I f you, as an independent retailer think that most of your prospective customers know your business, think again! This recent survey tells a different story.

This is the first of a two-part series on the results of a nationwide survey to understand today’s U.S. consumer—specifically, the shopping behaviors and purchasing patterns for durable home goods such as furniture. The results were surprising. Preconceived notions of what consumers want were shattered, particularly for independent retailers as they grapple to compete against larger national and regional chains in today’s digital age.

“My store is in a small town, so everybody already knows me and my business.” This is an all too common myth encountered when talking with independent furniture retailers.

If your furniture business is located in a big city, you’re acutely aware that most potential customers in your area don’t know you or your business. You’ve likely experienced firsthand how difficult it is to win attention in a competitive, noisy marketplace, and understand the critical importance of standing out in the crowd.

However, if your business is located in a small town, it might be easy to assume that most potential customers in your area know your business. After all, small towns tend to foster tight-knit communities where everybody knows your name. People are more likely to readily share information. That includes the places they shop and the products they purchase. Further, if you believe most of the potential customers in your small town already know about your furniture store, you may also think you don’t need to do any marketing to stand out. After all, why pay good money to tell people what they already know?

Honestly, my brother Jim and I were passengers on this same train of thought. Between us, we have devoted more than two decades of our professional lives to helping independent retailers of furniture and other durable goods compete and succeed in a rapidly evolving retail environment. We serve more than 2,000 independent retailers across North America with a host of digital marketing solutions, spending much of our days talking with small business owners.

So, as we put ourselves in our customers’ shoes when we’re developing new website, e-commerce and marketing automation products, we used to work on the assumption that the smaller the town, the bigger the presence the independent retailer would have, especially if the store was multi-generational.

Challenging Conventional Wisdom

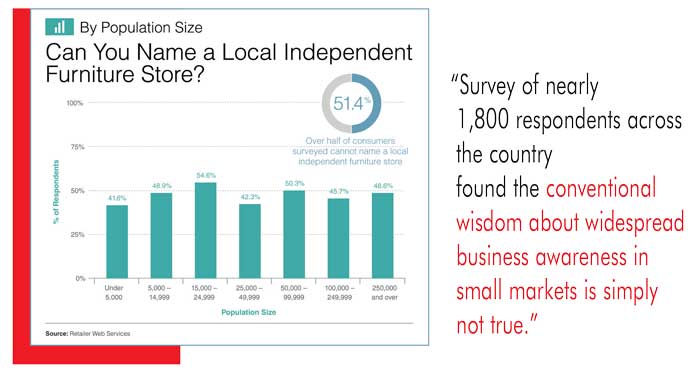

Yet, despite this comforting logic, when we conducted a survey of nearly 1,800 respondents across the country, we found the conventional wisdom about widespread business awareness in small markets is simply not true. In fact, we found that if you sell durable goods like furniture in a small town, most of your potential customers do not know you or your business.

Here’s some quick background on our survey: It began in the spring of 2014. During the year or so that lead up to it, we had been hearing a lot of angst and uncertainty from business owners. They felt as though retail was evolving faster than they could keep up, and they didn’t know what to do about it. No doubt, the retail industry is awash in data, but unfortunately, little or none of it is focused on the core durable goods categories: furniture, appliances, home electronics and mattresses. So our goal was to remove the uncertainty by embarking on a research effort to find answers to questions independent retailers had been asking.

Our nationwide survey asked consumers about their durable goods shopping habits and what qualities were important to them when it came to the online presence of durable goods retailers. Of the nearly 1,800 consumers surveyed, about 20 percent came from towns of 5,000 people or fewer, and what they told us was eye opening.

For example, we asked respondents to name all the local places they could buy furniture. This question was unaided: We didn’t provide a list of possible retailers from which to choose, or guide their responses in any way. We didn’t ask them to differentiate a national brand from a local independent. We wanted to find out what brands were most relevant and top of mind in their daily lives.

Distilling the Results

We were shocked to find that only 42 percent of small-town consumers were able to name an independent furniture retailer. In fact, consumers in small towns were less likely to successfully name an independent furniture store than consumers from towns with larger populations. By comparison, 49 percent of consumers in larger cities (populations of more than 250,000) were able to name at least one independent furniture retailer.

To ensure this result wasn’t unique to just furniture retailers, we also asked respondents to list all of the appliance stores they knew in their area. Less than 20 percent of small-town consumers were able to identify an independent appliance retailer. By comparison, consumers in larger cities were able to name an independent appliance retailer 19 percent of the time—a single percentage point of difference!

The situation doesn’t get any better for independent mattress providers: Just 32 percent of respondents—one in three—from towns of all sizes could name their local independent mattress retailer without any prompting. As for electronics stores, while 82 percent recalled Best Buy as a nearby electronics retailer, less than 13 percent could name a local independent electronics retailer.

It’s interesting to see how consistent the awareness levels were across almost every community size. These responses run counter to the preconceived notion that consumers who live in smaller communities know their independent furniture retailers—or other independent durable goods stores for that matter—better than consumers in larger communities.

Bottom line: If you’re an independent durable goods retailer in the business of selling furniture, most of your prospects don’t know who you are. And it doesn’t matter how many generations your store has been there. Think of it this way: While your firsthand experiences would confirm that everyone you engage already knows you, this familiarity doesn’t extend to those in your community who you don’t engage with regularly—or at all. These strangers are your prospective customers!

The Good News

Comprehensive research shows regardless of the size of your market, durable goods business owners command the awareness and mindshare of less than half—and in some cases, less than 20 percent—of their prospective market. While the research challenges our basic assumptions, we encourage you to consider the positive side of the situation: If 51 to 87 percent of your target audience is truly unaware you exist at this moment, your market opportunity just doubled, at least.

Using this knowledge to your advantage means you can grow your business without opening new stores or expanding to new territories. To win hearts and minds, no matter the size of your market, you must fight to win the attention and business of your neighbors just as diligently as if you picked up shop and moved to a new location. Acknowledging you must reach out to prospects, whether your business operates in a small, medium or large market, is the first step in expanding your pool of customers. And while there are literally hundreds of ways to market your furniture business, in-depth discussions on the research findings with independent retailers led us to develop “11 surprising things” you can do now to win customers in the digital age.

Next Issue

Part 2 in this series will discuss the high price of hiding prices on your website. It’s one of the most hotly debated discussion points when we speak to independent retailers. With the websites of your national, regional and local competitors just a click away, your company’s website must compare favorably to the other sites your prospects are viewing at the same time (an average of four to 17!) if you have any hope of being successful in the age of the Internet. We’ll discuss the reasons why including prices is essential for your success.

About Gennie Gilbert: Jennie Gilbert is the Chief Operating Officer of Retailer Web Services, a Scottsdale, Ariz.-based company whose mission is to help independent retailers realize their dreams through the promise of technology. Jennie is a frequent speaker at durable goods retail conferences and the co-author of RE:THiNK: 11 surprising things you should do now to win retail customers in the digital age (Retailer Web Services, 2015), available on Amazon and at

www.retailerwebservices.com.

Furniture World is the oldest, continuously published trade publication in the United States. It is published for the benefit of furniture retail executives. Print circulation of 20,000 is directed primarily to furniture retailers in the US and Canada. In 1970, the magazine established and endowed the Bernice Bienenstock Furniture Library (www.furniturelibrary.com) in High Point, NC, now a public foundation containing more than 5,000 books on furniture and design dating from 1620. For more information contact editor@furninfo.com.