Item selection and the in-store experience.

The results of this research on the key drivers of consumers’ furniture purchasing decisions provide a variety of findings that can help guide retailers on matters ranging from marketing and promotion to sales approaches.

In this second of two articles, the findings of a study that relate to the last two stages of the purchase process – Item Selection and Store Experience are discussed. The first installment that focused on the first two stages of the consumer purchase process, Planning and Research and Deciding Where to Shop, can be found on FURNITURE WORLD’s website www.furninfo.com in the “Marketing Management” article archives. Retail policies that are mindful of consumer needs at all four of these stages will greatly enhance retailers’ overall performance.

Stage 3: Item Selection

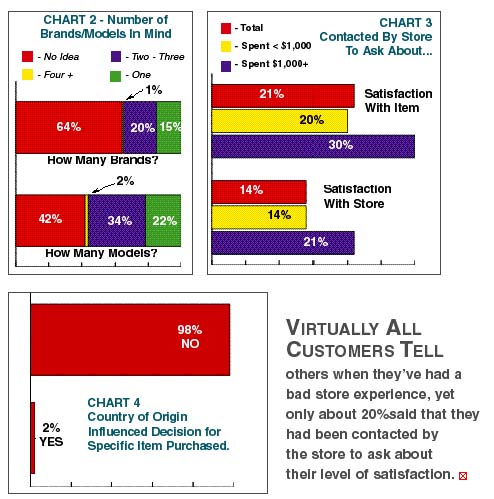

At the third stage of the buying process – item selection – there are several key findings to consider. First, the study revealed that when consumers decide to buy furniture, 64 percent have no idea which brand and 42 percent have no idea which model they want to purchase. For most, the final decision on what to buy is made in the store. Only 2 percent of respondents said that country of origin influenced their decision to buy a specific item of furniture.

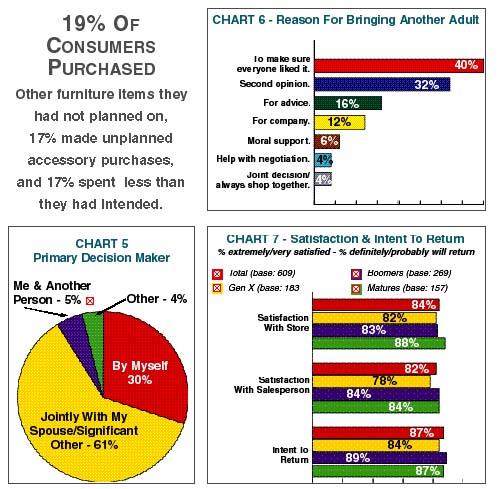

Second, 61 percent of furniture purchase decisions are made jointly with a spouse or significant other, which no doubt leads to most (70 percent) bringing another adult along when furniture shopping to make sure they also like the item and to get a second opinion. There may also be an opportunity for furniture retailers to convert unspent funds to profitable incremental purchases, given that 19 percent of consumers purchased other furniture items they had not planned on, 17 percent made unplanned accessory purchases, and 17 percent spent less than they had intended.

In summary, the findings show that the majority of consumers only have a general idea of what they want to purchase at the item selection stage. Brands and models are not pre-determined and final selections are made in the store. These facts suggest retailers should advertise a large selection of items, focusing on the range of styles and quality available – not necessarily a specific brand or model.

Since most consumers do not purchase additional furniture or accessories that they had not planned on, it is important that retailers consider creating tie-in promotions of accessories and core furniture items to achieve incremental sales.

Stage 4: Store Experience

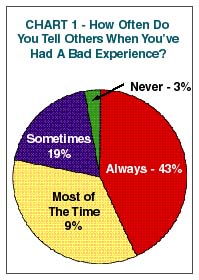

The fourth stage in the furniture purchase process is the in-store experience. Here, research focused on how consumers feel they were treated and whether or not they would return. Satisfaction levels with both the store and salesperson were found to be high. Eighty four percent reported they are extremely or very satisfied with the store and 82 percent with the sales staff. As expected with high levels of satisfaction, the intent to return to the store is also high (87 percent). It is also important to remember that customers who have a bad experience share the news. Virtually all (97 percent) tell others when they have a bad experience at a store. Therefore, it is critical to quickly resolve problems as they arise to ensure a good shopping experience. However, only about one in five respondents said that they had been contacted by the store to ask about their satisfaction with the item purchased, and/or their store experience. While consumers who spend more than $1,000 (30 percent) are more likely to be contacted than those who spend less than $1,000 (20 percent), the overall levels of contact are still low. With these low follow-up numbers, most furniture retailers would not know who has had a bad experience, or why.

Given the fact that consumers have high levels of satisfaction with stores they have shopped at previously, relationships with existing customers are critical. In order to maintain those relationships – and create new ones – retailers might consider creating loyalty programs to keep customers informed of new items and sales, and encourage repeat business. Retailers can also feature financing, consultation, and retention programs, as well as special offers for new homeowners or new parents. These programs can help to establish new loyalty patterns.

Since satisfied customers intend to return to your store and unsatisfied customers will probably tell all their friends why they would not return, there is a significant benefit to getting feedback from customers to understand how well your store is satisfying consumer needs and to quickly identify and resolve problems.

By understanding the four steps to the consumer furniture purchase process, retailers can design marketing and communications programs, as well as internal systems, which will help them deliver against consumer needs to ensure maximum revenues and customer satisfaction.

Research Background: the ADVO study was conducted by NFO WorldGroup, one of the world's leading providers of research-based marketing information. The study was conducted using a panel, a national representative group of households that have agreed to participate in research studies and are replenished routinely to maintain the integrity of the panel. In July 2001, we used a Consumer Panel Screener survey to identify U.S. households that had purchased furniture in the past six months. Follow-up questionnaires were mailed in September 2001 to approximately 750 past six-month furniture purchasers who had spent at least $100 on a new item of furniture. The primary or co-decision maker for the furniture purchases in the household completed the questionnaire. Seventy-three percent of the primary or co-decision makers were female. While typical response rates for panel studies range from 65 percent to 70 percent, the ADVO study saw a 79 percent return rate for this study.

About the Author: Joella Roy is Senior Marketing Research Manager at ADVO, Inc. ADVO is the largest full-service targeted direct mail marketing services company in the United States. The company’s shared mail advertising programs are distributed to over 100 million U.S. households. Questions can be sent to Ms. Roy care of FURNITURE WORLD Magazine at editor@furninfo.com.