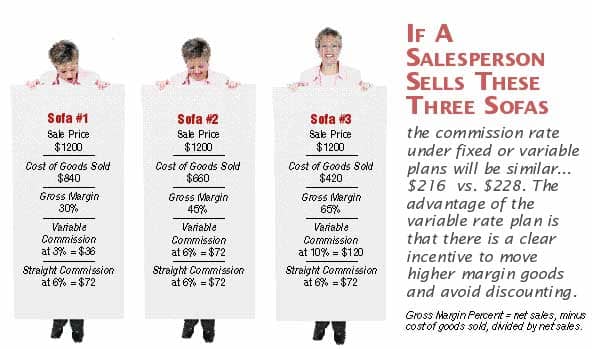

Variable rate commissions are a powerful motivator for salespeople, they stop discounting and boost margins.

A variable rate commission system can increase store margins and boost your sales associates’ income level.

As noted in the article, “Give Salespeople an Incentive to Boost Margins” in the February/March issue (posted to the Marketing Article Index on the furninfo.com website), variable rate commissions can eliminate discounting, stop underselling and be a powerful motivator for your salespeople. All these benefits require proper implementation.

There are two kinds of “fears” that must be eliminated in order to maximize your results from a variable commission plan. These are management's fear and the sales force's fear.

Eliminating Management's Fear

As a manager or owner, your primary fear is that you'll construct the commission schedule improperly and end up paying out a lot of extra commissions without realizing the increase in gross margins you're hoping for. There's an easy way to avoid this: The key is to construct a chart using your historical gross margin and commission figures as your starting points. To do this, take a fresh sheet of paper and construct your commission schedule as follows:

1. On the left hand side halfway down the page, write your last year's average gross margin percent, rounded to the nearest whole percent. In our example, this figure is 44.8%, rounded to 45%.

2. On the right side, opposite the gross margin percent, write your last year's total sales compensation expense (including selling salaries and commissions) expressed as a percentage of sales, rounded to the nearest whole percent. In our example, let's say that the sales volume last year was $2,500,000, and the selling salaries and commissions were $153,000, or 6.12% of sales, rounded to 6%. This figure is the effective commission rate that you paid last year.

3. Next, decide what maximum commission rate you might be willing to pay (if they earn you enough gross margin)… say 10%. Enter this figure in the upper right hand corner of your chart, above last year's effective commission rate. This figure is the maximum commission to be paid.

4. Subtract your historical rate (in this example, 6%) from the maximum commission rate (in this example, 10%) to arrive at the difference between last year's average commission and your maximum (in this ex ample, 4%). Multiply this difference (4%) by 5 to arrive at the percentage (in this example, 20%) which you add to the historical average gross margin to arrive at the gross margin (in this example, 65%) to be entered in the upper left corner of the chart. This figure is the minimum gross margin required to earn this maximum commission.

5. Next, decide what minimum commission rate you can pay and still have your salespeople willing to wait on the customer and not walk away, go back to the sales bullpen to work the crossword… for example, say 3%. This figure is the minimum commission rate that will be paid, regardless of how low the gross margin goes.

6. Subtract this minimum commission rate (in this example, 3%) from your historical rate (in this example, 6%) to arrive at the difference between the minimum commission rate and the historical rate (in this example, 3%). Multiply this difference (3%) by 5 to arrive at the percentage (in this example, 15%) to be subtracted from last year's average gross margin (in this example, 45%) to arrive at the gross margin to be entered in the lower left corner of the chart (in this example 30%). This figure represents the maximum gross margin that will generate the minimum commission rate.

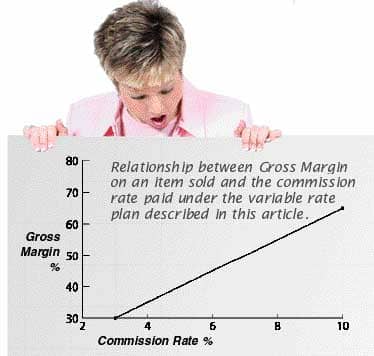

Your chart (with your figures) should now look similar to the example below.

The reason why retail managers have nothing to fear is that in the previous example, we’ve multiplied the gross margin numbers by five. As a result, for each percentage point in extra commissions paid the store will earn five more percentage points in gross margin.

Eliminating Sales Force's Fear

Any time management says that they’re changing the compensation plan, salespeople will naturally be suspicious. Despite assurances to the contrary, they will naturally assume that any change in compensation that isn't guaranteed in amount is invariably going to result in a decrease in pay. This natural fear makes them doubt management's motives any time a change in compensation is proposed. This natural reaction should be expected. It can very easily be eliminated by presenting the new compensation plan at an introductory sales meeting in the following way:

1. First, announce that you have an idea for a change in their compensation plan that you think will make both them and the company more money.

2. Immediately follow that statement by saying that, of course, you are not absolutely sure that it will work, so you are going to have a 90-day test.

3. Also, assure them that if either they don't like it or you don't like it at the end of the test, you're going to kick it out and go back to the old plan. No one is going to have to live with something they don't like long term.

4. Finally, eliminate any possible opposition to the new plan by announcing that during the test you are going to pay each salesman, each pay period, the old way or the new way, whichever will pay them more.

Presenting the new plan in this way to the sales force makes it obvious to them that you're NOT trying to get into their pocket. They can't lose, so they might as well relax. give the new plan a chance and see if the plan really does make them more money.

You've now handled the sales force fear, but what about you… does offering to pay them the old way or the new way, whichever will make them more money open you up to any risk? NO. You've already constructed the chart so that it's a mathematical impossibility to pay them more money on the new plan without earning the company five times as much additional gross margin as is being paid out in extra commissions. If the old way would pay them more, you still can't lose, because you're paying them the old way now.

One Final Tip

If you want to motivate salespeople to earn higher commissions by selling at higher gross margins, they must be able to easily determine the commission rate they are going to earn if they sell an item at the marked price. A letter code representing the rate to be paid can be printed in the upper right hand corner of each item's price tag. It should be printed about an inch high, so that a salesperson can read it from a distance. Codes that would be appropriate for the example above would be as follows:

Code RATE

A 10%

B 9%

C 8%

D 7%

E 6%

F 5%

G 4%

H 3%

Picture this situation: A customer is torn between two sofas, both $699, one is coded “D”. The other is coded “G”. The customer turns to the salesperson and says, “I just don't know. What do you think?” Is there any doubt in your mind which one the salesperson is going to cast his/her vote for?

Having had personal experience with variable commissions in our own stores and having had the opportunity to see the results they have produced for hundreds of our clients, I know that it is a fact that a variable commission system such as this one can produce gross margin increases of 3% to 9%. If your gross margin is already 45% or better, you should probably not expect much above 3% improvement. But 3% improvement gross margin will produce an improvement in net profit of 2.4% (after allowance is made for the extra commissions you'll pay on that extra 3% gross margin). There is not a penny more of other expense associated with this program. An additional 2.4% of sales net profit on our example store's volume of $2,500,000 would amount to $60,000. That's better than a poke in the eye with a sharp stick, and 3% improvement in gross margin is the minimum improvement I've ever had a client report. Clients whose historical gross margin was lower have reported greater improvements in both gross margin and net profit.

Larry Stark is the Chairman of PROFITsystems, Inc. Larry spent the first 21 years of his working life running Stark's Furniture, the retail furniture business founded by his grandfather in 1897. He has spent the last 26 years running PROFITsystems, a leading retail furniture software and consulting firm located in Colorado Springs, Colorado. Inquiries on any aspect of retail financial management can be sent to Larry care of FURNITURE WORLD Magazine at lstark@furninfo.com.