Out with the Old in 2018: Flexible Financing to Drive Revenue

Furniture World News Desk on

2/12/2018

Fortiva Retail Credit uses a proprietary underwriting system that analyzes data beyond a FICO score to determine a customer’s overall credit-worthiness resulting in approvals of consumers with credit scores as low as 480.

Fortiva Retail Credit uses a proprietary underwriting system that analyzes data beyond a FICO score to determine a customer’s overall credit-worthiness resulting in approvals of consumers with credit scores as low as 480.

By Joseph Ferguson and Judy Munden

With the holidays behind us and 2018 resolutions in the works, many families are in the process of ensuring their homes look perfect this year. Of course, consumer financing is a must-have for most customers after recuperating from holiday spending in order to take advantage of current home furnishing promotions. Stores without a flexible, multi-tiered financing program could miss out on a significant portion of these new year sales because they are unable to assist a broad base of customers during the months before tax return season arrives.

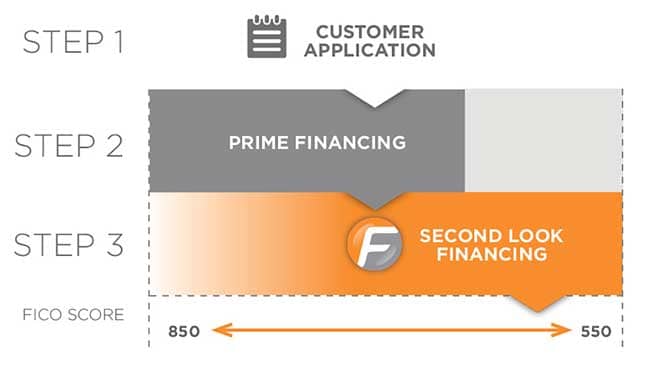

Credit programs and branded credit cards supported by prime lenders like Synchrony, Wells Fargo and Citi Bank are commonplace in the home furnishing world, yet these programs are typically only able to provide credit to customers with FICO scores above 700. However, FICO.com reports that more than 43 percent of the U.S. population has scores below that benchmark, disqualifying many people from prime credit offerings.

Savvy store retailers have expanded or plan to expand their financing programs in 2018 to incorporate a second look line of credit solution for less-than-prime customers – wherein a provider is able to approve customers who were initially declined by their prime credit option for a revolving line of credit. Extending customers a second look credit option can enable stores to save between 30 and 50 percent of sales that were initially declined, while also offering a more favorable option to satisfy customers who otherwise might have to resort to a lease-to-own payment structure.

“When 50 percent of all applicants are declined prime financing, having a valuable second look option is crucial to serve a substantial portion of our customer base,” said Charlie Malouf, President and CEO of Broad River Retail, a licensee of 16 (soon to be 18) Ashley HomeStore locations. “If you are relying solely on prime customers, you are losing sales – especially on big ticket furniture pieces.”

The Customers You’re Missing

The credit-challenged customer profile can include a wide range of potential buyers that furniture stores covet. In fact, TransUnion reported that 43 percent of millennials, 33 percent of Generation X and 20 percent of baby boomers are all considered less-than-prime consumers.

However, shoppers with less-than-prime credit could be extremely viable customers with great cashflow. Knowing that it can take between 7 and 10 years to overcome negative credit history, a buyer whose past financial woes are still reflected in their credit report could cause prime lenders to turn them away despite their ability to afford payments. For this reason, second look credit provider Fortiva Retail Credit uses a proprietary underwriting system that analyzes data beyond a FICO score to determine a customer’s overall credit-worthiness resulting in approvals of consumers with credit scores as low as 480.

Untapped Value to Your Business

Second look line of credit solutions are a key tool to expand your customer base and ensure that marketing efforts and investment toward these audiences do not go to waste. Additionally, implementation and processing are increasingly simple thanks to omnichannel capabilities offered across the array of point-of-sale solutions such as kiosks, internal POS systems and eCommerce platforms.

Leading second look providers can integrate their application and instant approval process into retailers’ in-store, online and mobile payment interfaces. Thanks to strategic partnerships with prime providers, retailers can also allow customers to apply for a second look line of credit without filling out a second application, making the process even more seamless. Third-party solutions like Vyze, STORIS, Versatile Credit and LendPro have also simplified matters by offering retailers a seamless, one-stop-shop for omnichannel credit solutions.

Given the simplicity of implementing a diverse, flexible financing program in the digital era, stores that operate in-house financing centers stand to benefit significantly by leveraging these advances. Beyond deferring billing, collections and risks of default to the financial providers, bringing a prime and second look provider with a seamless application at the points of sale will also expedite the process for the customers while boosting satisfaction with the shopping experience.

What Are the Benefits?

First, the obvious: more approvals lead to more sales, which leads to more money for the business.

Increased sales will also lead to happier sales staff. By adding more money to sales teams’ pockets, stores will ultimately save money in recruiting, training and turnover costs.

Approving customers who would otherwise not qualify is also a great way to boost customer satisfaction and loyalty. Providing a path wherein the customer can gain a sense of ownership rather than leasing the furniture, not to mention the cost savings from financing, leaves a lasting impression. Further, revolving lines of credit can help bring these loyal customers back for years by establishing an ongoing account for a customer and incentivizing them to return to that store for future furniture needs.

In addition to this expanded base of loyal, returning customers, happy buyers will inevitably tell their friends and family about the positive experience. Added referrals will ultimately lead back to the first benefit mentioned: increased sales.

Conclusion

Furniture retailers hoping for the uptick in customer interest in the new year must have the processes in place to ensure that they are able to convert that interest into sales. While most are set up to assist prime customers, it is vital that stores can serve the nearly one-half of Americans who fall outside of this customer profile. Otherwise, those customers will find their way to a competitor who has added the second-tier financing solution that can make their 2018 resolutions come true.

More about the Authors: Joseph Ferguson and Judy Munden represent Fortiva Retail Credit, the only second look consumer financing program serviced by a publicly traded company with decades of experience servicing credit-challenged consumers (issued by Mid America Bank and Trust Company). For more information, visit https://www.storis.com/accounting/