Virtually every furniture warehouse can improve at least 10% by following these basic steps.

|

Often the manufacturer has provided disposition credit or a return authorization, but the retailer simply hasn’t completed the task internally. |

|

The single most productive operations improvement opportunity for furniture retailers is in the area of inventory management. Regaining control over inventory puts more cash in the bank, more room in the warehouse and reduces damaged goods inventory. Attention to inventory management often makes it possible for retailers to handle business growth without expanding warehouse capacity.

There is general agreement that inventory-carrying cost is about 3% per month or 36% per year. This is based on the associated costs for interest, space, taxes, utilities, insurance, damage, labor and other overhead. Keep in mind that warehouse labor productivity dramatically declines when a warehouse space exceeds 85% capacity.

One furniture retailer recently cleaned up warehouse inventory over a five-week period raising $200,000 or almost 20% of their total warehouse value. While this situation was more dramatic than most, virtually every furniture warehouse can improve at least 10% by following these basic steps. This is true at every price point and in every region of the country.

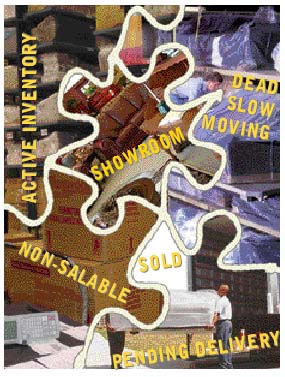

The “puzzle” (right) shows the general categories of merchandise that make up your inventory. Ultimately you must deal at the item sku detail level, but approaching each category breaks the work into smaller pieces for easy handling. (Remember the question, “How do you eat an elephant?” Answer: “One bite at a time!”)

SHOWROOM INVENTORY: This is generally the best-maintained segment. You have a set amount of space and a capacity that appropriately fills the area while providing adequate space for customers to make their choices.

SOLD PENDING DELIVERY: Estimating sold pending inventory is a constant challenge without an exact answer beyond constant follow up. This furniture may be going to a new home that isn’t completed, or in the case of some Southern USA retailers, awaiting the arrival of northern snowbirds. If the vast majority of the purchase is on hand, gentle persuasion to accept a partial delivery is in order, even though a follow-up delivery will be required. The worst-case scenario for sold inventory pending delivery is where the furniture is COD without a deposit, and after an extended period, the customer cancels. Look for savings on stock items that can be received from a future dated purchase order… freeing up the unit already in stock for immediate sale.

DEAD/SLOW MOVING: This is typically the largest single opportunity area for freeing up warehouse space and raising cash. It is far better to sell these items at cost or even below cost, as they don’t appreciate or become more saleable with age. If you decide to sell off dead or slow moving inventory, make sure that your sales compensation program is not working at cross purposes. A program distorted toward gross margin will discourage your sales staff from selling these items, even though liquidation of this inventory is in the best interest of the company.

NON-SALABLE: This category includes a range of merchandise including damaged goods received from suppliers as well as pristine items refused by customers upon delivery. Damaged pieces often hold up the delivery of other items of similar value. You may think that your non-salable is 8% of inventory when it actually is affecting up to twice that amount. The frustrating aspect of this problem is the typically large number of items which should be repaired within a few minutes, but sit around for weeks or months. Even more frustrating are special order items that could be repaired immediately and delivered.

The first thing you must have if you want to clean up non-saleable inventory is a backlog report. This is a listing showing the status of every item awaiting shop repairs. Benchmark Retailers have an average backlog of several days to a week. Any items not repaired for over one week should be waiting for a supplier’s parts shipment. These parts orders must also be tracked weekly.

Daily review of any items coming back to the warehouse from customers is mandatory. These returned items should be reconciled by noon of the following business day. At that point, you have the following options:

•The item is in new condition and can be returned to stock.

•The item is in new condition but requires modest touch up prior to restocking.

•Extensive repair is needed and reason (factory, delivery damage, RTV, etc.)

•Touch up and send to Clearance.

•Trash the item.

The appropriate inventory book adjustments must then be made.

Vendor Adjustment and Return To Vendor of non-salable inventory are problem spots for many home furnishings retailers. Sometimes inventory sits around waiting for a quality problem to be resolved, but in many instances, the vendor has provided a disposition credit or return authorization, but the retailer simply hasn’t completed the task internally (found the non-salable inventory and returned it, or moved it to clearance and taken any manufacturer’s credit). If you don’t already have every manufacturer’s rep review this category prior to meeting with buyers, please consider amending your procedures. Another excellent way to speed the process of obtaining parts and processing claims is to use a digital camera and email communications. If space permits, all this merchandise should be put in an area where visiting reps can see damaged products easily.

ACTIVE INVENTORY: Even this final category of active inventory can be improved. The January 2003 Furniture World article by John Egger, “Casting Off Your Inventory Blues” is recommended for these excellent tips on average rate of sale analysis and inventory aging. (The article is archived on the FURNITURE WORLD website at https://www.furninfo.com/operations/egger0103.html).

The most important tip regarding active inventory is that if it isn’t displayed, it doesn’t ever sell. Do you know how much inventory is on hand that isn’t displayed? More importantly, are you doing something about it?

The second major tip is to be aware of vendors’ true lead times. Retailers often carry twice or three times as much inventory as necessary based on lead times. You may be able to switch suppliers to get a virtually identical line with consistent and shorter lead times... boosting both profits and customer satisfaction.

Finally, don’t get into a “deal” purchasing mentality. If you can’t sell off the inventory within the terms of purchase, you didn’t make a good business decision.

The Bottom Line for cleaning up excess inventory is that it is more effective to manage information than physical goods in the warehouse. Use all your information reports and walk the warehouse to know what is there and take the appropriate actions. You will gain competitive advantage; have a stronger balance sheet and fewer hassles.

|

Cleaning Up

Warehouse Inventory

over a five-week period raised $200,000 or almost 20% of their total warehouse value. |

Daniel Bolger of The Bolger Group helps companies achieve improved transportation, warehousing and logistics. Questions can be directed to Mr. Bolger care of FURNITURE WORLD at dbolger@furninfo.com.