promotional store,

perhaps it’s Target.

“Besides gobblers, furniture retailers must be aware of smaller online

nibblers selling particular looks that focus on a specific aspiration

through Wayfair and Amazon. Only then can they develop ways to take back

little bits of market share from these guys.”

Grounded Aspiration

CALM EMOTIONAL CONNECTION

- I aspire to be earthy, spiritual and healthy

- I have an independent mind

- I seek meaning and connection

- I focus on authenticity

- I value artisanal methods

- Trend Movement: Stable & Influential

Escape Aspiration

FREEDOM EMOTIONAL CONNECTION

- I aspire to be relaxed and friendly

- I am collaborative and welcoming

- I seek comfort in good times

- I love traveling and I value the outdoors

- Trend Movement: Stable & More Romantic

Managing Style Evolution

Furniture World asked Cleghorn how furniture retailers might evolve from

selling a sea of products to being more trend-focused.

“My advice is to give customers what they want at the moment, then inspire

them with what they could have,” he replied. “They should do more research.

For example, match our six aspirations with their customer’s transactional

histories. And incentivize customers to fill out customer surveys that place

them in the most stable aspirational groups, such as grounded or ordered.

“Large retailers can afford to have marketing departments that talk about

their customers’ feelings, avatars, profiles or personas in a sophisticated

way backed by research, but any retailer can put a variety of looks and

styles in their social media feeds and measure engagement. They can also

look at their top sellers, see where they align with the six aspirations,

and review helpful, free materials found online, including previous

forecasts on the mccotrend.com website.

Opulent Aspiration

LUXE LIFE EMOTIONAL CONNECTION

- I desire luxury

- I adore expressions of glamour

- I am sophisticated and worldly

- I seek comfort in luxury

- I see value in the cosmetic

- Trend Movement: Increasing + Pared Back

Nostalgic Aspiration

SENTIMENTAL EMOTIONAL CONNECTION

- I aspire to celebrate history

- I seek comfort in the past

- I am retrospectively focused

- I see value in revisiting

- Trend Movement: Growing + Diversifying

“The goal of performing this kind of research can be to present products and

collections better aligned within the evolving part of their market, moving

selections slowly towards positions that reflect how their customers’

aesthetics are evolving.

“Doing this requires an alignment of proportion, material and texture for

case goods and upholstered designs. We suggest creating more stories that

resonate with customer aspirations. Develop small in-store presentations

that reflect where these aspirations are going and maybe do softer marketing

around concepts to see how customers respond. That’s how to pull new

customers away from gobblers and nibblers. We talk to our clients about this

based on the deeper work we do, but there’s no reason why other retailers

can’t start thinking about these issues on their own.”

Cleghorn observed that brands and retailers tend to blame poor sales

performance on the products they produce or purchase from suppliers. “They

approach us saying, ‘We’ve got a product problem.’ Our analysis shows that

they often have problems knowing who their customers are, how their internal

teams communicate, or their processes.

“Retail departments can be quite siloed. Buyers and product developers may

buy a product with a certain concept in mind. But then, their visual

marketing and advertising departments develop different concepts completely

out of sync with the original intention.

“All departments should be on the same page regarding their target

customers’ aspirations, approach to life, cycle, viability and velocity.

Once this language enters a business,” he emphasized, “buyers or product

developers can explain if a concept they create is emerging or evolving for

their audience. Then, marketing departments can adjust messaging to, for

example, attract the interest of early adopters or adjust to a mainstream

mood.

“An awareness of customer aspirations,” he continued, “can become part of a

company’s brand DNA. When that happens, a new language forms that seamlessly

links product development to marketing and retail operations. Once everyone

in an organization understands this language, it leads to better planning,

execution and emotional connections with customers.

“This approach is also a great way to bring analysts and senior managers who

may not have a strong understanding of where aesthetics and style are going,

into the conversation so they can manage the people below them.”

Ordered Aspiration

STRUCTURED EMOTIONAL CONNECTION

- I aspire to be structured and strategic

- I seek comfort in order

- I adore functional design

- I value classicism

- Trend Movement: Stable + Influential

Playful Aspiration

SPIRITED EMOTIONAL CONNECTION

- I aspire to be cheerful

- I am rebellious and noticed

- I seek comfort in whimsy and humor

- I am color focused

- I see value in lightheartedness

- Trend Movement: Growing + Challenging

Baby Steps

Engaging with this process doesn’t often happen in one season. “That’s why

many of our clients,” said Cleghorn, “are on a two- or three-year program of

evolution starting with what we call a ‘handhold to handover.’ Check-ins are

needed to measure the implementation progress. It’s necessary to ask if the

rug buyer is aligned with the lighting buyer, the upholstery buyer and the

case goods buyer. Is everyone from the CEO to the newly hired sales

associate aligning their stories?”

Market Movement

He explained that marketing to shoppers with a focus on the grounded,

ordered, escape, nostalgic, playful and opulent aspirations is a proven way

to attract customers interested in expressing themselves through home

interiors. Purely transactional shoppers who primarily want a comfortable

and affordable sofa may not be as interested in digging deeper.

“In general, the market for home furnishings is moving towards shoppers who

are thinking, ‘What do these products say about me? What will people think

of me? Do I feel the emotional connection?’ Marketing with this in mind has

become a more important consideration.”

Losing Entrepreneurial Assessment

Cleghorn believes that some retailers who buy by the numbers can lose the

art of what he calls entrepreneurial assessment. “If we think about the

market in a very simplistic way,” he explained, “there are three types of

shoppers: the decorator, the innovator and the pragmatist. The market is

moving from the pragmatist type to the decorator type. So, retailers

operating by the numbers in functionally oriented furniture operations

should, depending on their specific model, consider moving from a pragmatist

toward a decorator orientation.

“In a design business, not everything can be run by spreadsheets. There has

to be a dynamic tension between analytics and entrepreneurial assessment,

vision and risk-taking,” he observed. “There’s a lot less risk in retail

than we used to have. Innovating and taking on risks needs to be qualified.

This is what we try to do through our trend forecasts. We qualify where the

least risk is for a business looking at innovation through product programs.

Every company must find a path forward by evolving a measurable strategy

that works within the current supply chain and marketing dynamics.

Refreshing an evolving style is usually less risky than working with

emerging trends. However, retailers can take elements from emerging trends

and apply them to evolving trends to stay relevant.”

Macro Trends

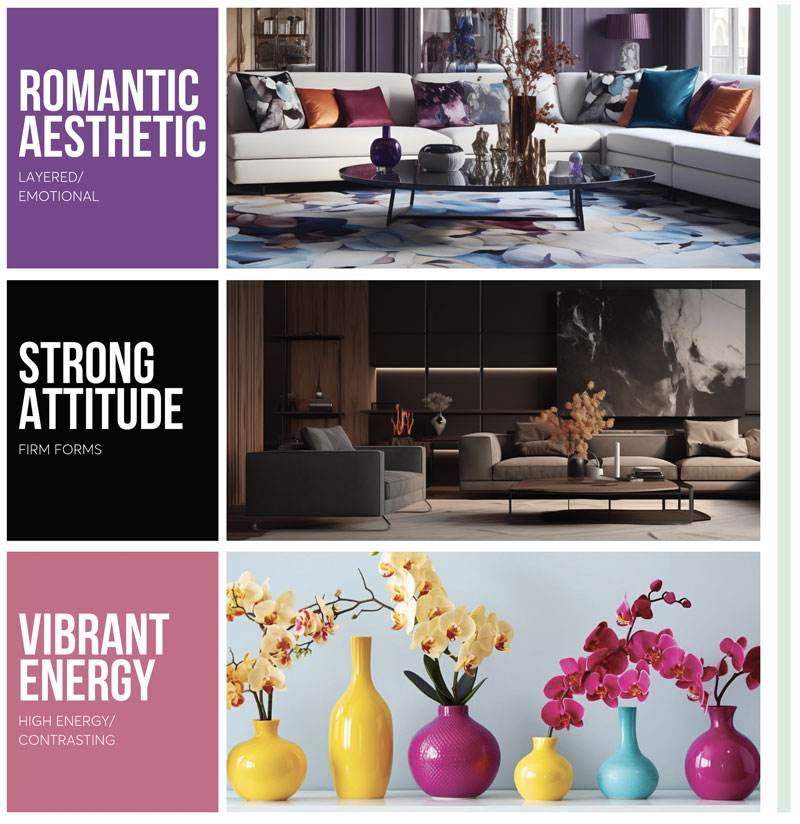

Macro trends are considered high-level forecasts that provide a

framework for a wide variety of interpretations. A macro trend can be

applied to any of the six aspirations—grounded, ordered, escape,

nostalgic, playful and opulent.

The most recent MC&CO Trend forecast has identified macro trends,

including increased consumer alignment to romantic, layered

aesthetics, bold, strong shapes and vibrant color energies.

Demographic Effects

Retailers can no longer assume that older shoppers will necessarily aspire

to create traditional home environments and that younger demographic groups

will do the opposite. Cleghorn provided an example. “Interior designer,

actress and fashion designer Iris Apfel,” he pointed out, “has created a new

culture of older women who are saying that they refuse to age gracefully.

Instead, they want to be incredibly playful through color, whimsy and humor.

That’s a ‘playful aspiration’ mindset normally associated with a younger

generation.”

He believes that shopper’s aspirations and approaches to life have little to

do with age, earnings or socioeconomic position. “People who want opulence

in their lives,” he told Furniture World, “can be wealthy, retired baby

boomers who hire top designers to create million-dollar fit-outs for their

apartments. But a 26-year-old Gen Xer who lives in a basic studio apartment

might fulfill their opulent aspiration by purchasing a velvet cushion from

K-Mart or Target.”

Conclusion

In closing, here are other style considerations retailers might think about

courtesy of Michael Cleghorn:

More Macro Trends

There are many style trends in the current marketplace. Although

vibrant energy, romantic layering, and strong attitudes are

increasing, there are also high levels of consumer alignment to

classic, simple aesthetics, soft, curvilinear shapes, and soothing

tonal color energy.

-

Polarization: What’s interesting about our six

aspirations from a marketing perspective is that home furnishings

shoppers’ social media feeds have become polarized. If a shopper keeps

searching online for nostalgic home furnishings styles, eventually,

that’s all they will be exposed to. Much like politics, style is

becoming more polarized.

-

Style Guides: If you don’t already have one, create a

style guide.

-

Alignment: Create alignment between buyer categories.

-

Be Alert: Watch retailers that present highly

considered, curated and resolved interior expressions, such as RH, West

Elm and Room & Board. They’re growing.

-

Self-curation: If your store targets customers with

multiple aspirations and lifestyle choices, consider focusing on

eclectic self-curation. Consumers who want to tell you ‘their style’ is

a strongly growing innovator category.

-

Individualism: Consider that younger consumers mix

their clothing eclectically to create their own styles. Many, especially

those with less disposable income, are focused on mixing, re-purposing

and recycling flea market and secondhand shop finds with contemporary to

build highly eclectic, self-curated interior home furnishings looks.

This trend is likely to influence more mature demographics as well.

-

Small nibblers: Highly curated looks that reflect a

specific mood may be difficult for some established furniture retailers

to commercialize. Consider how small online nibbler companies that have

done this successfully are siphoning off market share.