eMarketer: US Retail Sales to Drop More than 10% in 2020

Furniture World News Desk on

6/8/2020

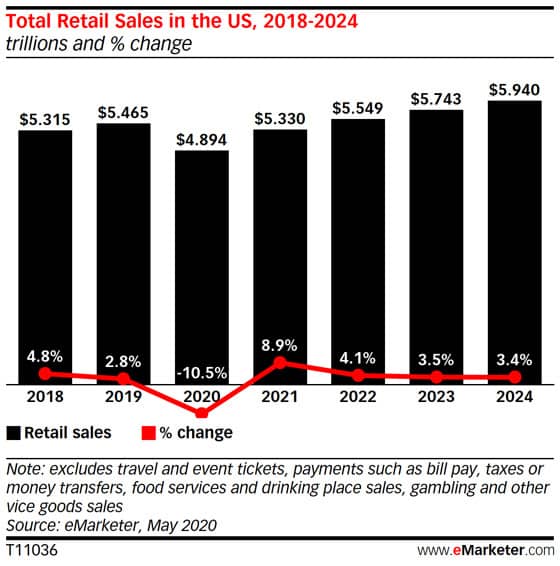

The US retail sector could take years to recover from the impact of the coronavirus, and the hit could be worse than that of the Great Recession. According to eMarketer’s latest forecast on US retail sales (which includes auto and fuel), total retail sales will drop by 10.5% this year, steeper than the 8.2% drop in 2009. Ecommerce is the only bright spot, jumping 18.0% this year, as Americans rely on Amazon and other online retailers for necessities.

Total Retail

In 2020, total retail sales will drop 10.5% to $4.894 trillion, a level not seen since 2016. These estimates assume that widespread social distancing measures, which have gradually been lifted in May, will continue to ease and economic activity slowly resumes in Q3. However, consumer spending will likely remain dampened throughout the year. Total retail sales won’t rebound to 2019 levels until 2022, and estimates throughout the forecast period will be lower than previously predicted.

“This is the sharpest consumer spending freeze in decades in the US,” said eMarketer senior forecasting analyst Cindy Liu. “In just a couple weeks, as Americans sheltered in place, retail sales fell dramatically in March. With sales hitting their lowest point of the year in Q2, it will take years before consumer activity returns to normal levels.”

Brick-and-Mortar

Brick-and-mortar sales will weigh down overall retail long term. Brick-and-mortar retail sales will fall 14.0% to $4.184 trillion in 2020. It will take up to five years for offline sales to return to pre-pandemic levels.

Ecommerce

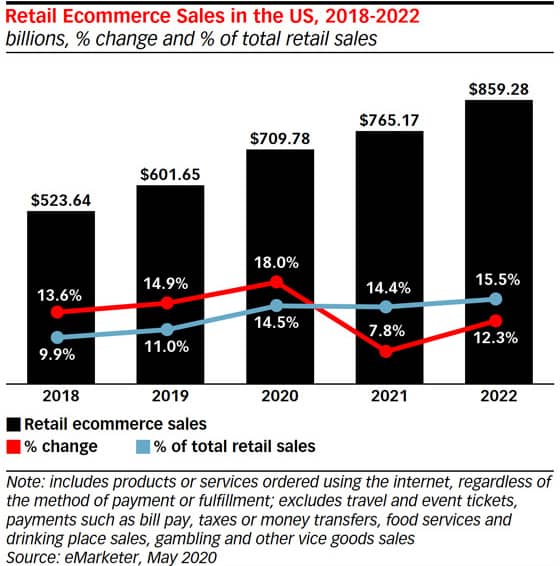

While ecommerce hasn’t been nearly strong enough to offset brick-and-mortar losses, it is mitigating the severity of retail’s decline. Ecommerce sales will climb 18.0% to reach $709.78 billion this year, representing 14.5% of total US retail sales in 2020.

“Everything we’re seeing with ecommerce is unprecedented, with growth rates expected to surpass anything we’ve seen since the Great Recession,” said Andrew Lipsman, eMarketer principal analyst. “Certain ecommerce behaviors like online grocery shopping and click-and-collect have permanently catapulted three or four years into the future in just three or four months.”

The top-growing ecommerce categories will be food and beverage at 58.5% and health/personal care/beauty at 32.4%, as Americans turn to online ordering for household essentials. Apparel and accessories, the second-largest ecommerce category in overall sales, will grow just 8.6% as consumers shift spending from more discretionary, nonessential categories.

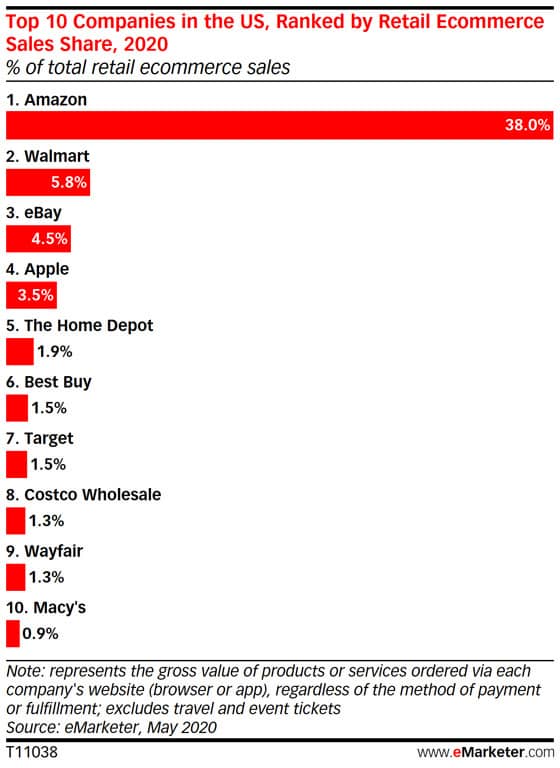

For the first time, Walmart will surpass eBay as the No. 2 ecommerce retailer in the US. Here’s how the top 10 US retailers (ranked by ecommerce sales) will fare this year:

“Amazon will increase its ecommerce market share to 38.0% and extend its reign of dominance,” Lipsman said. “But big-box retailers are leveraging their click-and-collect models to accelerate their ecommerce businesses. This will push Walmart into the No. 2 position for the first time. Along with Target, Best Buy, The Home Depot and Costco Wholesale, Walmart is expected to grow ecommerce sales more than 35% in 2020.”

Methodology

eMarketer’s forecasts and estimates are based on an analysis of quantitative and qualitative data from research firms, government agencies, media firms and public companies, plus interviews with top executives at publishers, ad buyers and agencies. Data is weighted based on methodology and soundness. Each eMarketer forecast fits within the larger matrix of all its forecasts, with the same assumptions and general framework used to project figures in a wide variety of areas. Regular re-evaluation of available data means the forecasts reflect the latest business developments, technology trends and economic changes.

About eMarketer: Founded in 1996, eMarketer is the first place to look for research about marketing in a digital world. eMarketer enables thousands of companies worldwide to understand marketing trends, consumer behavior and get the data needed to succeed in the competitive and fast-changing digital economy. eMarketer’s flagship product, eMarketer PRO, is home to all of eMarketer’s research, including forecasts, analyst reports, aggregated data from 3,000+ sources, interviews with industry leaders, articles, charts and comparative market data. eMarketer’s free daily newsletters span the US, EMEA and APAC and are read by more than 200,000 readers globally. In 2016 eMarketer, Inc. was acquired by European media giant Axel Springer S.E.