Interview with Michael Fiacco, CEO, Old Brick Furniture

Old Brick’s CEO, Michael Fiacco doesn’t have sales events. His sales associates don’t work on commission and he

allocates funds to hire additional service techs by reducing Old Brick’s advertising expenditures.

“Old Brick Furniture (www.oldbrickfurniture.com), a Furniture

First buying group member and winner of HFA’s 2023

Retailer of the Year Award, does not pay commissions on sales. “Only a handful of companies operate the way we

do,”

Michael Fiacco, CEO of fast-growing Old Brick Furniture, observed. “Whether an individual writes $800,000 or $2

million,

their earnings aren’t affected. We find that our teams work well within this framework. Some sales associates

might sell

more, but others help the group in different ways. Each person has a core competency that enables the group to

work

together and our company to prosper.”

Emphasis on Transparency

“We are probably the most transparent retailer you’ll find anywhere. We don’t discount or run sales promotions.

Our

prices are our prices. Vendor information is included on all our tags. Many retailers hide information from

their

customers. We want them to know everything they need to know to make the best purchase decisions. That

transparency

extends to our supply partners and employees. We believe that consumers want to know that what they’re being

told is

true, that they are getting a fair, honest deal, and aren’t going to have unresolved service issues down the

road.”

“Only a handful of companies operate the way we do. Whether an individual writes $800,000 or $2 million,

their earnings

aren’t affected. We find that our teams work well within this framework.”

Growing Brick by Brick

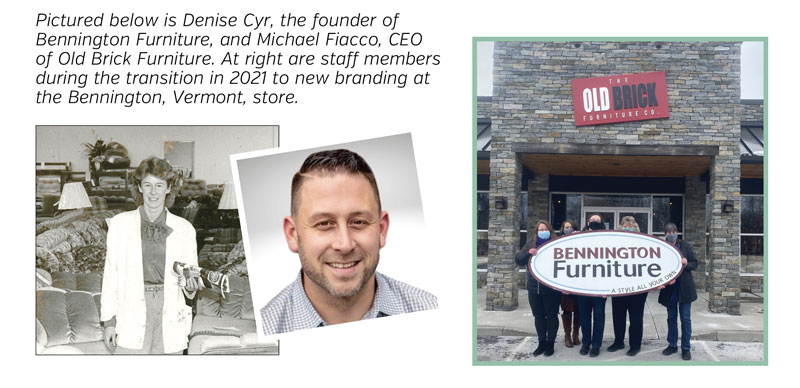

“My mother, Denise,” said Fiacco, “founded Bennington Furniture in 1986. Before then, she made ends meet by

waitressing

at night and working as a traveling sales rep by day. She was able to open her first Bennington store when two

furniture

distributors provided her with furniture on consignment. One of them, C. and D. Distributors, was the parent

company of

Old Brick Furniture, owned by Henry Terk. Terk, who also founded Old Brick Furniture, was acquired by Bennington

Furniture in 2020, bringing their business relationship full circle.

“Terk was a numbers guy and a sharp merchant. His commercials emphasized that Old Brick had the ‘Lowest Prices

From

Saratoga to Singapore,’” recalled Fiacco.

“Our service technicians will fix everything and anything, Even our competitors’ product. We find that

it

pays long-term

dividends.”

“Back in the 1990s, it was just my mother and me. She kept me busy building lamps and those ugly brass coat

racks

retailers sold in the 1990s.” Fiacco continued to cycle through various departments at Bennington Furniture

throughout

college, then accepted a job at a Wall Street firm. In 2006, his mother asked him to take over the company,

which at the

time had 12 employees. “I wasn’t sure that I wanted to do that, so I took a weekend sales job at a local

retailer for

almost a year while still working at the brokerage firm to help make that decision,” he said.

“I purchased my mother’s interest in the company in 2007 and moved our family to Vermont. We opened our third

store

within three months and continued to add stores every couple of years. In 2019, Henry told me he was ready to

sell, so I

merged the two companies, converting our Bennington Furniture stores into Old Brick Furniture stores. We now

operate

nine stores in Vermont, Massachusetts, and New York.”

Advertising & Repair

Old Brick Furniture’s business is designed for advertising efficiency.

“Eighty percent of our stores are located in the same Designated Marketing Area (DMA),” said Fiacco. This helps

maximize

our advertising efficiency, giving us one of the lowest advertising-to-sales ratios in the industry. The savings

are

reallocated to pay the salaries of service technicians.”

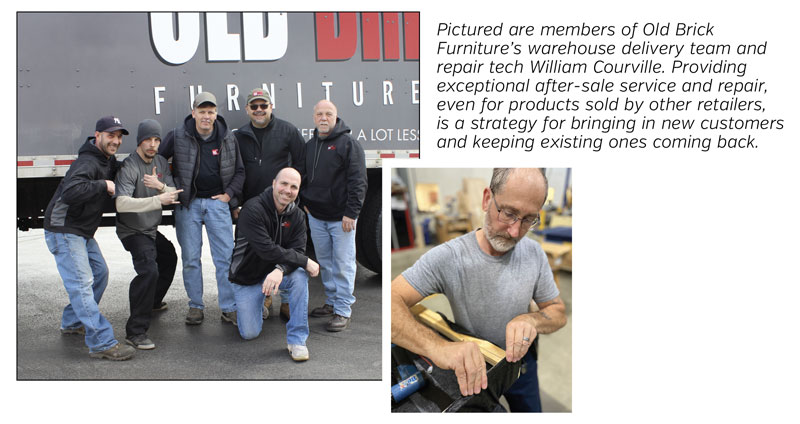

Providing exceptional after-sale service is a strategy at Old Brick Furniture for keeping customers coming back.

“Our

service technicians will fix everything and anything, even our competitors’ product,” he explained.

“The previous owner of Old Brick Furniture once told me,” Fiacco recalled, “‘The reason why we take money out of

advertising and hire service techs is that every time you do a great job of fixing someone’s furniture, the

business

resulting from positive word-of-mouth goes a lot farther than any TV ad or direct mail piece.’

“Especially if a competitive store won’t make a repair, we find that it pays long-term dividends to fix sofa

legs,

provide new cushion cores and replace or repair cracked arms. We let them know, ‘Hey, you didn’t buy this from

us, but

we will gladly take care of it for you.’ Sometimes, we can get the manufacturer to pay for the repair. Other

times, we

charge a bit.”

Marketing

Old Brick Furniture’s advertising expenditures are one-third broadcast television and one-third direct mail. The

final

third is digital, including Search Engine Marketing, social media marketing (Facebook, Instagram, TikTok,

LinkedIn,

Pinterest), email, SMS and OTT. Fiacco told Furniture World that his experienced internal marketing team places

most of

Old Brick’s digital advertising. “We partner with some external platforms/hosts to manage a small percentage of

those

buys. We also meet partners regularly to review campaign effectiveness and match back as much data as possible

to sales

to demonstrate ROI. I am adamant that we should never slip into a ‘set it—or spend it—then forget it mindset.’

If you

can’t show the attribution to sales, I’m frankly not interested.

“Our sales philosophy is that people will buy from us when they’re ready. I’m sure we’ve lost some

business

this way,

but I believe we’ve gained much more.”

“We track ROI based on marketing channel but know that it wasn’t exclusively a direct mail piece or a TV spot

that led

to a customer visit. Our media buys work together, touching customers at different points in their purchasing

journeys

to build relationships with Old Brick Furniture.

“I anticipate the percentage we invest in nontraditional marketing will rise annually, especially with

categories like

OTT. About a year ago, Netflix introduced its ‘Basic With Ads’ subscription. Roughly six percent of its

worldwide

subscribers have already signed up. I believe these types of services will present more opportunities for

furniture

retailers going forward.

“We do trigger mailings and email campaigns. If a shopper searches for something on our website, they may

receive an

email 15 minutes later and another the next day. The messages might show them what they looked at and provide

financing

offers. We don’t bombard our customers; we give them enough information to help them make informed decisions.

Neither do

we pressure them into buying. Our sales philosophy is that people will buy from us when they’re ready. I’m sure

we’ve

lost some business this way, but I believe we’ve gained much more.

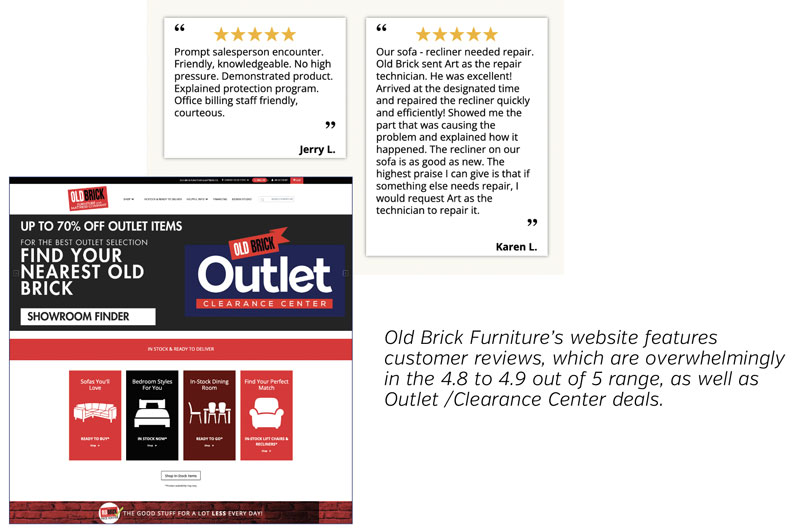

“I can see how some people in our industry might think, ‘How are you following up? Why don’t you get shoppers’

names and

phone numbers?’ My answer is that we want shoppers to be as comfortable in our stores as possible. That’s

reflected in

our 5,000 Google reviews in the Albany area, which are 4.8 or 4.9 out of 5. It doesn’t take a genius to figure

out what

that means for our brand.”

Fiacco said that every negative and positive review gets a response. “Doing that is the responsibility of our

marketing

team, which responds to the good, the bad and the ugly. Bad reviews receive an online response and a phone call

because

we want to know the cause. Every retailer drops the ball occasionally. Our goal is to get all five-star reviews.

Getting

there, however, is not so easy.

“Our goal is for 20% of all sales to result in a public-facing review. Every month, managers at each store

receive a

monthly ‘reviews’ update. The report includes a QR code that staff can scan to see their new reviews. It lets

them know

their monthly reviews conversion percentage and gives shoutouts to those who went above and beyond. These are

posted in

showroom breakrooms. The regular cadence of the reports keeps reviews top-of-mind at all of our showrooms.”

Repurposing Delivery People

“There are only so many years our delivery people can tote 300-pound pieces up two flights of stairs, explained

Fiacco.

“Many of those guys are among our best and most experienced employees. We don’t want to lose them as they age

out of a

physically demanding job, so we provide them with an opportunity to learn repair by spending one or two days a

week

learning from a lead tech in our service shop. This training can take more than a year to complete. Eventually,

they

become on-the-road techs.

“Some choose to come inside, do warehouse work, or move into receiving or prep. Others like the idea of

remaining on the

road. We put them in comfortable minivans. The best delivery drivers are used to dealing with customers and have

excellent customer service skills. With proper training, they become excellent service techs and earn lots of

tips.”

“Showrooms range from 5,000 square feet in a second homeowner community at the base of a mountain in

Manchester,

Vermont, to their 70,000 square foot Albany, New York, store.”

Independent Store Survival

There are Raymour and Flanigan, Bob’s Discount Furniture, Mattress Firm and Metro Mattress stores operating in

most of

Old Brick Furniture’s trading areas, but there are only a handful of independents left. “Some,” Fiacco noted,

“were

bought out; others lacked succession plans. Many were lost during the financial crisis in 2008 and 2009, and the

pandemic grabbed some.”

When asked why he’s grown when so many couldn’t, he replied, “Success in this business has a lot to do with

getting up

early and working until the day’s done. One reason we’ve done well is that we’ve focused on retaining and

growing our

team, many of whom have been with us for 20-plus years.”

Fiacco observed that storeowners who care about their employees’ well-being reap rewards because employees, in

turn,

take better care of the business and their customers. “It’s easier to grow when they treat a business like it’s

their

own,” he said. “I think we do a good job in that regard. It’s not so difficult. I have many experiences in

common with

others working at Old Brick Furniture. We try not to make things hard on staff and to listen to their requests.

Based on

what they’ve asked for, we’ve invested a lot of money into our business, especially over the last two to three

years.

It’s helped Old Brick Furniture run more smoothly.”

“Our marketing team responds to the good, the bad and the ugly. Bad reviews receive an online response

and a

phone call

because we want to know the cause. Our goal is to get all five-star reviews.”

Merchandising & Design

Old Brick Furniture stores are well-merchandised with constantly updated visuals. Showrooms range from 5,000

square feet

in a second homeowner community at the base of a mountain in Manchester, Vermont, to their 70,000 square foot

Albany,

New York store. “Our visual merchandisers make sure that our displays don’t stagnate. They have 20-plus years of

experience and are serious about the way customers see our stores.

“On the other hand,” he noted, “if a product turns out to be a dog, it’s identified and out of here in 30 to 40

days. We

don’t sit on poorly-performing furniture. It’s marked down aggressively. That’s why we didn’t run into an

over-inventoried situation toward the end of the pandemic. When we got heavy on something, we got out of it

quickly,

took the loss and moved on.”

Old Brick hasn’t highlighted its mattress departments with separate entrances or built free-standing mattress

stores. “I

don’t know why that’s so popular right now,” he continued. “We dedicate a lot of interior space to our mattress

departments, with the bulk of our galleries in newer stores located within 10 to 15 feet of front entrances,

right or

left. It’s working well. Since we are team-based and do significant training, we don’t need to assign a mattress

specialist to these departments.

“We do a lot of custom work, especially for clients who have second homes in Vermont. Most of our design

business comes

from our Manchester and Clifton Park stores, but design staff can travel to any of our stores to make house

calls.”

Near-Term Challenges

Fiacco believes adopting new technologies will be a major challenge for small and medium-sized furniture

retailers over

the next five years. “It’s more important than ever to allocate funds and do what needs to be done to compete,”

he said.

“Wayfair recently announced plans to lay off 1,650 employees. My view is that Wayfair didn’t achieve $12 billion

by

accident, so this may be an opportunity for independent retailers to hire tech-savvy people who are familiar

with the

furniture business. Some of my fellow independent furniture retailers have told me that they don’t believe that

the

amount of business Wayfair does has affected them. But what happens when Walmart, Home Depot, Lowes, and

everyone else

get even better at selling furniture? Many furniture retailers don’t realize it, but competitors they may not

even know

about are taking little bits of their market share. And before they know it, 15% of their business may be gone.

“We believe in investing in marketing technology and up-to-date software solutions chosen by a new generation of

Old

Brick Furniture employees. Sometimes, these solutions work well; other times, they don’t, but our team always

knows the

direction we need to be headed. Retailers that can’t do that will have more difficulty going forward.”

The Economy

Fiacco believes that the way people shop is going to change dramatically. “It’s changing as we speak,” he said,

“but in

five to ten years, the furniture business will be way different than it is today. The next generation of

consumers who

are 29 years old and under aren’t going to buy furniture like their parents. I think these adjustments will come

quicker

than many retailers realize.

“We were overdue for a correction, as reflected by the current decrease in store traffic. I came into 2024

thinking

business conditions would look a lot like 2023, when Old Brick Furniture experienced a very strong first half

and booked

better year-over-year results in the second. My gut tells me that the first six months of 2024 will be tough,

but

conditions will then start to improve. The remainder of 2024 will be a bumpy ride on the retail and wholesale

sides of

the business.”

Fiacco concluded his remarks by saying, “The good news is that the best time to grow a business can be when it’s

the

bumpiest. We haven’t been on a downcycle like this in a long time. The cost of doing business, especially

commercial

real estate, has increased over the past couple of years. If we experience some deck-clearing, real estate

prices may

drop, making it easier for growth-focused retailers to expand.”