Bill thinks this promising demographic target is being over-hyped by marketers who don’t know what they are talking about. Ed isn’t so sure!

Editor’s Note: Now Furniture World has it's own point/counterpoint duo, Bill Napier and Ed Tashjian who join historic Point Counterpoint editorial teams such as Shana Alexander and James J. Kilpatrick of CBS' "60 Minutes" and their mirror images Jane Curtin and Dan Aykroyd of SNL. This is their second installment, having debated celebrity licensing in the January/February 2017 edition.

Point: Bill Napier

Daily I get some sort of propaganda Info-Graphic that provides information about how and why everyone should be marketing to Millennials. When I see this sales and marketing propaganda, I must wonder if the people who write this trash have ever done their homework on this 77 million strong demographic group.

My answer is a resounding NO and it’s time marketers adjusted their thinking to a reality based strategy, vs. the fictional stuff everyone wants you to think and believe. The old adage – “Strength in Numbers” does not apply to this generation… yet. The reason we get bombarded with Millennial misinformation is simple. Someone wants to sell us something; most likely a service to help us sell more to Millennials.

Whenever I get these emails, mostly from marketers, I wonder how they become marketers when they don’t know what they are talking about? It's my view that it exemplifies the arrogance of ignorance.

Before I present the FACTS, please know I understand that the people who send this information have jobs to do. Their jobs as marketers are to inspire, motivate and engage their audience to “buy something”. It’s my job as well, one I’ve been doing for over 30 years… so I get it. The difference is, I always include the downside of marketing to Millennials, without pulling punches!

So, here are the facts. I’ll write and you decide.

Millennials seem at first glance to be a promising target demographic of 77,000,000 potential consumers that may buy your products and services, right?

MOSTLY WRONG, here’s why;

Everyone writes that this generation is the key HOPE for retail. Here are some interesting facts to get your head straight on this subject.

Have you heard? Millennials have the worst credit scores of any generation. The data point plays well with one of Americans’ favorite pastimes: discussing the dismal state of the nation’s youngest consumers.

16 Dismal Facts

1. The average 19 to 34-year-old has a credit score of 625, but it’s 650 for Gen X (35-49), 709 for baby boomers and the Greatest Generation (together, those generations include everyone older than 50). The national average is 667. The data comes from credit bureau Experian, a company that uses the VantageScore 3.0 credit score range, from 300 to 850.

What that means is that financing purchases is more expensive for Millennials.

2. The current savings rate for Millennials is negative two percent. Yes, you read that correctly. Not only aren’t Millennials saving any money, they are actually spending a good bit more than they earn every month.

3. A survey conducted earlier this year found that 47 percent of all Millennials are using at least half of their paychecks to pay off debt.

4. For U.S. households headed up by someone under the age of 40, average wealth is still about 30 percent below where it was back in 2007.

5. In 2005, the homeownership rate for U.S. households headed up by someone under the age of 35 was approximately 43 percent. Today, it is sitting at about 36 percent.

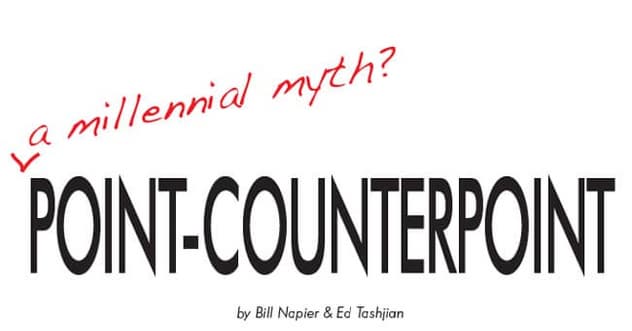

6. One recent survey discovered that an astounding 31.1 percent of all U.S. adults in the 18 to 34 years old are currently living with their parents.

7. At this point, the top 0.1 percent of all Americans have about as much wealth as the bottom 90 percent of all Americans combined. Needless to say, there aren’t very many Millennials in that top 0.1 percent.

8. Since 2008, close to 40 percent of all 27-year-olds have spent at least some time unemployed.

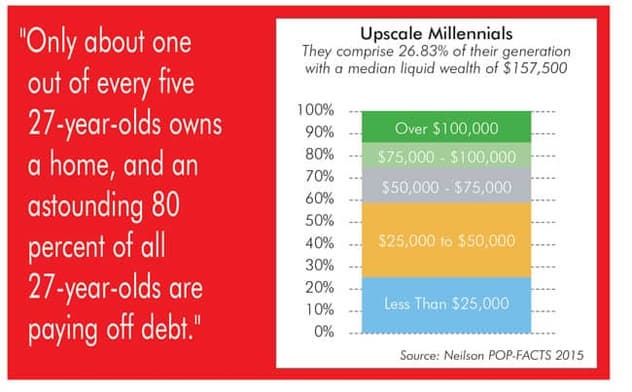

9. Only about one out of every five 27-year-olds owns a home at this point, and an astounding 80 percent of all 27-year-olds are paying off debt.

10. In 2013, the ratio of what men in the 18 to 29 year-old age bracket earned, compared to the amount the general population earned reached an all-time low.

11. Back in the year 2000, 80 percent of all men in their late twenties had a full-time job. Today, only 65 percent do.

12. In 2012, one study found that U.S. families whose head of household was under the age of 30 had a poverty rate of 37 percent.

13. Another study released back in 2011 discovered that U.S. households led by someone 65 years of age or older are 47 times wealthier than U.S. households led by someone 35 years of age or younger.

14. Two years after graduating from college, half of all graduates are still financially dependent on their parents.

15. In 1994, less than half of all college graduates left school with student loan debt. Today, it is over 70 percent.

16. At this point, student loan debt has hit a grand total of 1.2 trillion dollars in the United States. That number has grown by about 84 percent just since 2008. It is now at $1.4 Trillion dollars as of Q4 2016.

That equates to 44,000,000 people that owe an average of $36,172.00

- According to the WSJ - More Than 40% of sudent borrowers aren’t making payments

- There is $1.28 trillion in total U.S. student loan debt

- 44.2 million Americans have student loan debt

- The student loan delinquency rate of 11.0%

- The average monthly student loan payment (for borrower aged 20 to 30 years): $351

- The median monthly student loan payment (for borrower aged 20 to 30 years) is $203

- According to the Pew Research Center, nearly four out of every ten U.S. households that are led by someone under the age of 40 are currently paying off student loan debt.

- In 2008, approximately 29 million Americans were paying off student loan debt. Today, that number has ballooned to 40 million.

- Since 2005, student loan debt burdens have absolutely exploded while salaries for young college graduates have actually declined.

I’m not bashing Millennials here. The problems they face are based on false-promises and propaganda made to them by their parents, schools, government and more. Perception propaganda is what I call it.

They were led to believe that it was essential to get a college education to succeed in today’s workplace, but it was a false promise. If everyone has a college degree, what might a college degree be worth? The same holds true on the subject of pay. If everyone is paid $1,000,000, what would a loaf of bread cost?

So, it's not their fault. I have three Millennial children and can say that as a group this generation deserves respect for their attitudes and accomplishments. But this isn't an argument about the intrinsic value of people, it’s a blog about substance. So when an agency, marketing person, or whomever tells you that you must divert your marketing funds to this generation as a whole, take a walk back and re-read these facts and maybe educate all concerned.

No one does facts anymore, everyone works off perception and emotion in their decision making and to me, that’s very sad and it defines the arrogance of ignorance.

Counterpoint: Ed Tashjian

Editor's note: For our Millennial readers who weren’t alive in the late 1970s, or haven’t been watching SNL re-runs on their parents’ sofas (see chart on page 10), Ed Tashjian initiates his reply to Bill Napier on the following page by referencing a popular Point /Counterpoint “Weekend Update” skit featuring Dan Aykroyd and Jane Curtin.*

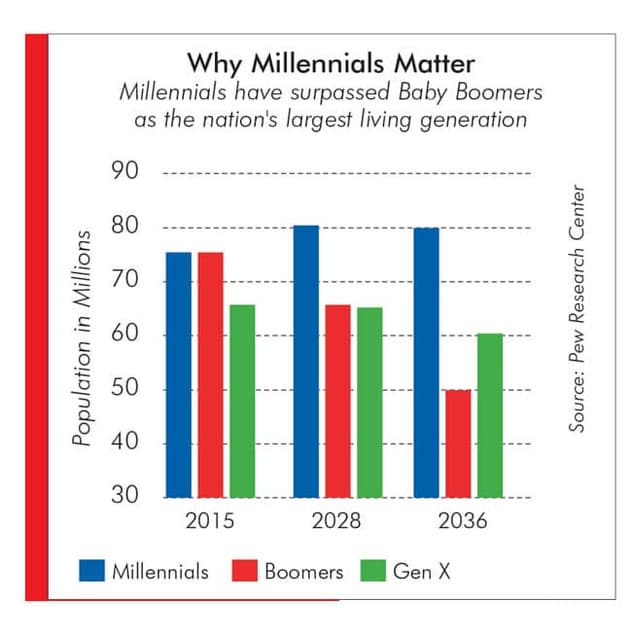

Bill you ignorant slut*! Let’s start with some common ground. While each of the generational segments are approximately equal in terms of size, boomers do in fact have 30% more purchasing power. But, according to a leading furniture trade magazine, the Millennials will still spend $27B on furniture this year. That’s a pretty sizable market that can’t be ignored.

While many of your facts are correct, you may be missing the larger issue. One of the beautiful things about the home furnishings business is that humans will always need a place to sleep, a place to eat and a place to sit and watch entertainment. That is why so many investment capitalists buy furniture companies— Because it’s $100B+ evergreen business that isn’t affected by technology or cultural change.

I have two major issues with your logic: the first is that you lump all Millennial’s together as if they were a homogeneous segment. The second is you suggest that Furniture World readers plan for the past instead of the future.

As it turns out, like every other demographic, there is little about the Millennial age cohort that makes people alike. While it may not be effective to market furniture to the underachieving reprobate living in his mother’s basement, upscale Millennial’s—those making more than $75,000 a year, comprise more than a quarter of all Millennial’s, and they’re excellent consumers. When you look at that in the perspective of what demographers called DINKs (Dual Income, No Kids) and HENRY’s (High Earners Not Rich Yet), there is a large pocket of Millennial’s that is extremely worthwhile, who can be targeted Geo demographically and behaviorally with digital media rather than targeting them generationally. Only the most lazy marketer would market to a generation without segmenting it. Different channels and different messages for different markets has always been the way to go.

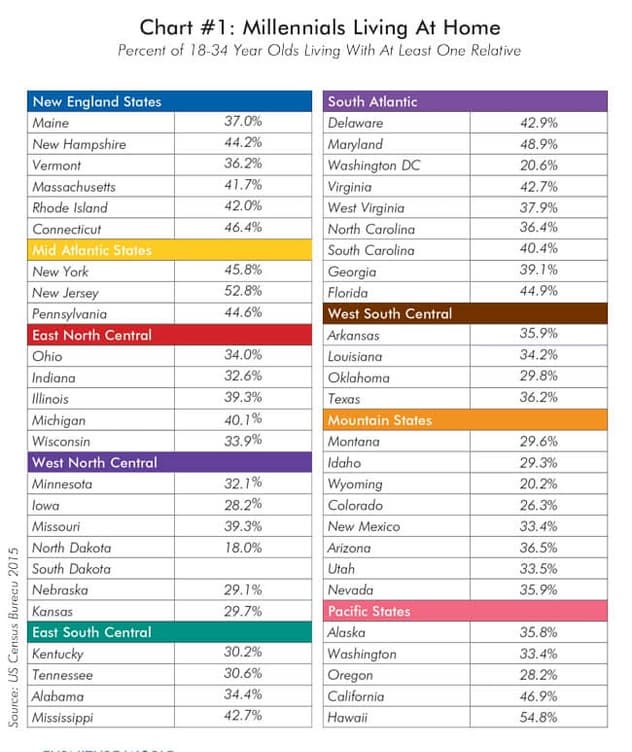

With immigration adding more numbers to its group than any other, the Millennial population is projected to peak in 2036 at 81.1 million. Thereafter the oldest Millennial will be at least 56 years of age and mortality is projected to outweigh net immigration. By 2050 there will be a projected 79.2 million Millennials.

Further, Millennials are the most diverse generation in history. Barely half (55 percent) are non-Hispanic and white meaning the remaining 45 percent are racial or ethnic minorities. By comparison, 39 percent of Generation X, 27 percent of Baby Boomers and just 17 percent of the Silent Generation identify as Hispanic and/or a race other than white. As diverse as Millennials are, they are likely to be the last generation in which most individuals are non-Hispanic and white since future generations will be more racially and ethnically diverse. To put them all in the same pot and call them homogeneous is misleading.

My final point is that the present is fleeting and you cannot live in the past. The metaphor I use to explain this is hunting ducks. Everyone knows if you shoot behind the duck you will miss it. What most people don’t know, is that if you shoot at the duck you will also miss it because by the time the shot arrives, the duck won’t be in the same place anymore. You need to lead the duck. The same thing is true in marketing. While Millennial’s may not be the prime target now, in less than five years they will be. There’s an Armenian aphorism that asks the question, “when is the best time to plant an orchard?” The answer is always, five years ago—because that’s how long it takes before the tree will bear fruit. It is wise for marketers to look to the future, and to mix metaphors, get their ducks in a row now so they will be prepared. Dig your well before you’re thirsty.

About Ed Tashjian: Ed Tashjian is Principal of Tashjian Marketing, a strategic marketing and business development consulting firm based in Hickory, NC specializing in the home furnishing’s industry. Get more information at www.Tashjianmarketing.com or call (828) 855-0100.