Don’t get “tackled” by the IRS when handing off your business to the next generation.

It’s First and 10 on your own 5 yard line on the final drive of the Super Bowl. You’re down by 6 points and you’re facing arguably the most dominating defense of all time, the ‘85 Bears.

Sound like an overwhelming task? It should! The chances of scoring on this drive are slimmer than your next shopper asking for that one-of-a-kind nightstand that’s been in your warehouse since 1981! It’s “Da’ Bears”, after all.

Call a Time-out! Remember what coach said, “Design, practice, and execute and you’ll win ball games.”

It’s not the ‘85 Bears defensive line that you’re trying to run the ball on, but you are looking to hand off something... your business. If you thought Refrigerator Perry and the other major appliances on the Bears line were FEARSOME, wait until you are facing the new Tax and Banking Laws! It can be a daunting job, especially if you haven’t properly designed and executed a plan.

Furniture store owners are tough! They’ve grown successful businesses and survived countless recessions, regulations, and market conditions. Yet one concern consistently arises during the estate planning process; “How do I hand down my business to my children and not leave them with a massive tax burden?”

There is often a dichotomous struggle: On one side of the coin, when it comes to management and operations, you want to insure that the organization continues to run smoothly. On the other, you want to make sure that children and family members are well-provided for, whether involved with the company or not. The major goal, in either situation, is to decrease the potentially large estate tax bill; which will hurt the organization and reduce the total dollar amount your family receives as your legacy.

One strategy that is commonly used to provide this is called “Gifting”. This strategy can potentially alleviate some of the financial problems that come up when passing businesses or estates to family members. The following is an example of a “Gifting” strategy and how it can work when handing a family business to the succeeding generation.

GIFTING CASE STUDY

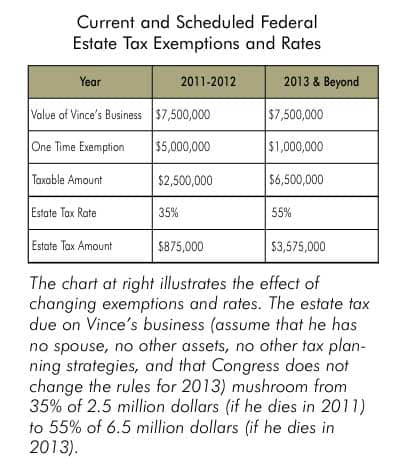

Vince (no, not Lombardi) owns a thriving retail company, Vince’s Fine Furniture valued at $7.5 million. He was married for 35 years but his wife passed away in 2007, leaving Vince and his two adult children behind. He wants to divide his estate equally between his two children. However, only one child, his son, is involved with the company. His daughter is not.

Giving up control of a business is not always an easy thing for an owner to do, particularly when he or she is still fully engaged in the day to day operations of the business, as Vince is. However, his financial advisory team; including his CPA, Financial Planner, Attorney and Insurance specialist, are swaying him to transfer at least some of the ownership to his two children as soon as possible.

Through a Gifting strategy, Vince can simultaneously maintain control of the business and reduce some of the taxable value from his estate. Vince prefers that his son takes control of the business, but he wants both children to economically benefit from the company’s continued growth.

His Attorney’s Advice: The “Keep it simple solution”. He suggests that Vince create voting and non-voting shares for his business.

This will accomplish the following:

- Vince will provide the control of the company to his son by giving him the voting rights.

- His daughter will receive economic benefit (from any dividends, distributions or liquidations of the company) by owning the non-voting right shares.

Sounds great! It’s easy and straight forward!

Not so fast…The problem that may arise with this simple solution is that if the business does not pay dividends, have any distributions or liquidate assets, his daughter is no longer receiving an equal portion of the estate. The variables in this solution may not work for Vince and his family.

Vince’s CPA adds in: “What about Vince’s annual exclusion?”

That’s one way for the business interests and estate to be gifted to his children. Vince’s “annual exclusion” - which is currently at $13,000 per year/per recipient, is an extremely tax-efficient way of gifting the estate. This strategy will be spread out over the course of many years, and (according to current code), have no tax consequences.

If Vince re-married, he and his wife could “split” the gift (thereby doubling it) and give $26,000 to each child, each year, tax-free. But when a company‘s value is as great as Vince’s, this tax-efficient tactic will never transfer a substantial proportion of the company’s value.

And there is always the possibility that Vince may choose to expedite the gifting process with a one time gift that exhausts his entire lifetime exemption, due to retirement or health concerns.

These two strategies alone can drive the ball down into field goal range, but coordinated with other designs, they can be part of a larger strategy that scores the winning TD.

Life Insurance is an option that many people forget about until it’s too late (either health has declined or premiums make the cost of coverage unattainable due to age). Life insurance death benefit proceeds can give your estate enough liquid assets to help complete your wishes. These may include providing enough funds to pay for administrative costs, gift taxes and estate taxes. Your estate might have assets and family heirlooms that your heirs may not wish to sell (to pay expenses), or that are not easily sold. That may include the family home, land, artwork, collectibles, the family business, etc.

It’s also imperative that the right type of life insurance is owned. There are many types of life insurance products available on the market today. Some are used to provide coverage for a specific amount of time, while others are used to maintain coverage for the entire life of the owner, and some are used as a managed asset to help mitigate market exposure in retirement years.

Regardless of what the need is, it’s important for business owners to have a meaningful conversation with their advisors to determine what action steps are necessary to accomplish your goal.

Handing your family business down to the next generation takes planning, design and execution, just like in the Super Bowl. Simple solutions, like simple playbooks may get you close, but who remembers the Super Bowl losers?

A properly planned design is a team effort, just like a winning football team; The offensive line is coached to do a specific task, as are the defensive and special team players. They know their role.

And just like in football, your succession planning team needs a quarterback, to manage the progression, coordination, strategizing and adjusting. There needs to be a trusted person that has managed the coordination of an estate plan. That person needs to bring your family, your CPA, Attorney, Banker and others together to make sure that everyone involved is working to protect your assets and organize them in the most tax efficient structure.

Your CPA and your Attorney may be very good at what they do. A financial advisor with succession and business planning expertise can assess your situation to ensure that your efforts are coordinated properly so your business and family can avoid unforeseen pitfalls and variables, and like the Star Quarterback, lead your team to victory.

With 11 years in the finance industry, Gavin von Loeser is a Strategic Advisor & Financial Risk Manager focusing on Estate and Business Planning at Strategies for Wealth. He helps clients (in the furniture and related industries) design financial plans that allow for transiting businesses and estates while maximizing tax efficiency.

Questions about the issues brought up in this article or any other aspect of financial planning can be sent to Gavin care of gavin@furninfo.com. He can also be reached directly at 203.621.8203.

Gavin lives in Stamford, CT with his wife and three daughters. Gavin has worked on business strategies with numerous companies in the retail and wholesale space as well institutional and private investment firms.