American 26-Year-Olds Are Now Retailers’ Prime Target: What You Need to Know

Furniture World News Desk on

11/14/2017

The Wall Street Journal recently reported that 26-year-olds are the customers that retailers are most eager to attract. Why? Because they are the single biggest age cohort in the American population today, numbering 4.8 million. Those aged 26 are smack dab in the middle of the millennial generation, “the group of 93 million comprises people born roughly between 1980 and 2000,” The Journal writes. By comparison, the baby boomers, born from 1946 to 1964 and numbering 78.8 million at their peak, have now declined to 74 million according to the latest census.

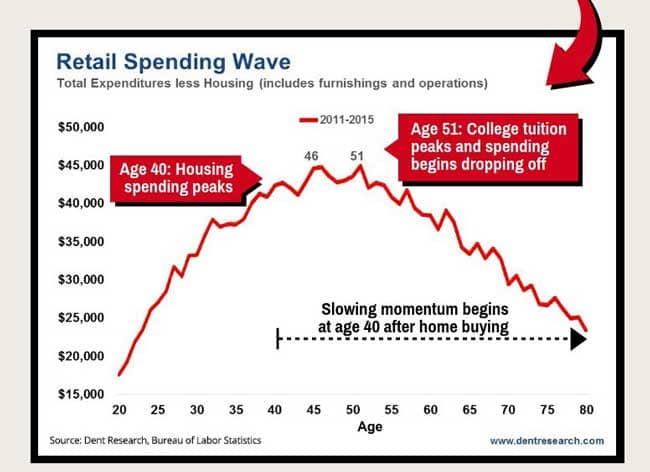

Millennials, aged 17-37, are vital to every brands’ future, as they are “entering prime spending years as they buy homes and make improvements. Their outlays are growing as more of the generation moves into adulthood.” Their importance will only continue to grow up till about age 50 when their household spending is expected to peak, according to spending wave research conducted by Harry Dent. That means from now until about 2040, millennials will be the key consumer segment driving the U.S. economy.

The WSJ article is filled with valuable data and interesting anecdotes about how different the millennials are from previous generations, most especially their baby boomer parents. As a result, “companies are developing new products, overhauling marketing and launching educational programs – all with the goal of luring the archetypal 26-year-old,” the article reports.

But amid the data reported, one critical perspective is missing: 26-year-olds’ income. Yes, age of the customer is important in targeting the things they will buy, but even more important for marketers is to understand their spending potential. At any age, those customers with the highest income spend two-to-three times more in any category than those in the middle. So retailers need to focus not just on the consumers’ age but their income to tap the 26-year-old’s lifetime spending potential.

Millennials at the top 20-25% of income distribution are prime – The HENRYs

The 26-year-old millennials on the road to affluence, called HENRYs (High-Earners-Not-Rich-Yet), are the customers whom retailers really need to zoom in on. That would be the 20-25% of those 4.8 million 26-year-olds who are at the top of the income distribution, or the 1.2 million earning more than 75-80% of their peers.

According to personal financial site DQYDJ’s income calculator, the 26-year-olds earning just over $50,000 are at the head of the pack in earnings, with the average income of 26-year-olds being about $32,500. At $55,000, a 26-year-old crosses over into the top 20% of their age group, and at $75,000 they break into the top 10%.

These 26-year-old HENRYs, earning so much more than their peers, are not only at the forefront of income; they are more educated, are more informed and, given their leadership among this age group, are setting the trends that those at lower incomes will follow. And since they are making so much more money at such a young age, they are likely to continue in the lead and out-earn their peers throughout their adulthood. Marketers that really want to get a bead on the 26-year-olds so critical to their future should focus attention on the high-earners at the vanguard of the pack – the HENRYs earning $50,000 and over.

What do 26-year-old HENRYs want?

In researching any consumer market segment, just as in detective fiction and police procedurals, you need three perspectives:

Means – Who can afford what you are selling?

Opportunity – Consumers’ past purchase behavior often predicts their future behavior

Motive – Who has the need, who has the desire?

Let’s dig further:

Means describes demographics of HENRYs

The demographic characteristics of the HENRY market segment are the place to start. With age (26) and income ($50,000-plus) as the baseline, these young HENRYs are also likely to share other defining demographics. For example, high levels of education put people on the path of affluence and certain career paths (e.g. tech, business, finance, engineering, healthcare) are more promising to yield high incomes than others. HENRYs are more likely be to married and live a more or less traditional lifestyle with a focus on financial planning and a long-term perspective, rather than a “live fast, die young” approach. They are also likely to own homes now or plan to shortly.

Opportunity circumscribes HENRYs purchase behavior

As we know, past behavior tends to predict future behavior, so marketers want to make their brand a “habit” when consumers are young to carry forward their connection into the future. While there is much conjecture about whether millennials are brand loyal in the same way their parent’s generation was, young consumers with a brand habit established when they are at his age, and that continues to be rewarded over time, saves them the trouble of researching, testing and trial that connecting with a new brand requires.

It’s the strategy behind Amazon PRIME, Costco, Blue Apron, Dollar Shave Club, Trunk Club, Stitch Fix and so many emerging membership brands. It’s the power of inertia, where people that opt-in are more likely to stay in, that is part of the Nudge Theory that helped win behavorial scientist Richard Thaler the Nobel Prize in Economics this year. If a brand can become embedded into millennials’ lifestyle young, it can become a brand for life.

The marketing opportunity is also defined by life stage. The young HENRYs with an eye toward the future are in the market for fashions that project their professional goals and the dress standards of their professional colleagues. This has given rise to a whole influx of new-age fashion brands, like Everlane, SuitSupply, Madewell, Free People, Bonobos, et. al., that fill the bill.

At this life stage they are making or will shortly make home operations and furnishings purchases, as the WSJhighlights with how P&G is poised to target “new movers” among this cohort with the household supplies they will need setting up home, such as Swiffer duster, Mr. Clean Magic Eraser, Tide detergent pods and so on. Or there is West Elm with its service packages to provide plumbing, electrical, painting and art/mirror hanging services and furniture offerings sized right for millennial’s smaller-scale homes; Home Depot establishing its stores as education centers to teach millennials DIY home basics; and J.C. Penney’s re-entering the home appliance market with models aimed at millennials’ tastes.

Motive is the underlying consumer psychology

Among the three perspectives, understanding the consumers’ motive to buy is the most important of all three perspectives. Unlike purchase behavior and brand preferences, which can change on a dime, consumers’ underlying psychology is their set point. It characterizes their basic consumer motivations regardless of how other factors change. This is the psychographics or psychology of the customers and target customers.

A spend-thrift consumer tends to always be a spendthrift unless they make concerted efforts to change their behavior. A penny-pincher tends to remain a penny-pincher, regardless of whether they accumulate a lot of money or not. Just look at Warren Buffett, who is renowned for his thrifty personal lifestyle.

If marketers aim to draw more 26-year-old HENRYs, with their significantly greater spending power now and in the future over middle-income consumers, they need to combine strategies borrowed from high-end brands, along with more mass-market tactics to send a clear message that these high-potential customers are understood, respected and catered to.

Specifically, mass-marketing strategies must focus on value, so that the HENRYs get a greater return on their spending investment. This doesn’t necessarily mean cheaper prices, but more value for the price asked. This realization was eye-opening for J.C. Penney in their recent appliance offerings. The company assumed that its lower, value-priced refrigerators in the $899-$999 price range would be the strongest sellers. But millennials wanted the latest, greatest models with stainless steel or black finishes and more contemporary door styles. They were willing to pay up to $1,599 to $1,799 for the specific values they were looking for.

Meanwhile, luxury-focused strategies must be directed to delivering high-quality goods and services, including careful attention to superior materials and workmanship, and making customers feel pride of ownership for the items bought, as well as pride of belonging to the cadre of shoppers that are smart and in the know. This is the appeal of Shinola, hitting all the right notes in quality, style, workmanship and value, plus membership in a cool tribe of people that share the same values, or Everlane, with its “luxury basics for less” positioning thanks to a commitment to “radical transparency” in pricing and ethical, conscientious manufacturing.

The recent Wall Street Journal article did an excellent job of identifying the customers within the 20-year millennial generational cohort that are pivotal for marketers to understand now that will take them into the future. But by ignoring their incomes and the spending potential that income affords, the article overlooked the single most vital data point in any marketer’s strategic plan. The 26-year-old HENRYs, with incomes at the top 20-25%, are the bellwether consumers that will lead the cohort in spending and set the trends that the lower-income 26-year-olds will follow.

More about Pam Danziger: Pamela N. Danziger is an internationally recognized expert specializing in consumer insights for marketers targeting the affluent consumer segment. She is president of Unity Marketing, a boutique marketing consulting firm she founded in 1992.

As founder of Unity Marketing, Pam leads with research to provide brands with actionable insights into the minds of their most profitable customers. She is the author of five books including a recent mini-book, What Do HENRY’s Want?, explores the changing face of America’s consumer marketplace. Pam is frequently called on to share new insights with audiences and business leaders all over the world. Contact her at pam@unitymarketingonline.com.

Pam Danziger

Articles in Pam Danziger