Logistics Tip #2 From Shiphawk: E-Commerce Disruption

Furniture World News Desk on

11/9/2015

By: Jeremy Bodenhamer, CEO of ShipHawk

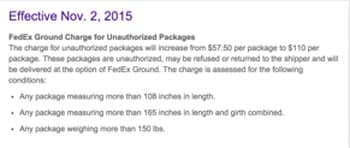

Several weeks ago, FedEx announced a price hike for delivery services, the second price hike of the year. FedEx and its main competitor, UPS, typically introduce price increases on an annual basis, so many dismissed this announcement as routine. Submerged in the official statement, however, was dramatic news: FedEx’s near doubling of the surcharge for “unauthorized packages” that exceed defined size requirements. Specifically, FedEx will charge a significant fee to ship items that are too large for its standard parcel infrastructure – a price adjustment that will hit furniture retailers particularly hard.

Notably, UPS recently made a similar

move, almost doubling its prices for oversize items. UPS will also be adding additional fees next year for third-party billing, raising costs for individual merchants who sell items through online marketplaces.

At the root of this startling announcement is a continued rise in the number of residential deliveries and an inherent weakness in the existing U.S. parcel network. The transportation infrastructure in the United States was built to accommodate freight in standard sizes: four-by-four pallets, small cardboard boxes, uniform envelopes, and the like. These systems are not flexible enough to accommodate demands for larger and unorthodox shapes and sizes.

Why is the state of logistical infrastructure suddenly big news? The evolution of consumer purchasing over the past two decades is putting an unprecedented amount of pressure on the entire system, and therefore driving broad changes in carrier requirements. In the early days of e-commerce, consumers purchased predominantly small items – such as health and beauty products – that retailers were able to pack into standard-sized boxes. As consumers have grown more comfortable with online shopping, they began purchasing more diverse and sizable goods online. Furniture retailers have clearly benefited from this trend, with the level of furniture ordered online skyrocketing and now projected to be the

third-largest e-commerce market by the end of 2015.

Shipping these larger items is difficult for the existing logistics infrastructure. Vehicles and conveyors that were built to handle the homogenous, smaller shipments of the past are no longer efficient and cost-effective. FedEx

admitted that the price jump for ground-delivered goods relates to “increases in average packing size and weight.”

UPS cited similar reasons. This is the second change FedEx has made to confront the growing size of the average e-commerce package in the last year—and it likely won’t be the last.

Earlier this year, the company instituted dimensional pricing, basing shipping costs on package volume, instead of merely on weight, to combat falling per-package density. This occurred after e-commerce sellers began packing items in boxes that were larger than necessary, resulting in “full” trucks that fall far short of the truck’s weight limit. Further changes to the shipping industry will no doubt follow these announcements.

One retailer has taken matters into its own hands. E-commerce giant Amazon recently launched its own delivery service called

Flex, signaling a potential end of the company’s total reliance on traditional carriers. Retailers will need to respond to this move by continuing to cut or subsidize delivery costs, while carriers must adapt by diversifying the types of goods they carry. To maximize cost efficiency and remain responsive to customers, vehicles and sorting facilities will need to evolve to handle all types of freight, from small lamps to enormous armoires, and carriers will need to control demand flow even more precisely if they are to ensure trucks stay full.

Other shipping players are reacting to the changing needs through consolidation. UPS, for example, recently acquired Coyote Logistics, a move that will allow UPS to drive more demand to its own assets – one of the most diverse networks of vehicles on the road.

Likewise, 3PLs (third-party logistics providers) are finding their business model at risk. Accustomed to controlling massive freight volumes and

impinging upon carrier margins in the process, 3PLs like XPO realize they need to adapt to the changing climate and have started to diversify their businesses with previously “taboo” assets, which brokers have historically viewed as too expensive to operate and maintain. XPO’s purchase of Con-way, the second largest provider of LTL services in North America, is just one example of the move toward diversification. These companies are betting that consolidation will drive greater efficiencies and create more reliance on their solutions.

The evolution of e-commerce has made every item on the planet sellable. Delivery infrastructure will need to evolve to make everything shippable as well. UPS and FedEx’s price increases are merely the latest pieces of evidence regarding the challenges facing carriers and retailers alike. Regardless of how this plays out, it is clear that a fundamental shift in the way goods are sold, packaged and shipped is underway. Furniture retailers must prepare for some of the growing pains that will accompany the imminent transformation of the shipping logistics industry by adapting their shipping policies and prices before these changes affect their bottom line.

Jeremy Bodenhamer is the Co-Founder and CEO of ShipHawk, a logistics automation technology that provides instant shipping solutions that help businesses grow. He is the leading expert in the intersection of shipping and eCommerce, has been featured on TechCrunch, AOL, and SoCalTech, is an active volunteer in the community, and is a frequent panelist and speaker on innovative technology and business development. Jeremy lives in Santa Barbara with his wife, educator and youth advocate Bethany Bodenhamer, and their three sons. Jeremy can be reached at jb@shiphawk.com.

Logistics Tips From Shiphawk

Articles in Logistics Tips From Shiphawk