Outside Philadelphia, the home furnishings warehouse called "The Dump." sells everything for the home; furniture, mattresses, electronics, outdoor, rugs, and accents. It's tag line sets the stage for its customer appeal, "Tired of Stores that Cost too Much? Dump 'em." With limited hours, open only Friday, Saturday and Sunday, you never know what you will find there, but whatever it is, it will be cheap.

At first blush, The Dump's name might seem like an odd choice, but from a marketing and branding perspective it is brilliant. The Dump's branding is the K.I.S.S. principle at its finest -- Keep It Simple Stupid. The name is simplicity itself, one word, one syllable. It's ironic, what does it mean?, so it engages people's minds and makes them think, imprinting it in people's memory, and inviting a visit. Because it’s a store where manufacturers 'dump' their overstock and excess inventory, it’s a place a shopper may find a diamond in the rough. It stands for one simple thing -- Cheap stuff for the home.

Does your store or your brand tell potential customers what, indeed, you stand for? Many times home marketers confuse rather than clarify their meaning for shoppers, not explicitly standing for anything, but too many things. Your store becomes just another place for home stuff, not The place to go for _________ (fill in the blank).

Unity Marketing recently completed a seven-year retrospective study of the home furnishings market. It focused on the mindset of the affluent, the top 20% of U.S. households based upon income. Those households account for more than 40% of all home furnishings sales in America. Since coming out of the recession, the affluents are the most important target customer for anyone selling home furnishings. They are about the only segment in the market that actually has discretionary income, as the middle-class has lost about $5,000 per household of spending power in the economic crisis. The affluent are a primary target, whether you compete at the low-end, like The Dump, mid-market, like Raymour & Flanigan or La-Z-Boy, or premium/high-end, such as Ethan Allen, Design Within Reach, Restoration Hardware or anywhere along the pricing continuum.

What Unity Marketing's seven-year retrospective look at the home furnishings market revealed is painful, but these three facts are important for all to know:

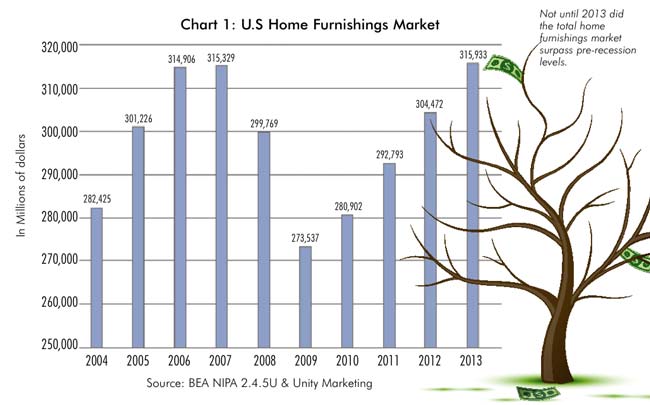

- First, not until 2013 did the home furnishings market recover from the losses of the recession. For the durable goods segment (furniture, major appliances, tableware & other hard goods) it still lags pre-recession highs. The Bureau of Economic Analysis put total personal consumption of nondurable furnishings (linens and soft goods) and durable furnishings and home equipment at $315.9 billion in 2013 (2014 data is not yet available), after hitting a $273.5 billion bottom in 2009. In 2013 this personal consumption measure remained at levels about equal with those from 2007 (See Chart 1).

- Second, the number of home furnishings retailers as tracked by the five-year Economic Census declined by 21% from 2007 through 2012, dropping from 65,144 stores to 51,998 through the recession. That means there are 13,000 fewer places for people to shop for their home, which may be a blessing, less competition, or curse, your store may be hanging on by a thread.

- Third, in 2012 the home furnishings retailers that survived the recession accounted for only 29% of total industry sales (i.e. $89.1 billion), as compared with 34% in 2007 ($108.2 billion). That means other types of retailers, think department stores, discounters, online/internet and more, have taken a huge chunk of business away from specialty furniture and home furnishings stores.

Given the realities that every home furnishings marketer faces -- i.e. there is a smaller durable home furnishings market today than before the recession, and people who want and need home furnishings have fewer specialty stores in which to shop -- how can home marketers grow their businesses and prosper? I think the answer is to keep focused on the best customer prospects -- the affluent with discretion -- and deliver the home furnishings experiences they crave.

Attract the Affluent

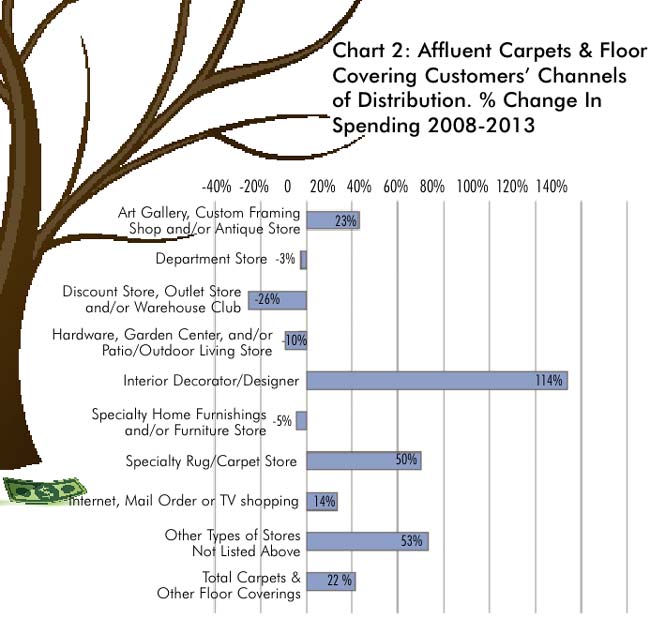

Drastic times call for drastic actions and 2015 is your call to action. Unity Marketing's research into the needs and desires of the affluent home furnishings customers from 2008 to 2013 reveals that when it comes to affluents buying things for their homes, they are turning more often to specialists, such as interior designers and stores that specialize. They are turning away from stores that don't specialize in any particular class of home goods. Chart 2 on page 92 tells you what's important to know about trends in the sale of home furnishings to affluent consumers from 2008 to 2013.

This chart shows that affluents more than doubled their purchases of rugs and carpets through interior designers and increased spending by 50% in specialty rug and flooring-type retailers. At the same time they spent 10% less in home improvement-type stores, like Home Depot and Lowe's, and 26% less in discount stores and warehouse outlets.

In other words, channels that position themselves as 'experts' or 'specialists' in rugs and carpets captured a larger share of the affluent market from 2008 to 2013. Retailers that were more mass or discount-oriented lost market share in the time period.

This is a trend Unity Marketing found across all 10 different home-goods product categories included in our study. Specialty is in and mass is out! Affluent shoppers are more likely to turn to specialty stores that are the 'experts' in specific types of home furnishings. For example, affluent shoppers are increasingly looking for these specialists:

- Furniture: Interior designers and decorators for new furniture choices

- Lighting: Interior designers and specialty lighting stores

- Window Coverings: Interior designers and specialty window dealers

- Major Appliances: Interior designers, contractors and specialty major appliances stores, as well as electronics and high-tech specialty stores

- Cookware & Small Appliances: Specialty gourmet cooking stores

Similar trends are noted across the other home categories studied. Affluents in the current market for home furnishings value the expertise and experience of specialists for their home purchases.

Stand Out

The call to action is to make your store, your destination, your service offering stand out. You must be clear regarding what you do, why you are better at that one special thing, and communicate it clearly and simply, like The Dump. The Dump doesn't claim to be all things for all people for home. But The Dump is a stripped-down shopping experience that offers the potential to find that one special thing for one's home at a deeply discounted price for the customer willing to search it out. One of The Dump's great appeals is its treasure-hunt atmosphere.

How do you compete, especially when so many other home furnishings retailers focus on price and discounting, like The Dump? It’s risky to go down the discount path, where there are plenty opportunities for consumers to buy good, cheap home furnishings. Instead, consider focusing developing a specialty. Unity Marketing's research reveals that the affluent shoppers in particular are looking not just for 'stuff,' but for special expertise along with products for their home. Affluent shoppers want to learn more about the home furnishings they are considering and how to use them effectively to make a design statement. More often than not, they have an idea of the way they want their homes to look and feel. They are turning to experts like interior designers who can help bring those ideas alive in their homes.

Specialty retailers selling across different categories should aim to develop category or product specialists within their stores to bring the kind of user information and design-specific expertise that affluent customers seek. No doubt, these customers made plenty of do-it-yourself design mistakes before they reached affluence. Now that they have reached higher levels of income, they are likely to want to avoid additional mistakes, and will value the services of an expert in a consultative retailing environment. Retailers need to lead with their expertise in specific categories to attract these high-potential customers.

And finally, specialty retailers need to develop a marketing communication plan that clearly and effectively communicates what that specialty is.

Developing this communications program can be more of a challenge for specialty retailers than finding and developing their actual home-related specialty. After all, you are an expert at home furnishings retailing, but not necessarily at effective branding and marketing communications. To communicate effectively with affluent target customers today, you should consider finding an expert in marketing, branding, public relations, advertising, and internet and social media marketing, to help you to reach this important target customer.

About Pamela Danziger: Pamela N. Danziger is an internationally recognized expert specializing in consumer insights for marketers targeting the affluent consumer. She is president of Unity Marketing, a marketing consulting firm she founded in 1992. Pam received the Global Luxury Award for top luxury industry achievers presented at the Global Luxury Forum in 2007 by Harper's Bazaar. Luxury Daily named Pam to its list of "Women to Watch in 2013." She is a member of Jim Blasingame: The Small Business Advocate's Brain Trust and a contributing columnist to The Robin Report, a newsletter for senior executives in the retail, fashion, beauty, consumer products and related industries.

Pam uses qualitative and quantitative market research to learn about luxury marketers’ brand preferences, shopping habits, and attitudes about their luxury lifestyles, then turns these insights into actionable strategies for marketers to use to reach these high spending consumers.

Pam has authored four books with her latest book Putting the Luxe Back in Luxury: How new consumer values are redefining the way we market luxury (Paramount Market Publishing, 2011). Visit

www.unitymarketingonline.com or email

Pam188@ptd.net.

Furniture World is the oldest, continuously published trade publication in the United States. It is published for the benefit of furniture retail executives. Print circulation of 20,000 is directed primarily to furniture retailers in the US and Canada. In 1970, the magazine established and endowed the Bernice Bienenstock Furniture Library (www.furniturelibrary.com) in High Point, NC, now a public foundation containing more than 5,000 books on furniture and design dating from 1620. For more information contact editor@furninfo.com.