Shoppers Return to the Store: Where They’re Shopping and What’s Trending Now

Furniture World News Desk on

9/1/2018

American retail is back with a vengeance. Through July 2018, retail and food service sales have topped 5.5% over last year, according to the Census Department’s Advanced Monthly Retail and Food Services Sales report.

The Wall Street Journal credited wage growth and improved job prospects as giving American shoppers renewed confidence to spend. “The robust U.S. economy is spurring people to shop,” it reports.

At the same time, the University of Michigan just announced that consumers’ sentiment of buying conditions backtracked in August, declining to last Septembers’ level based on its Survey of Consumers. Their worries about inflation are threatening to put the brakes on spending through the rest of the year.

“Some price resistance has been neutralized by rising wages, although the falloff in favorable price perceptions has been much larger than ever before recorded,” says Richard Curtin, the study’s chief economist in a statement.

Details trail by a month

Along with the Census’ advanced monthly retail report which provides a topline view of the retail sector in 13 major categories, it also releases a detailed report of the previous months’ results for all the specific types of retailers that makeup those 13 major categories. It is this detailed report covering January to June 2018 that I dug into.

Trending categories in retail, 1H2018

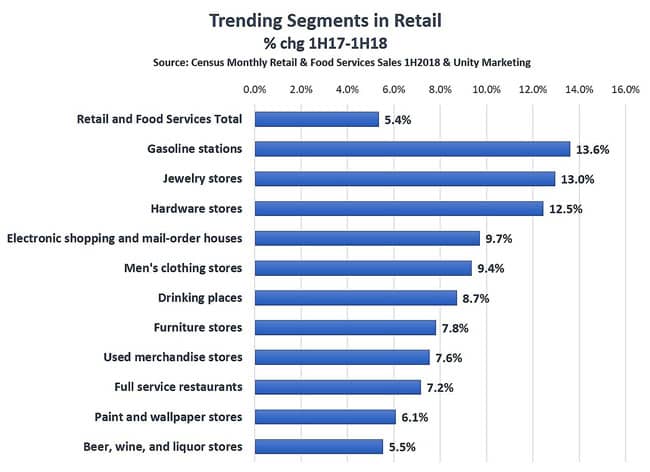

Through the first half of 2018 retail and food services sales advanced 5.4%. Here are the retail categories that are leading the pack and what the numbers reveal about American shoppers’ behavior mid-year.

Feeling pain at the pump

Perhaps the place we notice the effects of inflation first is at the gas pump. What else can you do for that minute or two it takes to fill your tank than look at those prominently displayed gas prices and reflect on what they were last week?

Retail sales at gasoline stations grew the fastest across all categories of retail in the first half of the year, up 13.6%, which tracks almost exactly with the rising price of gas. The AAA reports average price of a gallon of gas is $2.84 today, up from $2.49 at the first of the year, a painful 14.1% increase.

Look no further than this to understand the University of Michigan’s declining consumer sentiment measure. The more Americans have to spend on the things they need, the less money they will spend on the things they want.

More baubles, bangles and beads

Jewelry stores’ dynamic 13% growth through the first of the year is a surprise. This comes on top of a 4.5% annual increase in 2017. Americans are spending more on the luxury of jewelry, even while they worry about the price of gas.

Tiffany & Co is enjoying their indulgence, with sales in the Americas up 9%, though the company notes that foreign tourists are an important factor in its first quarter results.

Signet, on the other hand, is not benefiting much from consumers’ jewelry splurges. With over 3,500 jewelry stores, notably Kay Jewelers, Zales and Jared The Galleria Of Jewelry, its results are mixed. Same store sales across its brands are flat in the first quarter, though Zales is keeping pace with Tiffany, up 8.9%. However, Jareds, its higher-end brand, is down 7.8% and Kays, its largest brand, is down 1.9% in same store sales.

This leads me to assume that the nation’s independent jewelry stores are the primary beneficiaries of American’s growing demand for jewelry adornment.

Staying home, fixing home, beautifying home

Call it the HGTV effect. All those home rehab, makeover and decorating shows are giving Americans the know-how and encouragement to pick up their paint brushes and hammers and get to work.

Hardware stores are enjoying the boon, rising 12.5% making it the third fastest growing retail segment through first half of 2018. Specialty paint and wallpaper stores are also gaining, up 6.1% overall with Sherwin-Williams the big winner, as its second quarter sales rose 7.9%.

In the hardware store race Home Depot is the biggest winner. It just reported a second quarter increase of 8.4% and raised its annual guidance to 7.0%. Lowe’s, on the other hand, isn’t faring as well, with first quarter sales up only 3%.

After people paint their rooms, it is time to decorate and furniture stores are seeing a rise in sales as a result, up 7.8% so far this year. This follows disappointment last year, when furniture store sales only rose 2.8%.

Interestingly last year home furnishings stores, which sell a broader range and generally less expensive selection of home decorating items, had a gang buster year, up 8.2%, while furniture stores languished, rising only 2.8%. This year it is the reverse. Home furnishings stores have only advanced 2.1% this year.

So last year American shoppers were looking for linens, pillows, lamps and smaller decorative items; this year they are looking for major pieces, like sofas, chairs, beds and tables.

Bring it to me

Electronic retailers assault on brick-and-mortar retail continues unabated, rising 9.7% through first half 2018, though it is slowing somewhat from last year’s 10.4% increase. Shoppers want convenience. They want to stay home and let someone else pay the freight and do the heavy lifting.

Amazon is continuing to ride that wave. Its North America sales are up 45% for the six months ended June 30, 2018, with sales growth primarily attributed to “increased unit sales, including sales by third-party sellers, and the impact of the acquisition of Whole Foods Market.” Amazon also credits its efforts at reducing prices and improved delivery options.

The stars are aligned for online home furnishings retailer Wayfair, as it reported sales increased 48.8% in its most recent quarter. People wanting to create a more beautiful and comfortable home environment without having to schlep their purchases home is the reason.

Men’s fashion turn

Building upon strong men’s clothing store gains last year of 4.2%, the segment continues to advance, rising 9.4% in the first half of 2018.

Category leader Tailored Brands, however, isn’t capturing men’s interest, with comparable store sales only growing 2.1% in the first quarter. It operates more than 1,400 stores under the Men’s Warehouse, Jos. A. Bank, Joseph Abboud, Moores Clothing for Men and K&G brand names.

Second-hand gets the rose

American consumers, most especially the Millennials, enjoy the hunter-gatherer experience of second-hand shopping and have no qualms about owning used goods. As a result, used-merchandise stores notched a 7.6% increase the first half of this year on top of 11.6% gains last.

In the online sphere The RealReal is tapping the trend specializing in gently-used luxury goods. It was reported by Recode in April that the company was looking to raise an extra $100 million in funding to add to the $170 million it had secured since its in 2011 launch.

Commenting on The RealReal efforts to raise more cash and delay a long promised IPO, Recode speculated, “The RealReal and its investors [may] have realized that the secondhand market for luxury goods is a much bigger opportunity than they initially thought, and they feel confident that the site can take even greater market share by investing more in growth.”

The RealReal now operates two permanent stores, one in NYC’s SoHo and a Melrose Avenue location in Los Angeles just opened this month, along with pop-up stores in prime locations.

Eat, drink and be merry

Drinking establishments, full service restaurants and beer, wine and liquor stores are all enjoying booming sales the first half of the year, as Americans want to party and live the high life.

Food service establishments classified as drinking places saw sales rise 8.7%, with full service restaurants not far behind, growing 7.2%. Americans clearly want service with their drinks and food, as limited service eating places only grew 2.2%.

And while they are staying home in their freshly-appointed homes shopping online, they are enjoying a glass of their favorite refreshment, with beer, wine and liquor store sales up 5.5%.

On the down low

After this look at the fastest growing categories in retail, we can’t conclude without looking at the losers.

Office supplies and stationery stores are feeling the pain, with sales dragging behind all other sectors at -6.7%. No doubt these retailers are feeling the brunt of consumers’ shift online for office supply products. Category leader Office Depot is struggling as a result, with product sales down -.2% in the first half of the year.

Other clothing stores, which excludes men’s, women’s and family clothing stores, were off -4.2%, after dropping -5.9% last year. Presumably most of these stores cater to kids clothing. Leading player Children’s Place with over 1,000 stores is doing better than the category as a whole, but with comp sales off -1.8%, it has little to brag about.

Also feeling the pain are book stores, down -1%, household appliance stores, -2.1% and sporting goods stores, -3%.

To conclude, department stores, excluding discount department stores, are off by -1.3%, having slipped -1.5% last year. The general merchandise category overall is doing fair, up 3.5% overall, with strong showing in the other general merchandise stores, up 4.5% and warehouse clubs and superstores rising 4.1%.

More about Pam Danziger: Pamela N. Danziger is an internationally recognized expert specializing in consumer insights for marketers targeting the affluent consumer segment. She is president of Unity Marketing, a boutique marketing consulting firm she founded in 1992 where she leads with research to provide brands with actionable insights into the minds of their most profitable customers.

She is also a founding partner in Retail Rescue, a firm that provides retailers with advice, mentoring and support in Marketing, Management, Merchandising, Operations, Service and Selling.

A prolific writers, she is the author of eight books including Shops that POP! 7 Steps to Extraordinary Retail Success, written about and for independent retailers. She is a contributor to The Robin Report and Forbes.com. Pam is frequently called on to share new insights with audiences and business leaders all over the world. Contact her at pam@unitymarketingonline.com.