The center of power in the furniture industry is shifting. Now is the time to re-evaluate your position in the New Value Chain

The Challenge

The information revolution has turned the traditional retail model on its head, shifting the center of power from the retailer and manufacturer to the consumer. Consumers always had the power to choose what products they wanted to buy, but before the proliferation of the Internet, the retailer set the price and had control over what profit margins he could make. Today, in several industries, this paradigm has changed completely. For example, in 1998, one out of six people who bought a new car in the US went first to the Internet to find out the cost to the dealer for the car with the options they wanted. The negotiation with the dealer was then not about the cost of the car, but about the profit the customer agreed to leave with the dealer. This shift in power from the retailer to the consumer, though readily apparent, in the automotive industry, is occurring in every business. The furniture industry will be no exception.

The role of retailers, manufacturers and others in the value chain, will have to adapt according to this new reality. It is not far fetched to imagine that in the near future, the primary role of traditional dealerships may not be to sell a new car. Instead, the primary role of the dealer may be to provide service for cars sold through the Internet. In fact, Ford is buying several small and medium sized after sales service businesses, because they believe that in the future, more money will be made from servicing than from the sale of the new car itself. This is bound to alter the relationship between Ford and the traditional car dealership in their value chain as the boundaries between the partners in the chain become blurred. In this new environment the car dealership has to determine its new role in the new value chain. In other words, the dealership has to reinvent itself and demonstrate to the consumer and the other partners of the new value chain that they have a legitimate value added role in this new configuration. If not, the natural path of evolution is to eliminate any non-value added elements. Similarly, most furniture retailers and manufacturers have been reluctant to accept the reality of the Internet and the impact it will have on the future of their value chain.

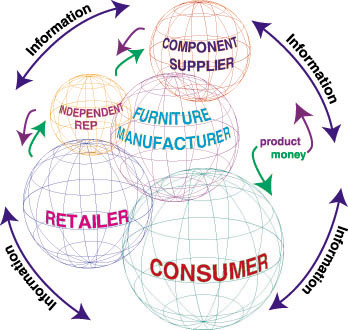

A value chain by definition is the network of organizations and individuals through which products and services flow in one direction and money flows in the other direction. In a traditional value chain, information flows selectively up and down the chain on a "need to know" basis. In the home furnishings, industry as in many other industries, the role of each of the members in a value chain is very clearly defined and the boundaries are apparent. In a majority of the cases, the manufacturer makes the products and sells them to the retailer, who in turn sells it to the consumer. In this value chain, the manufacturer's competency is product design and manufacturing while the retailer's competency is to sell the product to the consumer. Where furniture manufacturers do not have the resources to have their own extensive sales organization, they interface with retailers through independent multi-line representatives. These arrangements are necessary and valuable to all the organizations involved. Each organization operates in its own sphere of influence and there is very little overlap in their roles. This traditional value chain is represented at left.

As organizations become lean, the next major opportunity lies in the interfaces between organizations. Organizations are starting to extend their value addition in both directions of the value chain upstream and downstream. The value chain is undergoing a metamorphosis beginning at the overlaps. In the new value chain, in addition to the product flow in one direction and money flow in the other, there will be seamless sharing of information both ways up and down the value chain. The pervasiveness of the Information Technology revolution of the last few years has only accelerated this transition and each organization has begun to step on the toes of the previously isolated members of the chain. This new evolving value chain is represented above.

The opportunity for all organizations, be it a retailer, manufacturer or independent representative, is to develop a vision to focus on the interfaces where redundancies, weaknesses and duplication are most likely to occur. In the new value chain, many of the functions of the previous value chain will exist, but in wholly new forms and offered by new members or old members with new competencies. It is likely that more manufacturers will sell directly to the consumer, possibly through the internet. Some retailers may choose to provide an alternate distribution channel through the Internet and some others may partner with manufacturing organizations to manage the manufacturer's warehouse. This change in the relationship within the value chain, though very natural, threatens the profitability of organizations if they continue to conduct business in the old reality. Yet this reality will face resistance from retailers and reps as their current role becomes less defined and possibly less valuable. Nobody can predict the future with any accuracy, but those who are prepared will be ready to seize the opportunity.

As, Joel Barker, the futurist, would say, major paradigm shifts occur from outside an industry. This happens frequently because new organizations do not have a stake in past industry investments. For example, who would have imagined the phenomenal success of Amazon.com against established bookstores such as Borders and Barnes and Noble. Both of these traditional retailers wished the online retailing paradigm away only to find that they had to reenter the market at a much higher cost and a significant disadvantage. Today, the entire business model and their relevance in the value chain is under question.

There are countless examples of leading companies that failed, even before the advent of the Internet, who conducted their business while only looking in "the rear view mirror". The Swiss watch industry lost its leadership position because they were not willing to acknowledge that the Quartz watch was going to replace the mechanical watch even though it was invented in their own research facilities.

IBM was a once fallen hero that found a way to climb back. Dell has unseated Compaq for the very reason that they have shown to be more relevant to their value chain by assembling a computer to each individual customer order.

Even in the furniture industry, Ethan Allen and Bassett Furniture have begun a modest effort to understand and reshape the value chain so that they can provide better service to meet their consumer needs. In spite of being up against Barker's theories on pioneers, it is imperative that retailers and manufacturers proactively shape their value chain or they will go the way of the Woolworth's.

The implication of these changes is not that brick and mortar business will cease to be a significant channel of distribution. They will, however, be challenged by the new business paradigms. There needs to be an urgency on the part of the furniture retailers and manufacturers to understand what part of the value chain they are in and want to be in because the future success is going to be determined by competition among value chains and not among companies. The more important inference is that understanding the value chain is at once a challenge and an opportunity. Indeed, the focus should shift to repositioning the value providing chain as an enabler for growth.

The Solution

In the face of these developments, continuing to think and operate with the same roles and business processes as before, will not bring commercial success nor respite from today's pressures. Any actions taken will make sense only if they contribute to the reconstruction of a much more efficient industry.

There is not a prescriptive solution to reinventing the value chain. Every company is different. The solution is necessarily situation dependent, but there is a systematic way to become prepared to seize the opportunity. The approach outlined here allows a company, either small or large, to characterize its own competitive context, and to make an appropriate context-specific plan for itself.

There are four keys to prepare one's company for the future. These are:

- Understand whatbusiness you are in.

- Be able to clearly articulate what value the organization wants to provide to its customers.

- Enable the customer.

- Get into the customers' mindset so that you understand the customer's needs as well as, or better than, he or she does. This will uncover business opportunities that provide value the customer appreciates.

- Create a responsive & adaptive internal organization.

- Organize your work processes and your workforce so that it is capable of rapid and constant change in response to customer needs and desires. Do this even if it means you must often restructure your company.

- Collaborate with other organizations

.

- Build relationships with suppliers and customers as part of an interactive, efficient value-providing chain. Do not remain a stand-alone company operating at arm's length.

Next Issue: Mr. Sundararajan will continue this discussion and will provide concrete tools and techniques for re-evaluating the Value Chain and your position in it.

Sekar Sundararajan is President, Libra Consulting Corporation, a leading business intelligence and decision sciences firm based in Bethlehem, PA. Libra Consulting specializes in supporting industry and government in crafting and implementing agile and mass customization strategies for the rapidly changing global marketplace. They provide consulting, training and decision support software services for their clients. International clients include Fortune 500 companies as well as small and medium sized businesses, across a variety of industries - furniture, food, appliance, automotive, and government. A short list of clients includes Stanley Furniture, Whirlpool, Ford, Kraft Foods and the Commonwealth of Pennsylvania. As, Executive Partner, of the Iacocca Institute at Lehigh University, Sekar has been at the forefront of the Agile Manufacturing revolution taking place in the U.S.. He was an invited industry representative to the Iacocca Institute at Lehigh University, to create the vision for 21st century manufacturing. His expertise is in the areas of agile strategies, reshaping value chains, lead time reduction strategies, supply chain optimization, theory of constraints, and plant design. Direct questions or comments to editor@furninfo.com.