American consumers have come a long way from wrestling with setting up saggy-bottomed webbed lounge chairs, or burning their backsides on rusty metal seats baking in the sun.

Gone are the days of dragging the dusty lawn furniture out of the garage into the back yard while the splintery picnic table and benches are hosed off before the barbecue.

Fond memories all… but today, as our customers spend more warm-weather leisure time out of doors, they are looking for comfort, style and functionality with their outdoor furnishings. They are looking for seating that encourages conversation. They want to present outdoor meals on elegant, easy-to-maintain dining tables with handsome chairs for those who like to linger after a meal. The chill after sundown no longer signals the end of the evening as the warmth of the company is matched by the glow from the fire pit.

Furniture World interviewed experts in the field of casual furnishings to learn about the trend to outdoor living, the variety of exciting choices for consumers, and how retailers can capitalize on the movement. Rory Rehmert, president of the Summer Winds division of Pride Family Brands responded to our question about trends in the casual industry. “By 2020, outdoor market furniture sales will grow by 19.5% and reach approximately $5.3 billion. Furniture stores are expected to see 5.3% growth as a vehicle for outdoor furnishings sales.”

“Recently there’s a lot of allure surrounding the outdoor category,” said Michael Gaylord, vice president of sales at Agio, USA. The outdoor room is a ‘thing’ now. It’s trending because of television networks like HGTV and others that feature ‘build my backyard’ shows. Now outdoor spaces qualify as trendy living areas that people want to have.”

“I think it’s that our lives are more stressful than ever,” commented Shelby Sari, Buyer for outdoor and leather at Furnitureland South. “And both new construction and remodels take that into account by creating spaces for relaxation – some even as simple as a screened-in porch. People are looking to find their oasis to take them away from the everyday stresses of life.”

Bob Gaylord, president of Agio International reminisced, “Things started changing for outdoor furniture in the 1980s. At that time we started selling fully-welded aluminum sets to mass merchandisers and home centers around the country. Indoor furniture retailers, to a great extent, got out of the business then because of competition from mass merchants and home centers that were selling inexpensive imports. Many furniture retailers started looking ridiculous to middle-class customers because of the difference in price points – the $4000 domestically produced set they carried versus the low-priced outdoor furniture sold at a local home center.”

“That’s right,” agreed Michael Gaylord. “When mass merchants got into the category at the lower end, in large part their sales were driven by price points alone, and they used a limited number of suppliers. We also lost a lot of longstanding specialty stores at that time.”

The pie has gotten bigger,“ Bill Howard, vice president of sales at Crosley Brands commented. “There has been rapid growth of people actively looking for more alternatives in the outdoor space. Outdoor furniture is low-hanging fruit for both manufacturers and retailers. One reason for that is the products’ seasonality hits time frames that have proven to increase traffic flow for furniture retailers.

“There are still a lot of significant specialty players out there – certainly not the number that there once was. The growth of online sales has made it more important for the brick-and-mortar folks to be better merchandisers of categories like outdoor furnishings.”

Marketing to Millennials and Beyond

Rory Rehmert cited a Casual Living 2015 Consumer Buying Trends Survey, published in April, 2106: “Most of the growth in the casual industry in the US is projected in the west, southeast, and northeast. Even metropolitan locations have a demand for small-scale outdoor furnishings. Broken down by age, 37% of sales in 2014, were to millennial households (aged 19-35), followed closely by the baby boomer households at 34% (aged 51-70). Gen X households (aged 36-50) represented another 23%, with 6% outside those categories.”

“The growth in the category is absolutely impressive,” agreed Agio’s Bob Gaylord. “When consumers start going outdoors with a furniture purchase, they are spending discretionary income. Today consumers are willing to spend more money outdoors than they are indoors.

“Outdoor living is something that everybody really enjoys. For a lot of lower- and middle-income people, their outdoor space is the best and largest entertaining area they have. Everybody throws a barbecue, but not everybody throws a sit-down dinner for 12 people in their dining room.”

Specifically addressing the millennial market, Rory Rehmert commented, “Millennials are a growth area, but it depends on the price point that you’re addressing. We recently launched five high-end collections of contemporary designs. Our demographic shows that the people buying it are folks 50 years and older. It doesn’t mean that the millennials don’t like those designs, but most don’t have the money, so we will be launching a mid-priced contemporary collection.”

Bob Gaylord cited a similar experience. “People over 45 are more settled with kids growing up. They generally need more than just a place to eat outdoors. Price point’s a big factor with millennials who may not want to spend what consumers 45 and older are going to spend.”

“For millennials it may be their first outdoor room purchase,” Michael Gaylord, interjected, “but they’re going to come to stores more prepared and more educated. They’ve been on Reddit, they’ve been on Twitter, they’ve been on Pinterest, and they’ve seen the prices.

“That’s why having a great website and a deep web presence with lots of information and good reviews is really important when you’re working with millennial customers. Millennials are never going to buy like the boomers, but the boomers are starting to buy like the millennials.”

Evolving Styles

We wanted to know how styles are evolving in the casual industry and what is particularly attractive to consumers today. Bill Howard, at Crosley Brands, offered, “There are a lot more options, many more looks, and more styles.”

“Product categories have grown as more chat sets and fire features are seeing expanding popularity,” said Rory Rehmert of Summer Winds. “These are the #1 product requests by millennials.

“Speaking for our lines, the entrance of luxury contemporary designs has been a tremendous growth area. In 2016, the modern designs, including frame and table styles, components, and finishes, created tremendous sales. Sleek and linear, geometric and clean angles, contemporary style, from a luxurious perspective, continues to trend. Many retailers are finding that they cannot keep contemporary collections on the floor.”

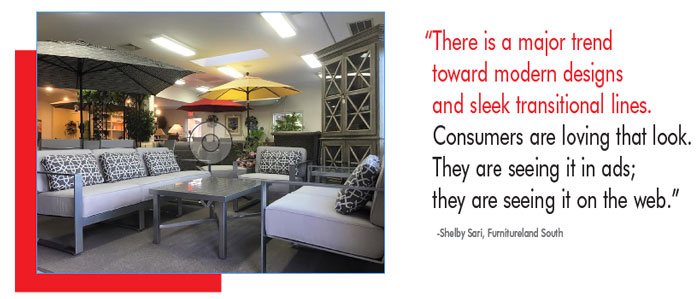

Shelby Sari, of Furnitureland South, agreed, “There is a major trend toward modern designs and sleek transitional lines. Consumers are loving that look. They are seeing it in ads; they are seeing it on the web. Live-edge tables have become very strong this season. Brown has been so strong, but now we’re finally seeing some beautiful gray finishes.”

“Design trends for the outdoor category typically follow indoor trends by a year or so,” responded Robin Mack, outdoor buyer for Art Van. “As a result, we are seeing an increase in urban, modern, and transitional styles, with a decrease in the demand for the more traditional styles. There has been an evolution to more on-trend designs. Gray as a key color has made its way from indoor furniture to outdoor. Navy is the new outdoor neutral.”

“There is certainly an interest in mixed materials,” added Agio’s Michael Gaylord, “especially incorporating the welded and wood looks, the reclaimed look. These are very hot in our industry right now, especially with designers. Fire pits have helped extend the season, both at the beginning and at the end, allowing people, even in the northern climates, to spend much more time outdoors in comfort and luxury.”

“In product categories,” reported Robin Mack, “we are seeing a shift from dining to seating. Today 45% of the business is coming from the seating category – 20% of this is seating with fire pit options. Dining comprises 38% of our sales at Art Van, with cast aluminum being the most important composition by far.”

“Over the past 15 years,” Bob Gaylord pointed out, “the biggest growth in our industry has been deep seating, the sofas, lounge chairs and chat groups, which has changed the whole dynamic. Furniture retailers can now sell what is basically living room furniture for the outdoors. It is a big business, but in a lot of respects, the outdoor room is still in its infancy.”

Developing Savvy Retailing

Furniture World asked what a savvy retailer needs to know to enter the field of casual furniture. Bill Howard responded, “One thing we encourage retailers to do is develop proprietary lines and a private label. I recently worked with a retailer whose average shopper for outdoor will never, ever get to $799 on any set of outdoor furniture. That makes it necessary for them to develop styles that will resonate with more than 75% of the people who walk through their doors. To do that, they need to investigate alternatives based on a close look at the outdoor products carried by competitive mass merchants like Home Depot, Lowes, and Target.”

Rory Rehmert agreed, “More often than not, indoor furniture retailers looking to get into outdoor really don’t have a good grasp on what their price points should be. If they are selling $499 indoor sofas, they shouldn’t be buying $2,000 outdoor sofas. The outdoor furniture assortment should parallel a retailer’s indoor selection. Outdoor price points can be a little higher because as an outdoor product it has to be very durable. But it can’t be radically different.

“I suggest that retailers carry good, better, and best,” Rory continued. “Let’s say Home Depot tops out at $699, maybe start with something at $999. In other words, don’t go down and fight with Walmart, Target, K-Mart, the big guys. Put yourself a step above them, but then layer it on up to a point where you’re comfortable. Everything should be sandwiched between the low and the high.”

“What we typically display on the floor at Furnitureland South is going to be above the price point of Lowes and Costco,” confirmed Shelby Sari. “But there’s always a way to sell against that big box store.

“A shopper may be looking at a table with two swivel rockers and two dining chairs in the high-back version. We can accommodate the price point they are looking for by going to a low-backed chair. We can change the grade of fabric; we can change the premium finish to a standard finish; we can go from cast aluminum to extruded aluminum to find a happy medium.”

“Shoppers are always looking for price points,” added Bob Gaylord, “but quite honestly, the mass merchandisers in this country are not doing a good job fulfilling customer desires right now with a limited selection of lower-end furniture. We believe that the future of the industry is with furniture retailers who offer a wide selection and employ good horizontal merchandising throughout all the categories. This industry can more than double or triple if the indoor guys get this message.”

Bill Howard, of Crosley Brands, was of a similar mind, “Here’s the biggest mistake I see when I talk to a retailer who says something like, ‘I’ve been in it now for a year or two and I haven’t had the type of success that I’d like to have.’ Too often what I see with new retailers in the outdoor industry is that they will start out at $1,499 or $1,799 and go up from there. My take on this is that they are appealing to probably less than 20% of the consumers that are going to walk through their door.

“For every other category they have the ability to move them up and down the price point scale, but they don’t do that with the outdoor furniture. I mean, realistically, what percentage of the population is going to put a $2,000-plus furniture set on their patio or deck? That’s one reason the online retailers have done a really good job of capturing a lot of the outdoor business.”

“Retailers must be wary of chasing the mass marketers, adds Agio’s Michael Gaylord They need to figure out their competition and where they are going to fit into their individual markets. You probably won’t want to chase the specialty guys at the high end either. Most retailers need to attract outdoor customers in the middle because that is where most of the business is being done.”

Bob Gaylord expanded, “To be successful in this category there has to be a commitment from top management to create a five-year plan and commit the space, the inventory dollars and the advertising budget to really go after the category. They must also understand that to get business they must earn it, and to do so means they have to take it from somebody else. Success in this category doesn’t happen by accident.”

Looking the Part with Horizontal Marketing

“So bottom line, where must retailers start in order to be successful?” Bob Gaylord, of Agio, continued. “They must look like they are in the business. That can include changing the look of the store and its emphasis. If you want to be a factor, you need to have selection. This is no different than selling indoor furniture. If you don’t have 30 or 40 sofas to sell, you’re not going to do significant volume. Likewise, you should have a decent selection of outdoor dining, deep seating and chat, outdoor bars, and all the accessories so you can look like you are absolutely in the business.”

“The breadth of products a retailer carries must be available in season,” Michael Gaylord explained. “There are some wholesale clubs who sell out earlier because their selling seasons for outdoors only last from February through June, or at the very latest, July 4th. Then they get out of the business so they can start moving back-to-school. To be a full-service, full-line furniture store, retailers need to set up the floor in a way that makes them look like they are in the business for the long haul.”

When we asked what was the best way for a new retailer to ‘look like they are in the business,’ the resounding answer was horizontal marketing.

Rory Rehmert, of Summer Winds, offered some statistics: “Fifty-four per cent of millennials buying outdoor furniture ‘absolutely need’ to feel the comfort; 41% ‘maybe need’ to experience the comfort. The attention to detail and the quality construction of our products also need to be experienced, as opposed to choosing furniture from a photograph. Best practice is that the collections are displayed as they would appear in your outdoor room – complete and accessorized.”

Shelby Sari’s gallery displays at Furnitureland South bear out that best practice. “We have specific galleries where I’ve tried to put similar categories together. For example, where we have a wood-species manufacturer like Jensen Leisure, who is working with Ipe and Roble woods, or Kingsley Bate and Gloucester who are designing with teak, I put them in the general vicinity of each other.

“Similarly, we would showcase the cast aluminum lines near each other in distinct gallery settings with either full or short walls to break them up. We accessorize the settings with outdoor rugs, umbrellas, and throw pillows.

Shelby concluded, “It’s important to have the very best designs that manufacturers offer. Here we are set up to display by manufacturer, so I try to make sure not to show duplication. For example, many manufacturers use Sunbrella® fabrics and they may use the same patterns, but we display different colors. We try very carefully to differentiate manufacturers and highlight their strong suits. The design consultants know that there are options for special orders and that the customer is not restricted to what is in the store.”

“Most retailers at first try to fit outdoor furnishings into their existing space,” commented Bob Gaylord. “They might try to work items into vignettes or create a store-within-a-store. That’s obviously a good idea for retailers who have the available floor space. Right now many retailers have spaces in their stores that are not necessarily producing year-round and can be re-purposed for outdoor. It works. I can tell you that retailers who realize the potential of the category will start building free-standing, separate stores – just like it’s already happening in the mattress end of the business.”

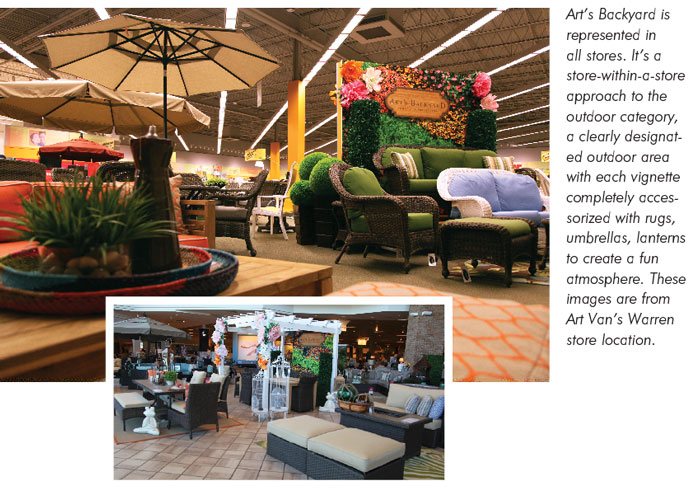

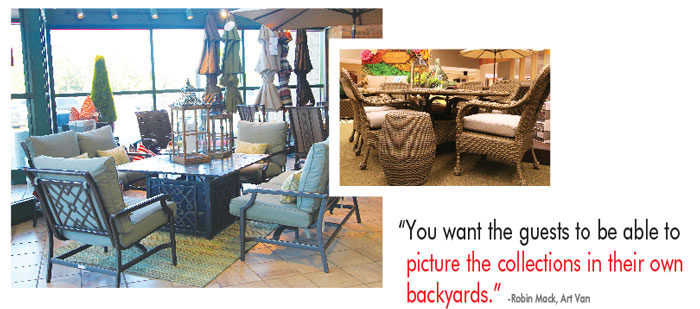

“At Art Van,” Robin Mack said, “we execute a store-within-a-store approach to the outdoor category. It is important for retailers to have a clearly designated outdoor area with each vignette completely accessorized with rugs, umbrellas, lanterns to create a fun atmosphere. You want the guests to be able to picture the collections in their own backyards.”

Agio’s Michael Gaylord added, “Today, retailers are showing about a third dining, a third seating, and the remaining third fire pit chat on their showroom floors. Being able to put a different assortment out there with lots of choices in each category is very important. Retailers can’t be successful by showing just three or four sets. That’s the #1 mistake. They need to take steps to become a destination location for patio furniture. And the only way to do it is by doing a better job than everybody else. Or, at a minimum, be at least as good as whoever is doing the best job locally.”

Bill Howard, of Crosley Brands, cautioned, “In outdoor, it’s really easy to get pigeonholed into dark brown, flat looking, and mundane. I always recommend big pops of color to draw people in. Retailers should consider increasing attention by creating attractive point-of-purchase displays that show customers all the options and how to piece an outdoor selection in various ways. The more you get the consumer touching, feeling, considering, and interacting with the displays, the better the chance of selling something.”

“At Furnitureland South we are kind of an anomaly in the casual industry, in that we are totally special order in outdoor furnishings,” reported Shelby Sari. “So I can go a little bit on the trend and bring in some fun, bright colors. Our design consultants are well-versed in letting clients know all the choices that are available.”

Rory Rehmert continued, “The best sellers are dressed in neutral textiles, however, a show-stopping color or geometric patterning can draw attention on a sales floor. Attention can also be drawn by the use of shining metallic frame finishes or colorful decorative pillows.”

That paralleled Shelby Sari’s experience: “So many times consumers will go with neutral fabrics, to the point where it is almost plain, and then they will pop it with color from the rug or with throw pillows or the umbrella. They realize that it’s the furniture itself that is an important investment. It is not just a fly-by-night purchase. They want comfort, durability, and simple upkeep.”

Bob Gaylord, of Agio, discussed a clever work-around for showcasing fire pits. “Besides deep seating, fire has been a big trend because it contributes ambient lighting and is a heat source. Just like indoors, fireplaces add a real focal point to the outdoor room. Unfortunately, retailers cannot light them inside of a store, so that’s why we’re making videos. Showing a lit fire pit is a terrific way to sell consumers on the benefits. The fireplace chat means four or six nice, big deep-seating lounge chairs or solo rockers or gliders around the pit. It’s a super strong category.”

Is An Outdoor Specialist Necessary?

We recapped what a savvy retailer needs in the casual industry: long-range planning, budget commitments, and horizontal marketing of a great selection of furniture in colorful displays. We asked if it was necessary to have a specialist on board.

Bob Gaylord recommended unreservedly, “Hire somebody with experience. There’s a learning curve and early mistakes can cost a retailer a lot of money. Selling indoor furniture is different than selling outdoor furniture. There are differences in materials, finishes, fabric qualities and grades that you just can’t easily learn about through on-the-job training. At the very least, retailers need to get somebody who becomes passionate about selling outdoor, really embraces it as their own and is willing to educate him or herself by engaging with companies, reps and others who have the experience and the background.

“With the customization feature of our products, an outdoor furniture specialist is key. That person would be versed in the features and benefits of the products, the performance of materials, and also the custom ordering of elements to create one-of-a-kind outdoor rooms. They also would be able to coordinate a furnishing plan with a customer’s existing elements, as well as enhancing the indoor to outdoor flow. And they would have a knowledge of the core consumers ‘buying habits and expectations.”

Shelby Sari offered another perspective: “If you’ve got a sales background and you know how to sell indoor products, then I think you can sell outdoor. It’s all about learning the nuances. I don’t think you have to have somebody that knows outdoor – and it’s harder and harder to find somebody that specifically deals in outdoor furnishings. But if you can train them properly and they’ve been in sales, then it becomes a natural flow.”

Crosley Brands’ Bill Howard observed, “I often encounter a stand-by, wait-and-see sort of mentality among retailers who are at the stage where they are considering giving outdoor furniture a shot. They’ve read in trade publications that they should get into the category. When they go to the markets, all the vendors tell them the same thing. They just barely dip their big toe in without fully committing to it.

“But to do it right and be successful,” Bill continued, “retailers need to go in with a good, positive mind-set, and look at the category as a big opportunity for growth. If they do it right, present their lines well, take advantage of the head counts and the traffic they are already generating, they will have a big leg up.”

Michael Gaylord, went on, “There are so many under-serviced markets in this country right now, where the only place consumers can go to buy patio furniture is a home center or a club. To do a better job, retailers need to have a professional sales staff, excellent financing, and professional delivery.

“Art Van Furniture has tremendous market share in the indoor side of the business throughout the entire state of Michigan and beyond. When they got into the outdoor side of the business they did it right by hiring a local guy who had a specialty store in the area as their first buyer. They’ve just done a tremendous job of advertising and have a beautiful full-color booklet to give customers. They have a fantastic selection and their floors are accessorized properly. That’s why they are having tremendous success in the category, growing on the outdoor side of their business every year. I’d say they are a case study for anybody looking to do it right.”

Getting the Word Out

“There’s a statistic out there that 60% of the people in the United States who plan to buy outdoor furniture say they will shop at either Lowe’s or Home Depot,” reported Bob Gaylord. “Do you know why? Because every customer out there, whether they drive a Kia or a Mercedes, visit Lowe’s and Home Depot. And for six months out of the year, they see outdoor furniture there. They don’t go into specialty stores. Tell me, how often consumers go into an indoor furniture store? It’s not very often. That’s why it is so important as a furniture store to tell them you’re in the outdoor furniture business.

“If you are a factor in your marketplace,” Bob continued, “the one goal you need to have is for every shopper in your trading area to come into your store before they buy indoor furniture. They may not buy from you; they might buy it from your local competitor; they might even buy it online. But it’s a goal to get them into your store. And that goal should be exactly the same for outdoor furniture. The advantages that indoor furniture retailers have in offering customers everything from financing to home delivery is huge.”

Rory Rehmert, of Summer Winds, observed, “Castelle, of Family Brands, finds that television continues to be the best method for advertising outdoor furniture.”

“Another good way to get the word out to shoppers who visit your store,” Bill Howard suggested, “is to make the outdoor sales area a part of the regular pitch, no matter what the customer may be looking for on a particular visit. Just saying, ‘Hey, are you aware that we also have a big selection of outdoor furniture and accessories at various price points? We can take care of your needs when it comes to the outdoor space as well.’ It’s a good idea to make it interesting and advantageous for customers to buy by working in promotions or contests.”

“Art Van typically runs a percent-off sale on the entire department,” Robin Mack added. “This allows the guest to choose the set from the entire assortment that works best for their unique situation. We also feature ‘Hot Buy’ prices on specific sets throughout the season.”

Shelby Sari enumerated the special events at Furnitureland South: “We have an annual Fabulous February kick-off sale, with participating manufacturers giving discounts. We have an outdoor-living event in April and an Awesome August sale.”

Educating Both Sales Staff and Consumers

“A lot of floor sales people who are not yet well trained avoid the outdoor category,” Bill Howard observed. “They don’t want to look foolish or jeopardize an existing sale they hoped to make. It’s important to educate and work with them to establish a regular rhythm so they can take people by the hand and show them what’s new in outdoor. You can’t just roll product out onto the floor and expect it to automatically resonate overnight. It is important to make a conscious effort to build consumer awareness throughout the organization.”

“Training is very important when it comes to the outdoor category,” agreed Robin Mack. “Art Van kicks off each season with an extensive 6-hour seminar in each geographical location. We invite our key vendor partners to come and give a hands-on presentation to teach the features and benefits of each of their collections in our assortment.

“We encourage the associates to ask questions and participate. These associates become our department experts and teach the other associates in their respective stores. In addition,” Robin concluded, “we produce special informational videos so that all sales associates can learn key features and benefits.”

Bob Gaylord, of Agio, added, “Salespeople have to be ready with the answers to customers’ questions about materials and fabrics. They have to reply with real honesty about care and maintenance of outdoor furniture. Truth in selling is number one, and good educational information is much appreciated by consumers who can’t get this type of service from mass merchants and home centers.”

“I think it’s very much an education process,” confirmed Shelby Sari. “Our design consultants raise a valid point: it’s not apples to apples. Consultants have to explain the different nuances to the consumer. If you are looking at the aluminum frame under a woven piece, you can talk about the durability of the frame and how it will hold up over time, as opposed to the possibility of going into a big box store and looking at a light-weight frame that can corrode and cause problems. You don’t want a piece of furniture that’s light-weight and can toss and blow around in a windy location.”

“I believe that most consumers would rather buy locally,” Bill Howard added. “Yes, there are some attractive things the online guys have that the brick-and-mortar guys don’t have. Online retailers can show an infinite number of products at an infinite number of price points. Buying from them is convenient – just point, click, purchase, and get it quickly. But most people still would rather have someone they can speak to face-to-face, someone who will explain how the features and benefits meet their needs. They need someone to support them if things go sideways.”

Shelby Sari concurred, “You’ve got the issue of replacements. If something happens to your purchase, there’s just a 1-800 number, and depending on the time frame, chances are your piece may no longer be available. You may only get a refund, and then you are starting over at square one.

“Replacements for us are less of a maze. Manufacturers always come out with new collections. If the problem is a warranty issue and they cannot replace the part, they can offer the customer a complete new collection. You’re not going to have that with a big box store.

“Most of the time if a manufacturer drops a collection,” Shelby continued, “they still carry the fabric pattern to do replacement cushions and replacement slings. So you can get replacement parts even if the collection is not current.”

Rory Rehmert of Summer Winds, added, “At the price point of our furniture, the more knowledgeable the sales person, the easier the sale. The better they know not only the product, but the performance aspect of the materials and the custom ordering options, the better they can be at fielding customer questions. Castelle provides a training handbook for retail sales personnel, as well as providing in-store training sessions upon request from the territory managers.”

“It’s very important that sales people qualify customers, to understand how they plan to use their furniture and get information on the environment where it will be used, “ said Michael Gaylord, vice president of sales at Agio. “For example, there are not a lot of people who end up very happy when they buy the thick, heavy deep seating cushions for use in an uncovered area. After a couple of years, they may get tired of sitting on wet cushions. Those customers might be steered towards just the seat pad, or possibly a sling chair.”

Shelby Sari underlined the importance of training, “A consumer was recently talking to one of our design consultants and said, ‘The price is a lot lower for this collection than the others I’m seeing from the same manufacturer. Is there something wrong with it?’ The consultant and the customer popped by my office and I spoke with the customer. I explained, ‘All the manufacturers were looking at ways of coming out with more value-conscious pricing. If you compare the different frames, you can see on one the aluminum strap is narrower and thinner. It is still the same quality but some of the metal and weight has been taken out of the frame to reach a value price point. The cushions are still the same comfort, still the same core – it’s just that some of the metal was taken out.’ We sold it!”

Bill Howard, at Crosley Brands, observed, “I think it’s always important for salespeople to focus on developing a rapport with outdoor consumers, instead of just pitching and regurgitating everything they know. Showing interest in what the customer needs and then listening carefully to their answers comes off as being a lot more sensitive, a lot truer, no matter what category is being sold.”

“Traditional furniture retailers are awakening to the potential of outdoor living and, therefore, outdoor furniture,” said Rory Rehmert. “Full-line furniture sales associates must be trained thoroughly on outdoor products. They have to understand why outdoor furniture is slightly more expensive than indoor furniture. Offering collections of multiple levels provides teachable value practices. Educating retailers on the value found in the outdoor category is a matter of doing the math.”

Robin Mack was like-minded: “A clearly defined outdoor area with fully accessorized settings will create an enticing atmosphere. Pair this with knowledgeable associates ready to explain the key features and benefits of each collection, and you have a winning combination.”

Bill Howard counseled , “Retailers new to the category should be looking for a nice steady progression over time. They can learn a lot by paying careful attention to the items their customers gravitate towards. As a seasonal category, it gives retailers an opportunity to reinvent themselves seasonally until they get to the point where their outdoor choices have optimal price points, advertising, exposure and looks. My biggest message is just to have fun.”

Rory Rehmert concluded with this advice, “Retailers need to evaluate their customer base and make decisions for expansions into new sales demographics. Retailers add value by having well-trained, knowledgeable sales personnel who are personable and professional. Retailers add value by having inventory and being able to complete the sale in a short time frame. Retailers add value by going the extra mile for the consumer. Retailers add value by servicing what they sell, today, tomorrow and sometime in the future.”

Furniture World is the oldest, continuously published trade publication in the United States. It is published for the benefit of furniture retail executives. Print circulation of 20,000 is directed primarily to furniture retailers in the US and Canada. In 1970, the magazine established and endowed the Bernice Bienenstock Furniture Library (www.furniturelibrary.com) in High Point, NC, now a public foundation containing more than 5,000 books on furniture and design dating from 1620. For more information contact editor@furninfo.com.