Here comes the sun! It is 6 a.m. on Saturday morning in Smalltown, USA and Mr. Furnituredealer is unlocking the back door to his 3rd generation family owned retail furniture store. He starts early on Saturday as he does every day to prepare his showroom in hopes that this will be the best sales day ever in his company’s 100 plus year history.

Oh the life of a furniture dealer! What is Mr. Funrituredealer trying to accomplish by working these long hours? He is in pursuit of a strong business reputation that returns profits and payrolls to support his family and his employee’s families. Simply put profit and payroll. So, as a prudent business person, Mr. Furnituredealer also buys business interruption insurance coverage, known as Time Element insurance. It’s a hedge against the risk of a catastrophic event that would put at risk the profits and payrolls he works so hard to create.

In fact, most prudent furniture retailers in large and small operations purchase Time Element coverage to provide protection for loss due to reduced sales/income and to restore a business to the condition prior to a loss.

The rest of this article provides information on Time Element coverage you may want to consider purchasing for your business. Time Element coverage is better known as Business Income insurance, Business Interruption insurance or just BI.

Business Income: Business income is defined as the net income (net profit or loss before income taxes) that would have been earned from continuing normal operating expenses including payroll. In the event of a covered loss, BI pays up to the policy limit as a result of the necessary suspension, slow down or cessation of business activities during a restoration period. This suspension must be caused by direct physical damage to a store or warehouse. The restoration period begins immediately after the damage happens subject to the deductible or waiting period, and ends when the property is repaired or business activities resume.

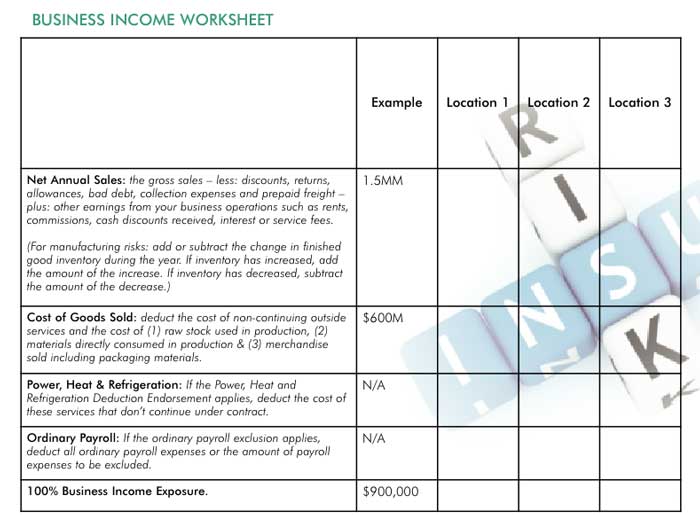

To assist in determining a limit of coverage to buy, the BI Worksheet below can be completed for risk management purposes.

Note: Calculate on accrual basis (not a cash basis) and provide actual values for 12 months figuring on the fiscal year. As you can see, it’s a very simple calculation.

Note: Calculate on accrual basis (not a cash basis) and provide actual values for 12 months figuring on the fiscal year. As you can see, it’s a very simple calculation.

Extra Expense: Extra Expense is the expense you incur during the restoration period, defined previously, that you would not have incurred if there was no covered direct physical damage to your store or warehouse. You buy it to continue doing business.

The carrier actually wants to pay Extra Expense in order to avoid or minimize your BI loss.

This coverage is intended to pay the cost of renting or even opening another store or warehouse location that will keep business flowing until you are back enjoying normal sales activity. It also pays overtime wages to help expedite the damaged property’s return along with any above market prices you have to pay as a result of the situation.

Business Income from a Dependent Property or Contingent Business Interruption: This Time Element coverage also defines Business Income as the Net Income (net profit or loss before income taxes) that would have been earned, and pays continuing normal operating expenses including payroll. The principal difference with this type of policy is that the covered loss must occur as a result of direct physical damage to a dependent property. A dependent property is a business operated by someone other than you, that your businesses’ income stream relies on. Problems at one of your major manufacturer’s plants, a wholesale supplier/distributor or even your warehouse/delivery service are examples of dependent properties that might interrupt your business operation.

Utilities Service Time Element: Under this coverage form, Business Income and/or Extra Expense is provided if business activities at your store or warehouse are suspended due to an interruption in utility service resulting from direct physical damage from a covered peril to a:

- Supply station located away from your store or warehouse.

- Water supply.

- Communication supply and/or power supply.

Be aware that this coverage will give you the option to exclude or include coverage for overhead transmission lines.

This was the most common loss experienced by retailers during Hurricane Sandy as they could not open due to lack of electricity.

Conclusion

So, when considering whether or not to buy BI, keep these reasons in mind:

- It will pay for lost profits as well as continuing expenses.

- Helps you to return to business more quickly.

- Enables you to retain key employees.

- Enables you to retain customers.

- Helps you to maintain expected financial results so as not to interrupt any planned growth and expansion.

- Encourages and prods the insurer to make prompt settlement of property claims.

One difficulty that can arise with BI is the claim settlement process. In my experience, it is the most time consuming and tedious of all insurance claims to process. That’s because when disaster strikes, the covered retailer asks to be paid on sales that haven’t happened yet. Predicting the future is like using a crystal ball, so insurers are very “thorough” in their investigations.

Disclaimer: The information contained in this article is for general information purposes only as you should always refer to your insurance policy for specific language relative to coverage, limits, conditions etc.

Next Issue

In future issues of Furniture World, this series will explore coverage essentials for the furniture dealer, and enhancing your insurance program & hot insurance topics.