"Here are my thoughts on this subject, especially as it pertains to senior level marketing positions, sales representatives, and technology consultants in our industry.”

Recently I read an article from Hyam Singer, VP User Engagement at TOPTAL, that in my opinion “nailed it” on the topic of hiring employees vs. independent contractors for some key positions, “Don’t Be Fooled: Calculate the Real Cost of Employees and Consultants.”

I’ve been on both sides of this question, as a former employee, as a manager that hired employees and as an independent contractor. Here are my thoughts on this subject, especially as it pertains to senior level marketing positions, sales representatives and technology consultants in our industry.

Considerations

When making a decision about whether to hire an employee or an outside consultant, there are a number of factors to consider.

Cost: Hiring an employee comes with some hidden costs (outlined later in this article) that most furniture retailers do not make explicit. It’s important to know what the hidden ongoing costs are when comparing options.

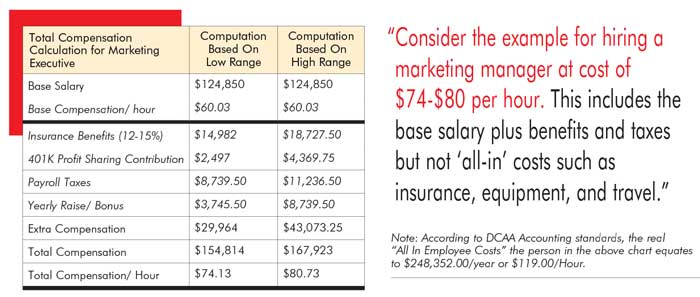

Duties: For higher paying jobs that require substantial expertise, it’s important to look at job descriptions and time requirements to do the most skilled parts of the job. Consider the example presented later in this article for hiring a marketing manager at cost of $74-$80 per hour. This includes the base salary plus benefits and taxes but not “all-in” costs such as insurance, equipment, and travel. Ask yourself if this person will be spending a substantial amount of his or her time doing tasks that could be done by a lower paid employee? If so, hiring an outside consultant to take on core responsibilities may be more cost effective.

Control Issues: Because of the way you like to do business, you may want to train employees from the “ground up”, keep them immersed in your culture and ways you do business. It may be important for you to hire from within or nurture young talent, especially if you are an expert with the time and talent to do this.

Long Range Planning: It may be your goal is to hire and keep talented people who will move up the corporate ladder, perhaps take an ownership stake, maybe even replace you. If this is the case, then the employee option may be the way to go regardless of the short term expense.

Expertise: Consultants often have wide expertise that can only come from working with multiple clients, perhaps in a number of industries. If you are looking for expertise you can’t develop in-house, or can’t afford to hire a full time, entry level or mid-level employee with the required expertise, hiring a consultant may be an attractive option.

Marketing Example

Here we will compare the costs of hiring a marketing employee vs. a consultant. The same basic calculations can be made for any job description. You can visit the toptal.com website link listed at the end of this article that will do the calculation for you.

According to the governments Bureau of Labor & Statistics (BLS) the “average” median pay for a senior level marketing person is approximately $124,850/year, or $60.03/Hour. BUT that is only the base cost and does not include;

- Insurance (medical, dental, life) – about (12%-15% additional).

- Optional 401K/Profit Sharing Contribution – about 2%-3.5%.

- Payroll taxes (company paid portion) – Approximately 7%-9% additional for the company paid portion.

- Employee bonuses – Ranging from 3%-7%, depending on overall compensation package.

- Additional fixed and indirect costs outlined below

Time to re-do the math

Assuming a base Salary (based on the BLS for a marketing manager) of $124,850 or approximately $60 per hour, we will add in benefits and expenses to calculate the actual salary per hour of between $74 and $80 per hour (see the chart above).

This does not include intangible costs such as “learning curve” time and the allocation of resources for this new employee’s acclimation into your culture, business systems and processes. Think about that for a minute. Other employees’ time and resources will be expended in mentoring this new employee, plus additional direct and indirect costs are amortized into each employee’s “real cost”. This includes items such as;

- Accounting fees

- Advertising

- Computer hardware

- Computer software licenses

- Conferences and trade shows

- Corporate graphics/web design

- Corporate taxes (property, etc.)

- Dues and subscriptions

- Equipment & furniture

- Insurance (liability, workers comp, unemployment insurance, etc.)

- Legal fees

- Meals and entertainment

- Meeting expenses

- Office supplies

- Overhead staff (exec. & admin.)

- Printing services

- Recruiting (advertising and fees)

- Travel

The Real Bottom Line

According to DCAA Accounting standards, the real “All In Employee Costs” for this person equates to $248,352.00/year or $119.00/Hour, figuring a base hourly rate of $60.03/hour and adding in all the additional costs outlined above.

I know, the math is getting really obnoxious. But from here on, it is going to get very easy.

If you hire a consultant at $60.03 per hour to do the same job, that’s what you pay, plus any additional “authorized” ancillary or travel expenses.

The amount of infrastructure that a consultant uses is significantly less than that of an employee (plus the consultant doesn’t receive benefits). As a result, the actual cost of a consultant is affected by general & administrative costs only; Fringe benefits and overhead are irrelevant to the cost of a consultant.

There are a couple other considerations. Here’s what Hyam Singer, VP User Engagement at TOPTAL has to say about additional financial risks and recruiting fees.

Potential Financial Risks. “Companies tend to make hire/fire decisions much more rapidly with consultants than with employees. It is not uncommon for under-performing employees to be kept on the payroll for multiple months, throughout various stages of probation, to minimize the potential for an employee-filed lawsuit. The resulting cost to the company can be quite substantial. In contrast, companies tend to dismiss consultants with minimal if any notice when in any way dissatisfied with their performance”.

Recruiting fees affect the cost of all employees. “One obvious savings with consultants is the avoidance of often -hefty recruiting fees. What may be less obvious, though, is that each recruiting fee paid drives up the real cost of all employees. Since recruiting costs are included in overhead expenses, every recruiting expense that your company incurs increases your overhead costs, which in turn raises your overhead rate multiplier, which in turns drives up the effective cost of each and every one of your employees.”

Go ahead and plug in your own numbers in this employee vs. contractor cost calculator (see link at the end of this article).

Liabilities. A consulting company takes on all the liabilities and usually holds their clients harmless. They carry their own insurance, pay their own taxes and use their own computers, cell phones and more. Sure they may bury those costs into their agreements, but they are usually minimal compared to your infrastructure.

Practical Considerations

If you decide to hire a consultant, here are a couple of quick suggestions.

Don’t make a long term employment commitment. When you hire a consultant make sure the engagement terms are usually very short, 3-12 months with 30-day renewal clauses. This also gives the consultant the opportunity to “fire you” should the synergy not work. A good consultant/company relationship should thrive based off synergies and exceeding goals without the need of a long-term contract hanging over their heads.

And one additional note, confidentiality and non-compete. Agreements should protect clients with a one year, minimum, confidentiality and non-compete clause. These clauses are standard to protect the integrity of the business relationships so information can “free-flow” for strategic purposes.

Conclusion

Every company and situation is different so there’s no “one size fits all” answer here. But an awareness of the factors and issues discussed in this article will help arm you to make the best financial decision for you and your team.

Note: Link to the employee cost calculator can be found at:

https://www.toptal.com/freelance/don-t-be-fooled-the-real-cost-of-employees-and-consultants.